- United States

- /

- Pharma

- /

- NYSE:ZTS

Zoetis (ZTS): Valuation in Focus as Lenivia Approval Expands Animal Health Portfolio

Reviewed by Kshitija Bhandaru

Zoetis (ZTS) just secured Health Canada’s approval for Lenivia, a monoclonal antibody therapy that provides three months of pain relief from osteoarthritis in dogs with a single injection. This milestone further strengthens Zoetis’ presence in animal health.

See our latest analysis for Zoetis.

Zoetis’ recent momentum, highlighted by Lenivia’s Canadian approval and upcoming European launch, comes amid a challenging stretch for shareholders. While new product wins keep innovation in the spotlight, the share price return year-to-date is down 11.4%, and the one-year total shareholder return has slipped 24.6%. Long-term performance remains muted, but signs of growth potential could draw renewed interest as investors weigh the company’s expanding portfolio against recent valuation pressures.

If you’re interested in what other leaders in animal health and life sciences are doing, take the next step and explore See the full list for free.

With recent setbacks weighing on Zoetis’ stock, investors are left to consider whether this underperformance could signal a compelling entry point, or if the company’s expanding pipeline has already been factored into its valuation.

Most Popular Narrative: 23.9% Undervalued

With the narrative’s fair value for Zoetis set at $189, the last closing price of $144.06 hints at significant upside potential, according to the latest consensus. This backdrop has analysts and investors debating the core drivers that justify the valuation gap.

Ongoing innovation and accelerated R&D output, with expectations for a major new product approval in a key market every year over the next few years, positions Zoetis to expand addressable markets, launch higher-margin products, and protect market share. These factors are seen as positively impacting organic revenue growth and net margins.

Want to know which breakthrough innovations could catapult Zoetis’ future earnings? The narrative hinges on an ambitious pace of product launches and margin expansion. Discover the forecasts and financial leaps behind this compelling target and uncover what could make Zoetis the sector’s next growth surprise.

Result: Fair Value of $189 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition in key franchises and slower adoption of new therapies could present challenges to Zoetis’ future revenue and earnings growth potential.

Find out about the key risks to this Zoetis narrative.

Another View: Multiples Tell a Different Story

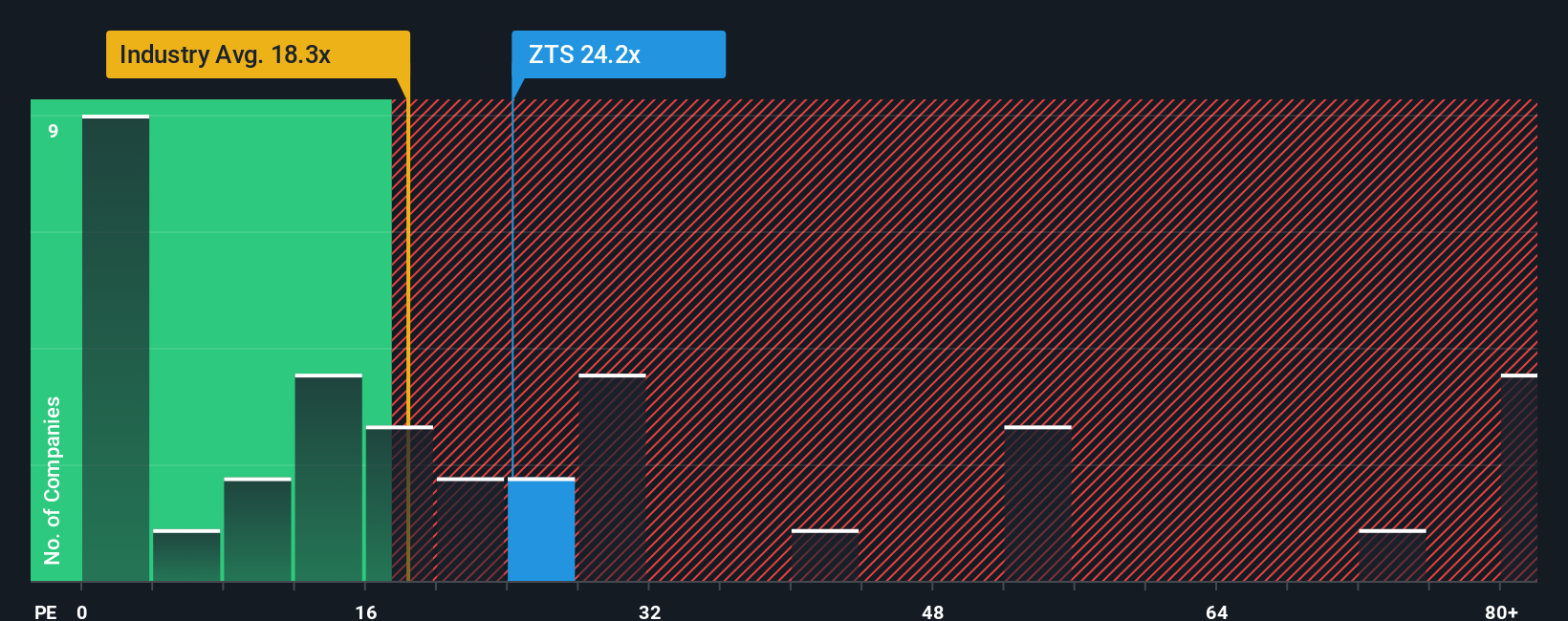

While the narrative points to opportunity, a glance at Zoetis’ price-to-earnings ratio shows a more cautious picture. At 24.4x, it stands not only above the US Pharmaceuticals industry average (17.6x), but also above its peer group (14.8x) and the fair ratio, suggested at 21.5x. This premium suggests that the market expects a lot from Zoetis, leaving less room for upside if growth falls short. Could this gap indicate more valuation risk than opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zoetis Narrative

If you want to dig into the data and draw your own conclusions, the tools are available for you to build your own perspective in just a matter of minutes with Do it your way.

A great starting point for your Zoetis research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take the fast track to smarter investing. Uncover unique companies and sectors that could boost your portfolio, and make sure you don’t miss the next big opportunity.

- Catch dynamic AI breakthroughs that are capturing headlines and reshaping industries by using these 24 AI penny stocks.

- Pounce on undervalued opportunities that the market may be overlooking by starting your search with these 877 undervalued stocks based on cash flows.

- Collect reliable income and grow your wealth with ease by exploring these 18 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoetis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZTS

Zoetis

Engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, diagnostic products and services, biodevices, genetic tests, and precision animal health products in the United States and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives