- United States

- /

- Life Sciences

- /

- NYSE:WAT

Will the Xevo CDMS Launch Redefine Waters' (WAT) Role in Next-Gen Therapeutics?

Reviewed by Sasha Jovanovic

- Waters Corporation recently launched the Waters Xevo Charge Detection Mass Spectrometer (CDMS), a system designed to facilitate unprecedented analysis of mega-mass biomolecules critical for cell and gene therapies, mRNA, and advanced protein therapeutics.

- This instrument allows rapid, highly sensitive measurement with minimal sample volume, enabling real-time characterization of complex drug modalities that were previously difficult to analyze efficiently.

- We'll explore how the Xevo CDMS launch strengthens Waters' position in next-generation therapeutics and its broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Waters Investment Narrative Recap

To be a Waters shareholder, you need to believe in the company’s capacity to expand its footprint in biopharma analytics and capitalize on innovation-driven demand, particularly with the surge in next-generation therapeutics. The Xevo CDMS launch directly supports Waters’ transition into these high-growth markets and could reinforce the company’s strongest short-term catalyst, a successful entry into cell and gene therapy workflows, though risks tied to the BD acquisition integration and execution remain unchanged for now.

Among recent announcements, the April expansion of the Alliance™ iS Bio HPLC line, with enhanced detection capabilities for laboratories, underscores Waters’ ongoing emphasis on broadening its product portfolio. This complements the momentum from the Xevo CDMS rollout, further positioning Waters to serve a wider range of analytical needs across pharma R&D, which remain a core engine for growth.

Yet, even as innovation accelerates, investors should be alert to unresolved challenges, especially if integration hurdles from the BD acquisition start...

Read the full narrative on Waters (it's free!)

Waters’ outlook anticipates $3.7 billion in revenue and $946.3 million in earnings by 2028. This is based on an annual revenue growth rate of 6.4% and represents a $284.9 million increase in earnings from $661.4 million today.

Uncover how Waters' forecasts yield a $351.07 fair value, in line with its current price.

Exploring Other Perspectives

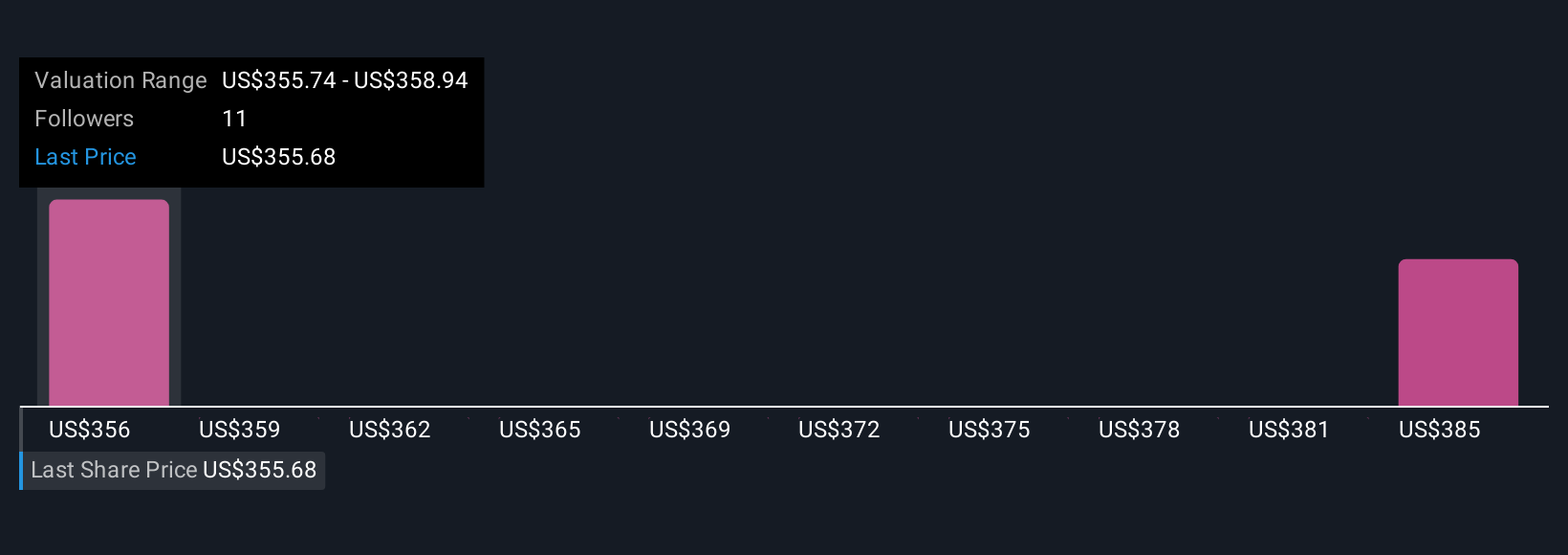

Two Simply Wall St Community members estimate fair values for Waters between US$351.07 and US$387.23 per share. With these differing outlooks, keep in mind ongoing integration risks could shape the company’s path and invite you to consider several perspectives.

Explore 2 other fair value estimates on Waters - why the stock might be worth just $351.07!

Build Your Own Waters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Waters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Waters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Waters' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAT

Waters

Provides analytical workflow solutions in Asia, the Americas, and Europe.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives