- United States

- /

- Biotech

- /

- NYSE:RCUS

Arcus Biosciences (RCUS) Is Up 11.5% After Strong Phase 2 Gastric Cancer Survival Results

Reviewed by Sasha Jovanovic

- Arcus Biosciences recently announced the first overall survival results from Arm A1 of its Phase 2 EDGE-Gastric study, showing a median overall survival of 26.7 months for patients with advanced gastric, gastroesophageal junction, or esophageal adenocarcinoma treated with domvanalimab plus zimberelimab and chemotherapy.

- The positive results, observed across all PD-L1 subgroups and with a safety profile consistent with other anti-PD-1 combinations, support ongoing Phase 3 development and highlight the potential clinical differentiation of Arcus' Fc-silent anti-TIGIT antibody regimen.

- We'll examine how these sustained efficacy and safety results for domvanalimab plus zimberelimab could influence Arcus Biosciences' long-term growth thesis.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Arcus Biosciences Investment Narrative Recap

To own shares in Arcus Biosciences, investors need to believe in the company’s ability to deliver regulatory approvals and commercial success for its pipeline, particularly domvanalimab and zimberelimab in gastric and related cancers. The recent positive survival data from the EDGE-Gastric study strengthens confidence in upcoming pivotal readouts, but the biggest short-term catalyst remains regulatory clarity; the most immediate risk is any delays or setbacks in the ongoing STAR-221 Phase 3 trial, as further progress depends on this large-scale validation.

Earlier this month, Arcus also presented updated monotherapy results for casdatifan, its HIF-2α inhibitor, showing 81% disease control in late-line metastatic renal cell carcinoma. While positive, this announcement is less directly relevant to the current gastric cancer catalyst, but it does point to Arcus’s broader oncology ambitions, which could diversify opportunities if the domvanalimab program encounters challenges.

In contrast, investors should note unresolved uncertainties about regulatory review timelines…

Read the full narrative on Arcus Biosciences (it's free!)

Arcus Biosciences' outlook anticipates $327.1 million in revenue and $52.5 million in earnings by 2028. This targets 7.7% annual revenue growth and a $350.5 million increase in earnings from the current -$298.0 million.

Uncover how Arcus Biosciences' forecasts yield a $29.91 fair value, a 77% upside to its current price.

Exploring Other Perspectives

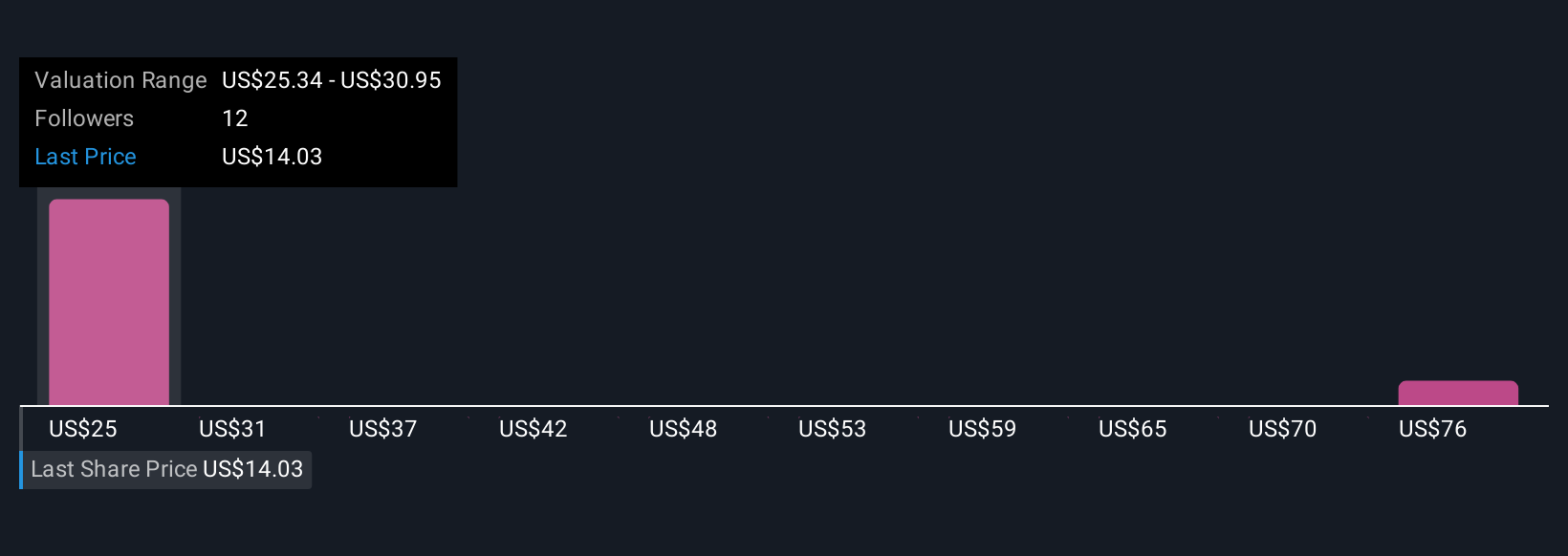

Simply Wall St Community members set fair value estimates between US$25.34 and US$80.93, based on three distinct analyses. Yet, regulatory approval risks for Arcus’s late-stage trials mean that performance outcomes could still surprise to either side.

Explore 3 other fair value estimates on Arcus Biosciences - why the stock might be worth just $25.34!

Build Your Own Arcus Biosciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arcus Biosciences research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Arcus Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arcus Biosciences' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCUS

Arcus Biosciences

A clinical-stage biopharmaceutical company, develops and commercializes cancer therapies in the United States.

Good value with adequate balance sheet.

Market Insights

Community Narratives