- United States

- /

- Biotech

- /

- NYSE:RCUS

Arcus Biosciences, Inc.'s (NYSE:RCUS) Shares Lagging The Industry But So Is The Business

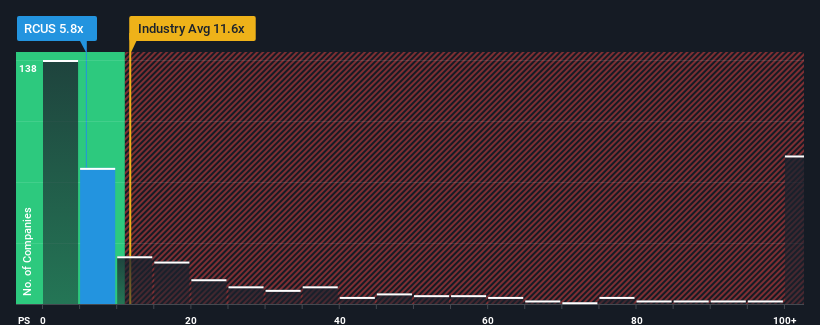

With a price-to-sales (or "P/S") ratio of 5.8x Arcus Biosciences, Inc. (NYSE:RCUS) may be sending very bullish signals at the moment, given that almost half of all the Biotechs companies in the United States have P/S ratios greater than 11.6x and even P/S higher than 63x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Arcus Biosciences

What Does Arcus Biosciences' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Arcus Biosciences has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Arcus Biosciences.How Is Arcus Biosciences' Revenue Growth Trending?

Arcus Biosciences' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 104%. The latest three year period has also seen an excellent 166% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 7.7% per annum during the coming three years according to the seven analysts following the company. With the industry predicted to deliver 139% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Arcus Biosciences' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Arcus Biosciences' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Arcus Biosciences that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RCUS

Arcus Biosciences

A clinical-stage biopharmaceutical company, develops and commercializes cancer therapies in the United States.

Excellent balance sheet and good value.

Market Insights

Community Narratives