- United States

- /

- Life Sciences

- /

- NYSE:TMO

Will Thermo Fisher's Asia Bioprocessing Tri-Hub Expansion Reshape Thermo Fisher Scientific's (TMO) Narrative?

Reviewed by Sasha Jovanovic

- In late November and early December 2025, Thermo Fisher Scientific announced a major expansion of its bioprocessing capabilities across Asia, opening a new Bioprocess Design Center in Hyderabad and enlarging facilities in Incheon and Singapore to support faster, more efficient biologics and cell and gene therapy manufacturing.

- This tri-hub network creates a connected platform for customers to co-design, test and scale bioprocesses locally, potentially deepening Thermo Fisher’s role as an end-to-end partner in Asia’s biopharmaceutical supply chain.

- We’ll now explore how this Asia-focused tri-hub bioprocessing expansion could influence Thermo Fisher’s investment narrative and long-term positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Thermo Fisher Scientific Investment Narrative Recap

To own Thermo Fisher Scientific, you need to believe in its role as an end to end enabler of global biopharma, where tools, services and manufacturing capacity all matter. The Asia tri hub bioprocessing expansion supports this thesis, but does not materially change the near term focus on stabilizing instruments demand and managing margin pressure in Analytical Instruments, or the key risk around ongoing weakness and policy uncertainty in China.

Among recent announcements, the €2.1 billion euro denominated bond offering stands out next to the Asia buildout, since both speak to Thermo Fisher’s willingness to keep investing in capacity and capabilities. For shareholders, that ties directly into the main catalyst of deeper pharma and biotech partnerships, but also raises questions around balance sheet flexibility and the return on incremental capital at a time when growth in several end markets is still normalizing.

However, investors should also be aware that Thermo Fisher’s exposure to China could...

Read the full narrative on Thermo Fisher Scientific (it's free!)

Thermo Fisher Scientific's narrative projects $50.0 billion revenue and $9.0 billion earnings by 2028. This requires 5.0% yearly revenue growth and about a $2.4 billion earnings increase from $6.6 billion today.

Uncover how Thermo Fisher Scientific's forecasts yield a $613.58 fair value, a 7% upside to its current price.

Exploring Other Perspectives

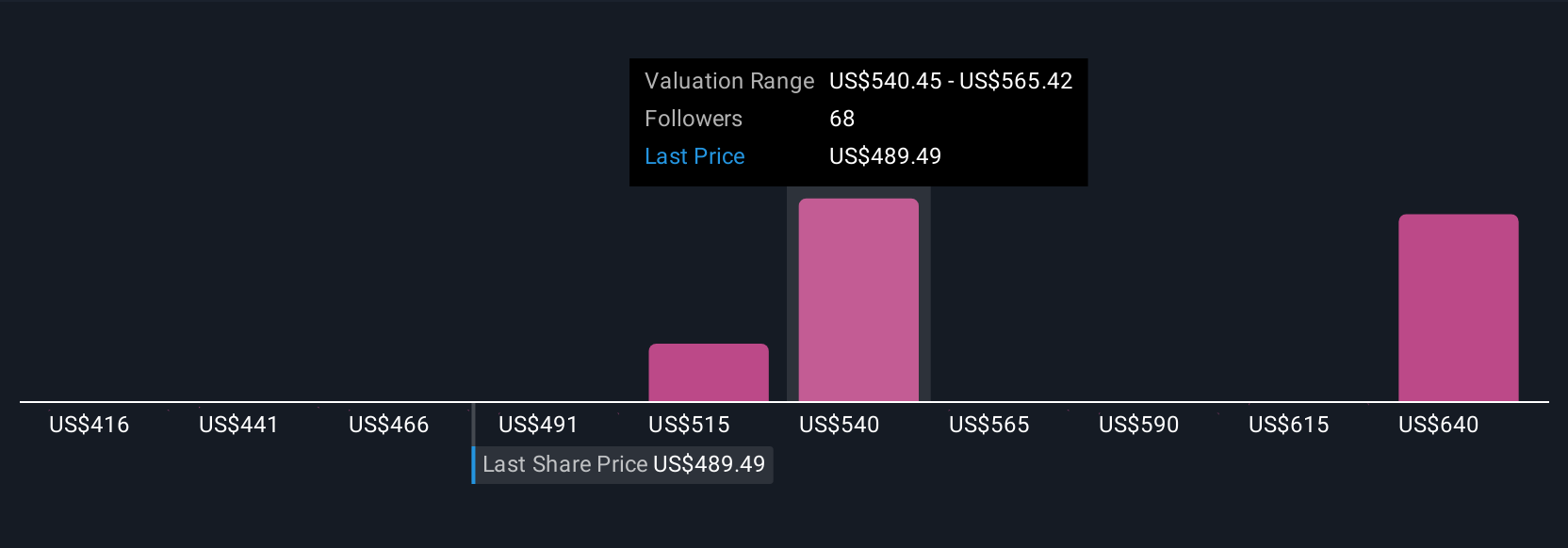

Thirteen members of the Simply Wall St Community currently see Thermo Fisher’s fair value between US$450 and about US$662, underscoring how far opinions can stretch. You can set those views against the risk that China related revenue softness and trade tensions may weigh on parts of Thermo Fisher’s international business and consider what that means for the company’s longer term earnings power.

Explore 13 other fair value estimates on Thermo Fisher Scientific - why the stock might be worth as much as 15% more than the current price!

Build Your Own Thermo Fisher Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thermo Fisher Scientific research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Thermo Fisher Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thermo Fisher Scientific's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026