- United States

- /

- Pharma

- /

- NYSE:ZTS

Zoetis (ZTS): Taking Stock of Valuation After a 22% Share Price Decline

Reviewed by Kshitija Bhandaru

Zoetis (ZTS) has seen its stock return slip over the past year, with shares declining by 22%. Investors now may wonder what this trend could mean for the company’s future and current valuation.

See our latest analysis for Zoetis.

Despite a tough year, Zoetis’s share price has struggled to regain momentum, slipping 22% from last year’s peak as risk perception around the stock has shifted. While the company’s 1-year total shareholder return remains in negative territory, its longer-term performance reflects some resilience; yet there’s little sign of a sustained rebound just yet.

If Zoetis’s recent moves have you rethinking your portfolio, it might be time to look beyond and discover See the full list for free.

With the stock now trading at a notable discount to analyst price targets, the key question for investors is clear: Is Zoetis undervalued at these levels, or has the market already accounted for all future upside?

Most Popular Narrative: 23% Undervalued

Zoetis’s most widely followed narrative sees the stock’s fair value at $190, a sizable gap compared to its latest close below $147, highlighting the bullish expectations that dominate analyst thinking.

Ongoing innovation and accelerated R&D output, with expectations for a major new product approval in a key market every year over the next few years, positions Zoetis to expand addressable markets, launch higher-margin products, and protect market share. This is expected to positively impact organic revenue growth and net margins.

Curious about what supercharges this valuation? The calculation pivots on bold expectations for both earnings and margin growth. Find out which assumptions truly move the needle behind this ambitious target.

Result: Fair Value of $190 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensified competition or setbacks in key product launches could limit Zoetis’s growth potential. These factors represent real catalysts that might challenge this optimistic outlook.

Find out about the key risks to this Zoetis narrative.

Another View: Multiples Tell a Different Story

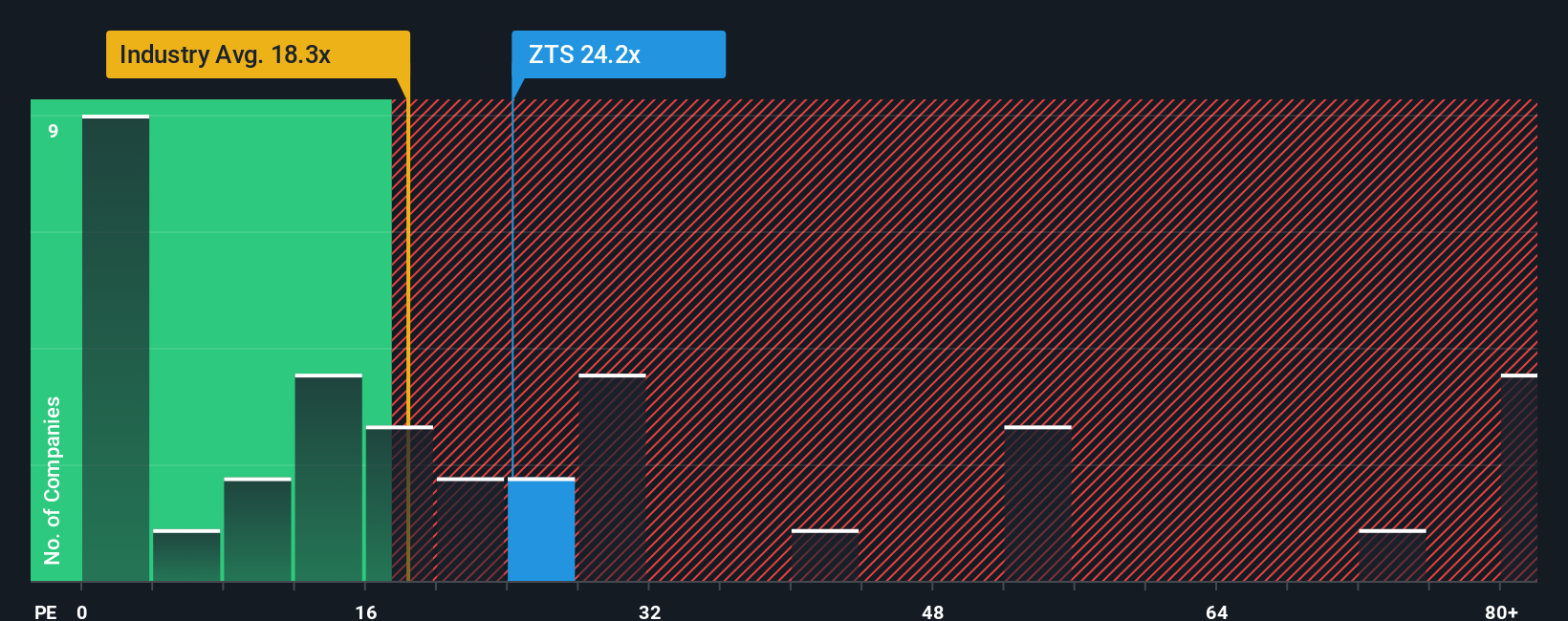

Looking at market valuations, Zoetis trades at a price-to-earnings ratio of 24.9x, which is noticeably higher than its industry average of 19.8x, its peer average of 15.5x, and even above its own fair ratio of 21.6x. This premium suggests investors are baking in higher expectations. However, does it mean the stock’s true upside has already been priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zoetis Narrative

If you have a different perspective on Zoetis or prefer to dig into the data yourself, you can craft your own take in minutes. Do it your way.

A great starting point for your Zoetis research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to go beyond Zoetis? Gain an edge with these hand-picked stock opportunities, each matched to unique themes and growth stories you will not want to miss.

- Boost your portfolio’s income by targeting companies with robust payouts from these 19 dividend stocks with yields > 3%.

- Capitalize on artificial intelligence breakthroughs by tapping into the momentum of these 24 AI penny stocks.

- Position yourself for value-led gains with exceptional businesses identified by these 900 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoetis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZTS

Zoetis

Engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, diagnostic products and services, biodevices, genetic tests, and precision animal health products in the United States and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives