- United States

- /

- Life Sciences

- /

- NYSE:RVTY

Are Revvity’s Strategic Partnerships Changing the Outlook for Its Stock in 2025?

Reviewed by Bailey Pemberton

If you are watching Revvity’s recent ups and downs, you are certainly not alone. Over just the past week, the stock has jumped 6.3%, and that positive momentum has built on a double-digit pop of 11.7% over the last month. While these gains seem to signal renewed confidence, it is hard to overlook that shares are still down sharply from where they started the year, sliding 13.5% year to date and posting a substantial 18.2% loss over the past twelve months. Looking even further back, Revvity’s five-year and three-year performances paint a similarly challenging picture, with returns of -22.9% and -28.4%, respectively.

What is driving these wild swings? Recently, Revvity caught investors’ attention after announcing multiple strategic partnerships focused on expanding its presence in the life sciences tools sector. These collaborations have sparked discussion among analysts who are weighing the company’s innovation capabilities and potential for future growth against lingering market pressures. As a result, market sentiment toward Revvity may be shifting, with some investors seeing new opportunities where risk once dominated the conversation.

For anyone weighing their next move, understanding whether Revvity is attractively valued is going to matter more than ever. According to our assessment, Revvity earns a valuation score of 3 out of 6. This means it appears undervalued in half of the key checks we use. To really decide what this means for your portfolio, let’s take a closer look at how these valuation methods work, and a little later, I’ll show you one approach to valuation that could offer even more insight.

Why Revvity is lagging behind its peers

Approach 1: Revvity Discounted Cash Flow (DCF) Analysis

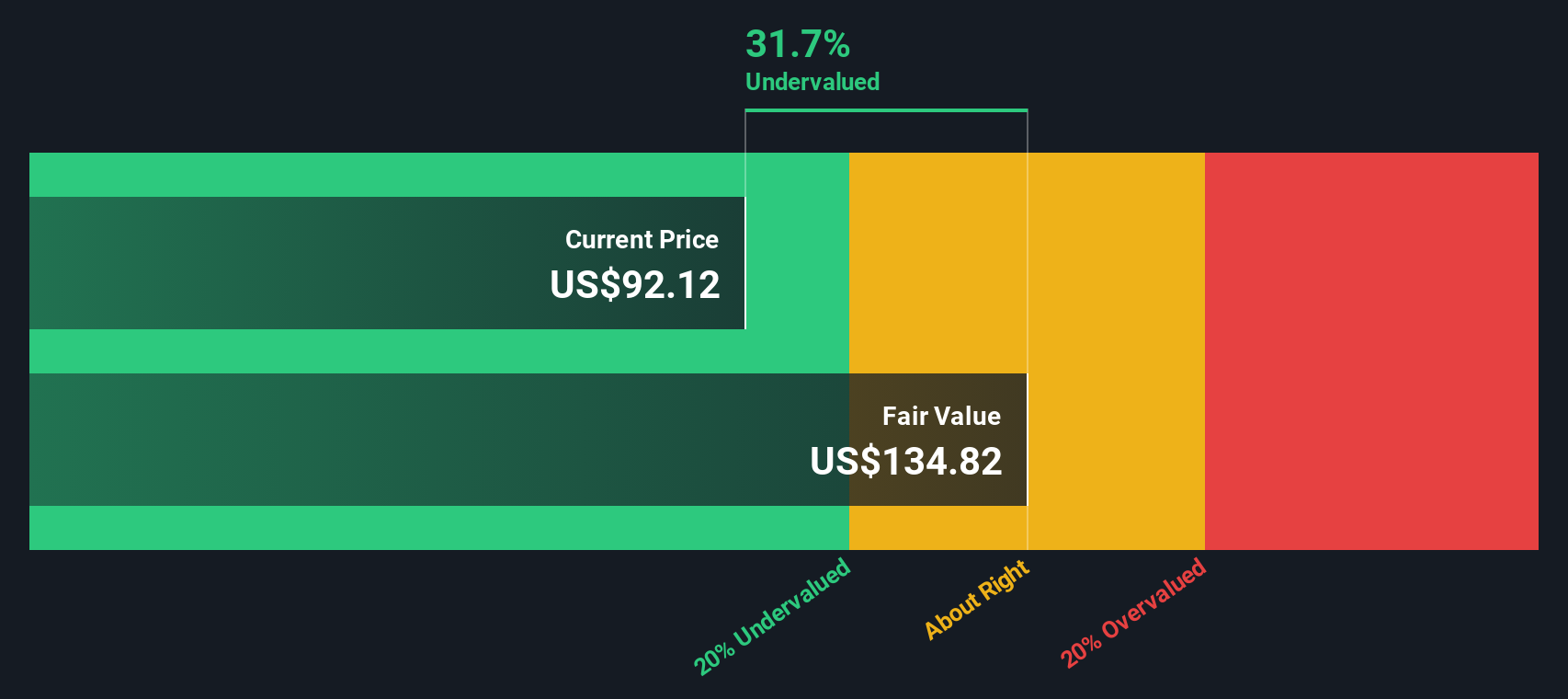

The Discounted Cash Flow (DCF) model is a powerful tool for estimating a company's true worth by projecting its future cash flows and then discounting them back to present value. In Revvity’s case, the DCF approach utilizes free cash flow forecasts, based on both analyst estimates and extrapolations, to calculate its intrinsic value today.

Currently, Revvity generates free cash flow of $503 million. Analyst projections go out five years, with Simply Wall St extending these forecasts further to estimate long-term trends. By 2028, Revvity’s free cash flow is expected to increase to about $753 million, and projections for 2035 suggest it could reach approximately $1 billion, based on steady annual growth rates. All cash flows are measured in U.S. dollars.

Putting these numbers through the DCF calculation results in an estimated intrinsic value for Revvity of $134.96 per share. With the current share price reflecting a 28.2% discount to this value, the model signals the stock is significantly undervalued at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Revvity is undervalued by 28.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Revvity Price vs Earnings

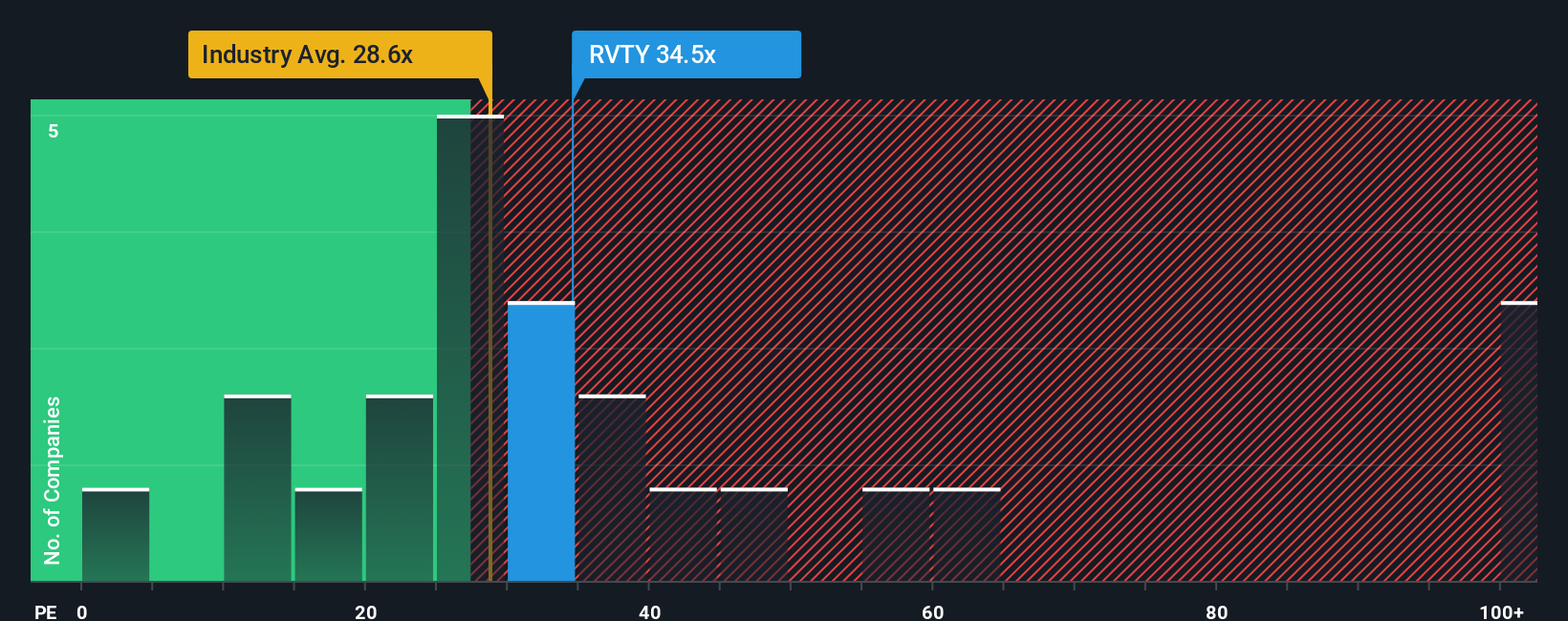

The price-to-earnings (PE) ratio is a widely used valuation metric for profitable companies like Revvity, as it compares a company’s share price to its earnings per share. It is especially insightful for mature businesses because it captures investor expectations about future earnings growth, potential risks, and the overall quality of earnings.

When looking at PE ratios, higher growth prospects or lower risk typically justify a higher "normal" PE. Companies facing greater uncertainty or slower growth tend to trade at lower multiples. Revvity currently trades at a PE ratio of 40.36x. This is above the broader Life Sciences industry average of 33.85x and somewhat lower than the average of its peer group, which stands at 51.61x. This suggests the market may expect Revvity’s earnings growth and risk profile to fall between that of the broader sector and its closest rivals.

To provide clearer perspective, Simply Wall St calculates a customized “Fair Ratio” for each company using not just industry comparisons, but also factors like Revvity’s earnings growth, profit margins, risk factors, and market cap. This approach is more insightful than merely comparing to peers or industry averages, as it is tailored to the specifics of each business. For Revvity, the Fair Ratio is 22.34x, noticeably below its current PE of 40.36x. This difference implies that, after accounting for all major inputs, Revvity’s shares appear overvalued based on current earnings and risk-adjusted growth potential.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Revvity Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique story about a company’s future, turning numbers like fair value, revenue, and earnings into a personalized forecast that makes sense to you. Narratives connect what’s happening in the business with your financial outlook and an estimate of what the company is truly worth, allowing you to see beyond traditional metrics like PE ratios or analyst targets.

On Simply Wall St’s Community page, millions of investors use Narratives as a simple, accessible tool to map out their thinking, justify a buy or sell decision, and instantly see how their Fair Value stacks up against today’s share price. Narratives are updated automatically whenever fresh data, news, or earnings are released, so your view keeps pace as the real-world story evolves.

Imagine, for example, that one investor believes Revvity’s digital expansion will accelerate recurring, high-margin growth. This leads them to set a Fair Value as high as $162 per share. Another investor may focus on margin pressures and regulatory risks, estimating a Fair Value closer to $100. These differences reflect each investor’s narrative, helping them make smarter, more confident decisions based on their own convictions.

Do you think there's more to the story for Revvity? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RVTY

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives