- United States

- /

- Life Sciences

- /

- NYSE:TMO

Thermo Fisher Scientific (TMO) Secures $1 Billion Vaccine Manufacturing Pact With Vaxcyte—What Could It Mean?

Reviewed by Sasha Jovanovic

- Vaxcyte announced a new long-term agreement with Thermo Fisher Scientific to secure up to US$1 billion in commercial fill-finish manufacturing capacity for its pneumococcal conjugate vaccines at Thermo Fisher's Greenville, North Carolina facility.

- This collaboration underscores Thermo Fisher's growing footprint in biomanufacturing and strengthens its position as a critical supplier to the expanding vaccine and biopharma sectors.

- We'll explore how this significant manufacturing commitment could accelerate Thermo Fisher's growth strategy and reshape its investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Thermo Fisher Scientific Investment Narrative Recap

To be a shareholder in Thermo Fisher Scientific, you need to believe in the company’s ability to capture growth in biomanufacturing, innovation, and end-to-end pharma solutions, despite macroeconomic and geographic headwinds. The recent US$1 billion Vaxcyte manufacturing agreement highlights robust demand in vaccine production and helps reinforce Thermo Fisher’s role as a partner to large biopharma, but it does not materially offset the current risk of ongoing revenue pressure in academic and government markets, or exposure to margin headwinds from tariffs and FX.

The recent AI-powered research tools partnership with BenchSci stands out in the context of strengthening Thermo Fisher’s R&D productivity offer, especially as life sciences customers increasingly prioritize automation and data-driven efficiency. While innovations like this can structurally boost long-term growth by enhancing recurring revenues and customer integration, they do not directly mitigate near-term sensitivity to academic funding slowdowns, the key risk investors are now paying attention to.

By contrast, investors should be aware that Thermo Fisher’s fundamental outlook still hinges on unpredictable shifts in government and academic funding, with potential for further...

Read the full narrative on Thermo Fisher Scientific (it's free!)

Thermo Fisher Scientific's outlook anticipates $50.0 billion in revenue and $9.0 billion in earnings by 2028. This scenario is based on a projected annual revenue growth rate of 5.0% and represents an increase of $2.4 billion in earnings from the current $6.6 billion.

Uncover how Thermo Fisher Scientific's forecasts yield a $546.76 fair value, in line with its current price.

Exploring Other Perspectives

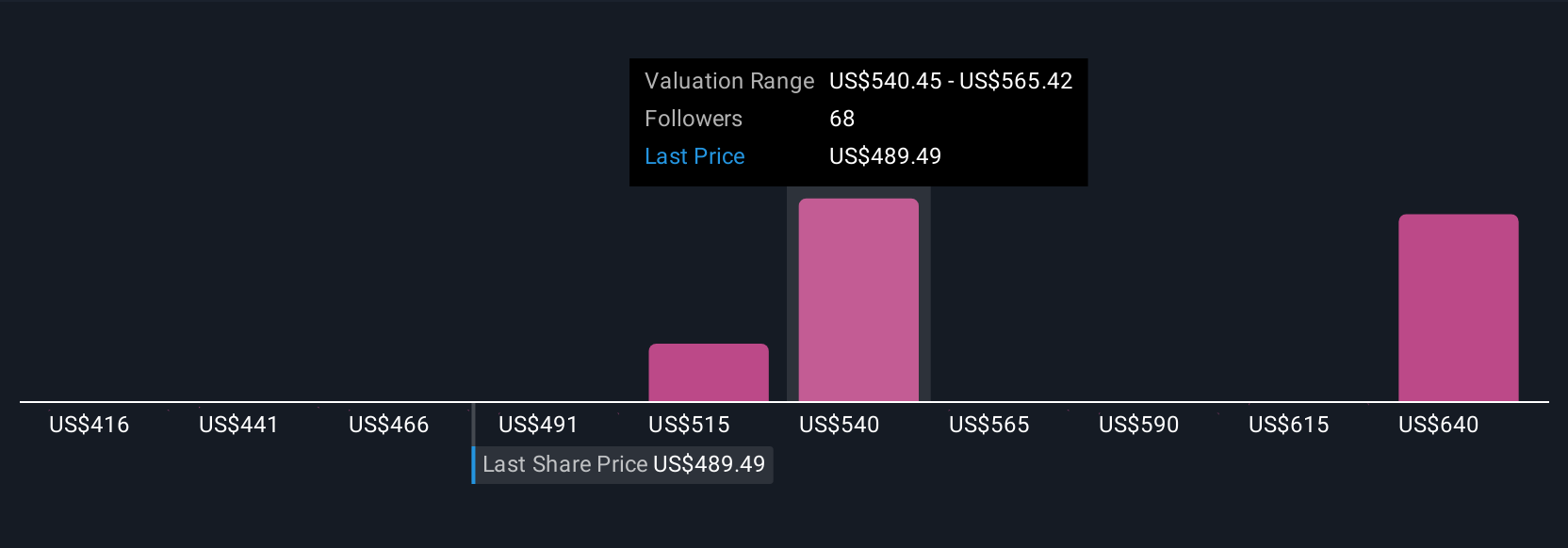

Fourteen private investors in the Simply Wall St Community estimate Thermo Fisher’s fair value anywhere between US$415.60 and US$658.66 per share. While growth catalysts abound, ongoing macro and regulatory risks could shape how these opinions play out in the real world, explore the range of views to see how expectations and concerns differ.

Explore 14 other fair value estimates on Thermo Fisher Scientific - why the stock might be worth as much as 21% more than the current price!

Build Your Own Thermo Fisher Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thermo Fisher Scientific research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Thermo Fisher Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thermo Fisher Scientific's overall financial health at a glance.

No Opportunity In Thermo Fisher Scientific?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives