- United States

- /

- Life Sciences

- /

- NYSE:WST

West Pharmaceutical Services (WST): Evaluating Valuation as Innovation and Investor Interest Gain Momentum

Reviewed by Simply Wall St

West Pharmaceutical Services (WST) has been catching the eye of investors as its consistent cash generation and strong balance sheet combine with fresh opportunities in innovative drug delivery and containment systems. Institutional interest has also been trending higher lately.

See our latest analysis for West Pharmaceutical Services.

After a steady run-up over the last quarter, West Pharmaceutical Services’ share price has rebounded sharply with a 21% return over the past 90 days. However, year-to-date it’s still down about 16%. Despite the short-term bounce and ongoing excitement about innovation in drug delivery, the company’s total return over the past year remains modest at -4%. This suggests momentum is recovering but not yet driving long-term outperformance.

If you’re looking to uncover more promising opportunities in the medtech and pharma space, this is an ideal time to explore See the full list for free.

The question for investors now is whether West Pharmaceutical Services’ current valuation still offers upside, or if the market has already factored in all of its promising growth prospects. Could this be a window of opportunity, or are future gains priced in?

Most Popular Narrative: 13% Undervalued

At the last close of $274.90, the most followed narrative estimates West Pharmaceutical Services' fair value at $316.36, suggesting that investors could be undervaluing its medium-term earnings potential. Anticipated gains appear tied to compelling catalysts and operational upgrades on the horizon.

The introduction of an automated line for HVP delivery devices later in 2025 to early 2026 is expected to improve margins by driving operational efficiencies and scale. This is anticipated to enhance net margins. The increase in demand and the transition to higher-margin HVP components, supported by approximately 340 Annex 1 projects, is likely to positively impact both revenue and net margins due to a favorable mix shift.

Curious just how ambitious the margin and earnings improvements are behind this bullish price objective? The narrative leans on accelerating operational leverage and a forecast growth pace that is not for the faint-hearted. Want to see the detailed assumptions that fuel this fair value? Dig in for the numbers and rationale that set the narrative apart.

Result: Fair Value of $316.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued demand shifts and tariff uncertainties could undermine margin gains and present challenges for West Pharmaceutical Services’ ambitious growth projections.

Find out about the key risks to this West Pharmaceutical Services narrative.

Another View: What Do Valuation Ratios Say?

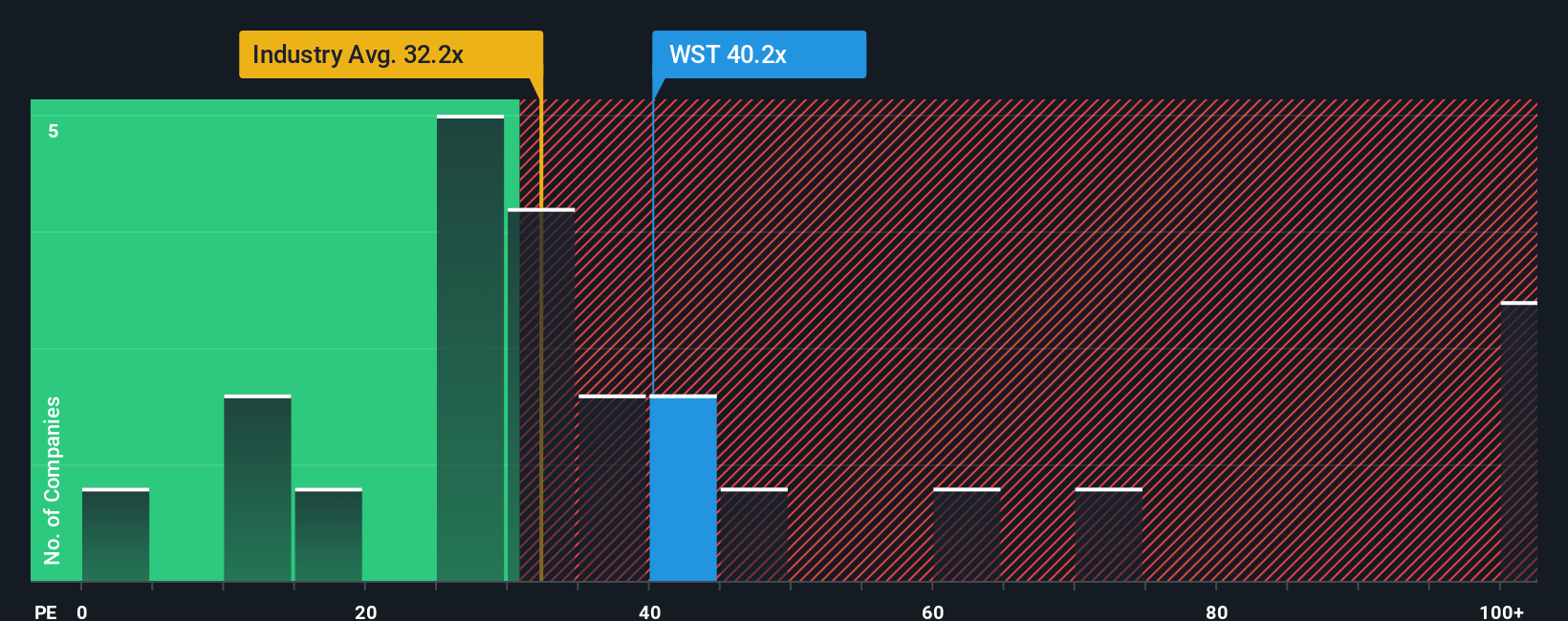

On the flip side, when using the price-to-earnings ratio, West Pharmaceutical Services trades at 40.5x, notably higher than the US Life Sciences industry average of 32.5x and far above its peers at 23.8x. The fair ratio for the company stands at 25.4x. This indicates the market expects premium growth, or is simply paying up. Does this generous rating reflect real opportunity, or does it introduce more valuation risk if expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own West Pharmaceutical Services Narrative

If you'd rather form your own outlook or want to dive deeper into the numbers, it only takes a few minutes to build your personal narrative for West Pharmaceutical Services, so why not Do it your way?

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding West Pharmaceutical Services.

Looking for more investment ideas?

Level up your investment game with fresh, data-driven stock ideas that could help shape your portfolio’s future. Don’t miss your chance to be ahead of the crowd.

- Tap into high-yield opportunities for monthly income and check out these 17 dividend stocks with yields > 3% for strong, reliable returns in a range of market conditions.

- Catch the next wave of generative machine intelligence by considering these 24 AI penny stocks, which are outpacing industry growth and challenging established players.

- Uncover untapped value by targeting these 874 undervalued stocks based on cash flows trading at attractive prices, positioned for potential recovery or future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Pharmaceutical Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WST

West Pharmaceutical Services

Designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives