- United States

- /

- Pharma

- /

- NYSE:TEVA

These 4 Measures Indicate That Teva Pharmaceutical Industries (NYSE:TEVA) Is Using Debt In A Risky Way

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Teva Pharmaceutical Industries Limited (NYSE:TEVA) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Teva Pharmaceutical Industries

What Is Teva Pharmaceutical Industries's Net Debt?

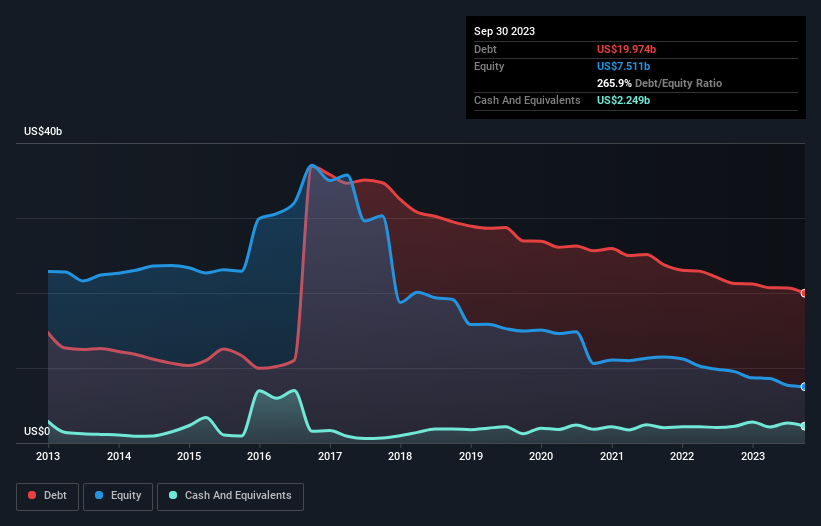

As you can see below, Teva Pharmaceutical Industries had US$20.0b of debt at September 2023, down from US$21.3b a year prior. However, because it has a cash reserve of US$2.25b, its net debt is less, at about US$17.7b.

How Strong Is Teva Pharmaceutical Industries' Balance Sheet?

We can see from the most recent balance sheet that Teva Pharmaceutical Industries had liabilities of US$11.4b falling due within a year, and liabilities of US$23.2b due beyond that. Offsetting these obligations, it had cash of US$2.25b as well as receivables valued at US$3.39b due within 12 months. So it has liabilities totalling US$28.9b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the US$11.0b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Teva Pharmaceutical Industries would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Teva Pharmaceutical Industries's debt is 4.7 times its EBITDA, and its EBIT cover its interest expense 2.8 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Another concern for investors might be that Teva Pharmaceutical Industries's EBIT fell 10% in the last year. If things keep going like that, handling the debt will about as easy as bundling an angry house cat into its travel box. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Teva Pharmaceutical Industries's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Teva Pharmaceutical Industries reported free cash flow worth 14% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

We'd go so far as to say Teva Pharmaceutical Industries's level of total liabilities was disappointing. And even its EBIT growth rate fails to inspire much confidence. Taking into account all the aforementioned factors, it looks like Teva Pharmaceutical Industries has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. While Teva Pharmaceutical Industries didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away. Click here to see if its earnings are heading in the right direction, over the medium term.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Teva Pharmaceutical Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TEVA

Teva Pharmaceutical Industries

Develops, manufactures, markets, and distributes generic medicines, specialty medicines, and biopharmaceutical products in North America, Europe, Israel, and internationally.

Undervalued with reasonable growth potential.