- United States

- /

- Biotech

- /

- NYSE:RCUS

Can Arcus Biosciences Rebound in 2025 After Latest Cancer Trial Updates?

Reviewed by Bailey Pemberton

If you have Arcus Biosciences on your radar right now, you are not alone. Plenty of investors are asking themselves whether this biotech stock is about to turn a corner after a stretch of underperformance, or if there is more volatility ahead. With the share price closing at $13.35 and eking out a modest 0.2% gain over the last week, it might not look like much is happening. However, dig a little deeper and there are some interesting sparks.

Over the past month, Arcus Biosciences returned 9.5%, hinting that investor sentiment could be shifting, even as the year-to-date performance remains down at -11.8%. Looking further back, the stock is still well off its highs, declining 22.8% over the last year and a hefty 48.9% over three years. If you have been holding long-term, you know this story all too well. Still, certain developments in the biotech sector, such as renewed interest in cancer therapeutics, seem to be breathing new life into the risk appetite for names like Arcus. This has occurred even if only in fits and starts so far.

But with the market’s perspective clearly on the move, the real question is all about valuation. Here is where things get interesting. By applying six key valuation checks that many investors swear by, Arcus is undervalued in four of them. That gives the company a value score of 4, suggesting there is far more going on under the hood than what you see in past returns alone.

Let’s break down how these approaches assess Arcus, and why there might be an even smarter way to think about the company’s valuation, which I will share with you by the end of this article.

Why Arcus Biosciences is lagging behind its peers

Approach 1: Arcus Biosciences Discounted Cash Flow (DCF) Analysis

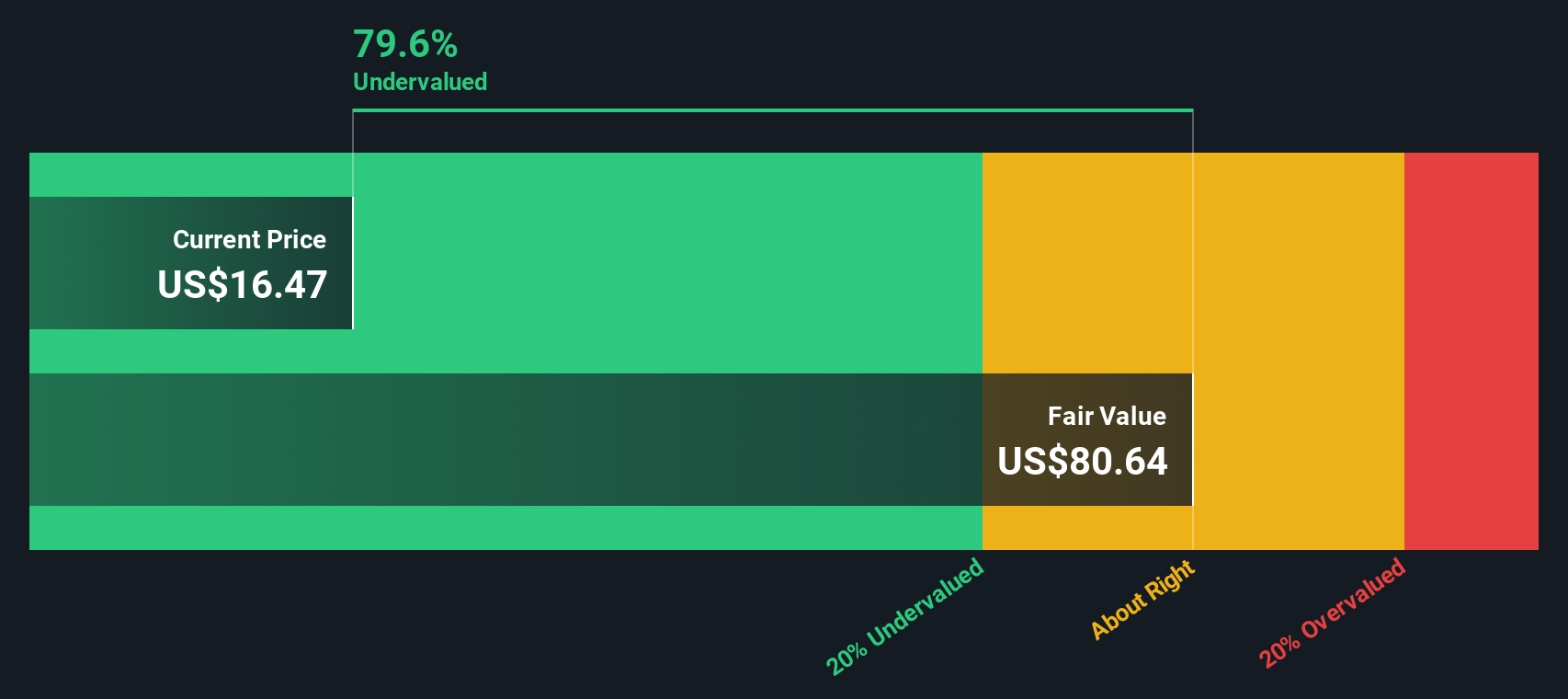

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and discounting them back to today’s dollars, aiming to capture what those earnings might realistically be worth right now. For Arcus Biosciences, the latest reported Free Cash Flow stands at -$353 million, reflecting the company's ongoing investments and current lack of steady profitability.

Analyst forecasts suggest a turnaround, with Free Cash Flow expected to reach $311 million by 2029. Estimates become more extrapolated in the years following, but the growth trajectory points to significant improvement, with further projections for 2035 approaching $460 million (all figures in USD).

Based on these cash flow projections, the DCF model calculates an intrinsic value for Arcus Biosciences of $78.00 per share. Given the stock’s current share price of $13.35, this suggests the stock is trading at an 82.9% discount to its estimated fair value, a substantial margin indicating considerable upside potential if projections play out.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arcus Biosciences is undervalued by 82.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

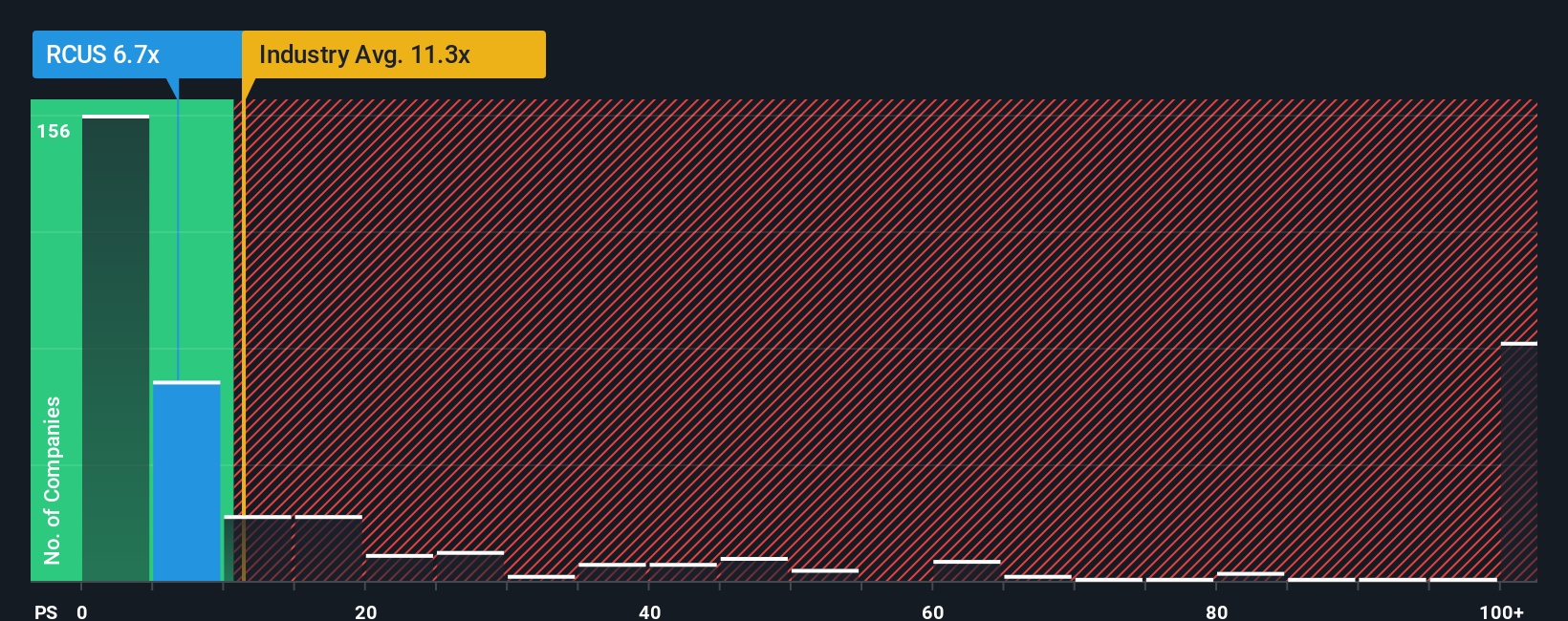

Approach 2: Arcus Biosciences Price vs Sales

The Price-to-Sales (P/S) ratio is a popular valuation metric, especially for biotech companies like Arcus Biosciences that may not yet be profitable. Because revenue is often more stable and less prone to accounting variations than earnings, the P/S ratio gives investors a clearer snapshot of how the market values each dollar of the company’s sales.

In the world of high-growth sectors such as biotechnology, the "normal" or fair P/S ratio depends heavily on growth prospects and risk. Companies with strong future sales growth or innovative pipelines often command a higher ratio, while greater uncertainty or weaker growth prospects can lower what investors are willing to pay per dollar of sales.

Arcus Biosciences currently trades at a 5.4x P/S ratio. This is below both the biotech industry average of 10.5x and its peer group’s average of 27.6x, suggesting the market may not be giving full credit to Arcus’ potential. However, relying solely on such averages can be misleading, as they do not account for company-specific factors.

That is where Simply Wall St's “Fair Ratio” comes into play. This proprietary metric considers much more than just sector averages. It incorporates growth expectations, profit margins, company size, market risks and other important elements, offering a more well-rounded benchmark for where the stock’s multiple should sit. For Arcus, the Fair Ratio is 1.0x, placing it very close to where the shares actually trade based on the preferred multiple.

Given that Arcus’s actual P/S is just over the Fair Ratio by less than 0.10, the stock’s valuation on this metric looks to be about right for current circumstances.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arcus Biosciences Narrative

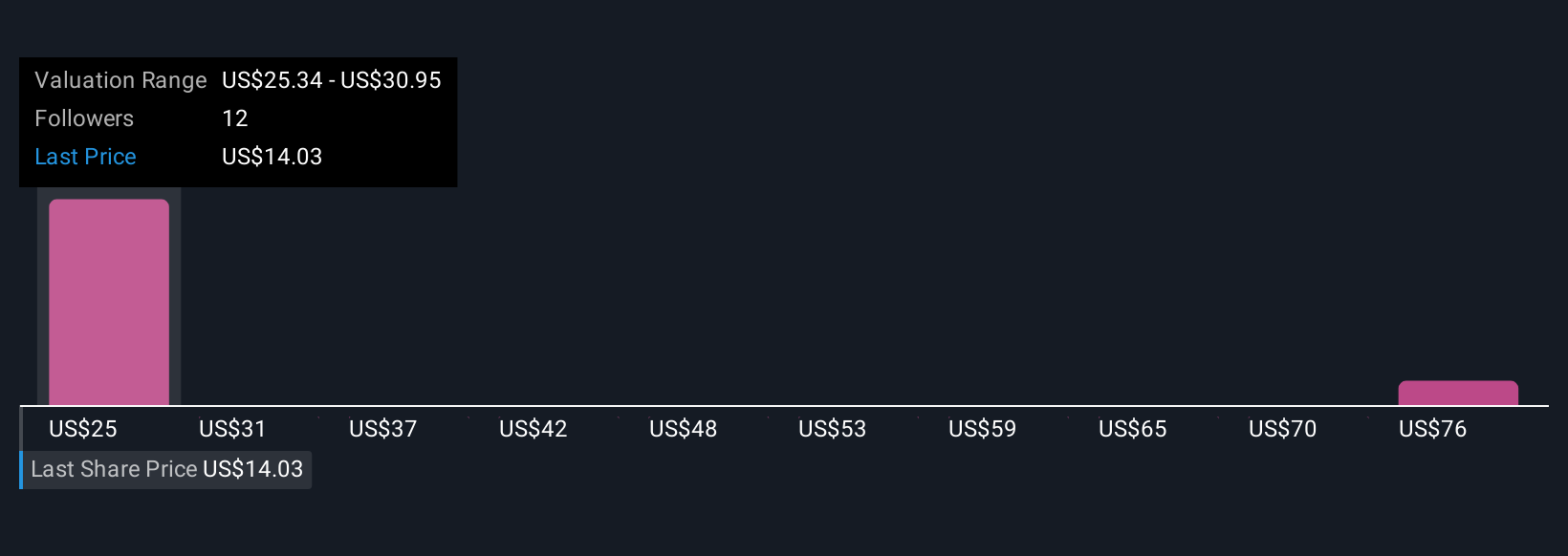

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply a story you craft behind the numbers, connecting your personal perspective on a company with what you believe about its future revenue, earnings, and margins. Narratives link Arcus Biosciences’ unfolding story directly to a clear financial forecast and a resulting fair value, allowing your outlook to shape and inform what you think the shares are truly worth.

This approach is both straightforward and accessible. Millions of investors already use Narratives on Simply Wall St’s Community page to map out their own investment strategies. Narratives make it easy to decide when to buy or sell: you compare the Fair Value, as guided by your own storyline and assumptions, with the current share price. As new developments hit the news or earnings reports are released, Narratives update dynamically, reflecting the freshest insights and changing conditions.

For Arcus Biosciences, some investors craft an optimistic Narrative anchored on successful cancer drug trials and forecast a fair value as high as $47.00, while others express caution given regulatory risks and see fair value closer to $12.00. This demonstrates how diverse stories lead to different investment actions.

Do you think there's more to the story for Arcus Biosciences? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCUS

Arcus Biosciences

A clinical-stage biopharmaceutical company, develops and commercializes cancer therapies in the United States.

Good value with adequate balance sheet.

Market Insights

Community Narratives