- United States

- /

- Life Sciences

- /

- NYSE:TMO

What Thermo Fisher Scientific (TMO)'s OpenAI Partnership Means for Shareholders

Reviewed by Sasha Jovanovic

- Thermo Fisher Scientific recently announced a collaboration with OpenAI to deploy artificial intelligence across its operations, aiming to accelerate drug development and improve operational efficiency.

- This move highlights the increasing adoption of AI technologies in life sciences, positioning Thermo Fisher to potentially enhance the speed and scalability of bringing new therapies to market.

- We'll explore how integrating OpenAI's technology into Thermo Fisher's clinical research may affect its long-term growth and profitability narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Thermo Fisher Scientific Investment Narrative Recap

To be a Thermo Fisher Scientific shareholder, you need to believe in the company’s ability to harness advancing technologies such as AI to drive efficiency, support recurring revenues from life sciences, and capitalize on long-term growth from pharma, biotech, and diagnostic demand. The recent OpenAI partnership is directionally positive for productivity-focused catalysts, but it is unlikely to materially shift the most immediate short-term catalyst, which is the upcoming Q3 earnings and guidance, nor does it remove key external risks, especially exposure to slower academic/government funding and China revenue volatility.

Among the latest announcements, the launch of the SwiftArrayStudio Microarray Analyzer is especially relevant. This new platform streamlines genotyping for population-scale studies and pharmacogenomics, reinforcing Thermo Fisher’s push for innovation-driven revenue streams, the very approach that underpins its biggest long-term catalysts, even as near-term headwinds persist.

However, against this backdrop, it is important that investors also keep in mind the ongoing margin pressures, especially as...

Read the full narrative on Thermo Fisher Scientific (it's free!)

Thermo Fisher Scientific's outlook anticipates $50.0 billion in revenue and $9.0 billion in earnings by 2028. This is based on a 5.0% annual revenue growth rate and a $2.4 billion increase in earnings from the current $6.6 billion.

Uncover how Thermo Fisher Scientific's forecasts yield a $554.14 fair value, a 3% upside to its current price.

Exploring Other Perspectives

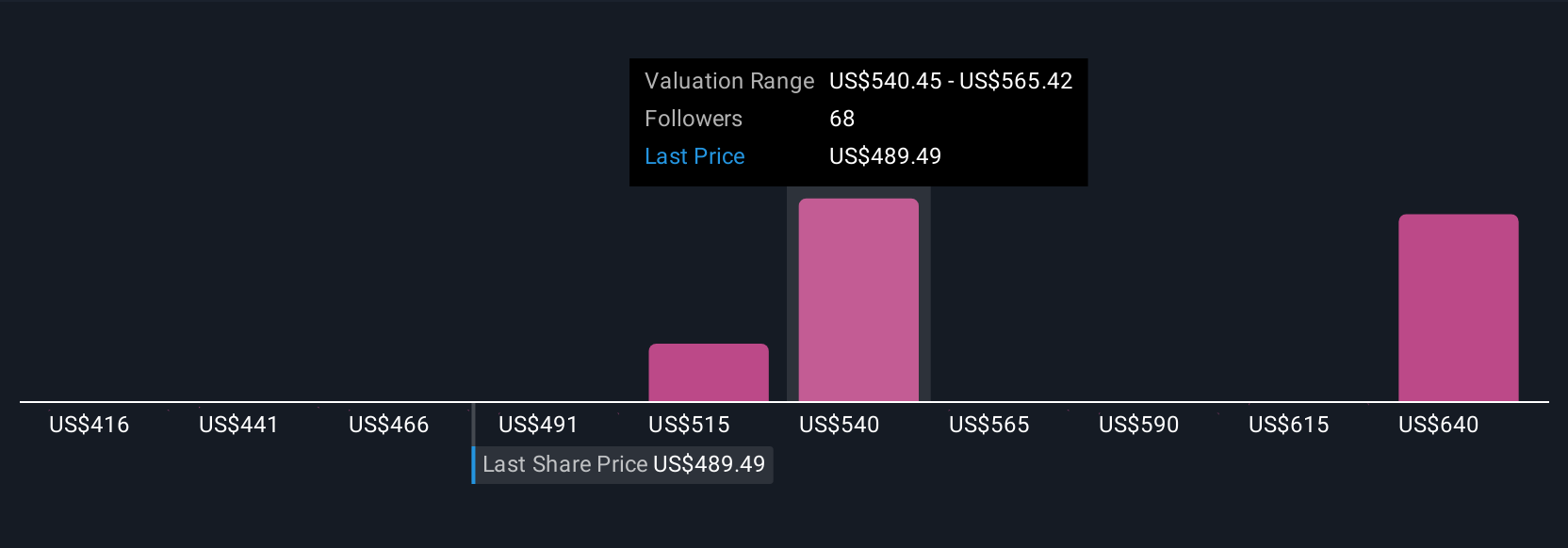

The Simply Wall St Community offers 14 fair value estimates for Thermo Fisher Scientific from as low as US$415.60 to as high as US$651.85. While investor opinions vary widely, near-term margin headwinds and muted organic growth remain at the center of market focus, inviting you to explore these different viewpoints in more detail.

Explore 14 other fair value estimates on Thermo Fisher Scientific - why the stock might be worth 23% less than the current price!

Build Your Own Thermo Fisher Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thermo Fisher Scientific research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Thermo Fisher Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thermo Fisher Scientific's overall financial health at a glance.

No Opportunity In Thermo Fisher Scientific?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives