- United States

- /

- Biotech

- /

- NYSE:RCUS

A Fresh Look at Arcus Biosciences (RCUS) Valuation Following Recent Stock Rally

Reviewed by Kshitija Bhandaru

Arcus Biosciences (RCUS) has caught the attention of investors after a steady rally, with shares climbing 37% over the past month. The company’s performance stands out compared to broader sector trends, sparking fresh discussions around its growth story.

See our latest analysis for Arcus Biosciences.

Looking beyond this month’s surge, Arcus Biosciences’ share price has made a dramatic 80% jump in the past 90 days, signaling growing investor optimism. However, its total shareholder return over the past year remains negative, a reminder that momentum is only just starting to build.

If you’re eager to spot more breakout potential, now is the perfect chance to broaden your investing horizons and discover fast growing stocks with high insider ownership.

With such rapid gains, investors may wonder if Arcus Biosciences still offers untapped value or if the stock's recent rally already reflects all the company’s future potential. This could leave little room for further upside.

Most Popular Narrative: 44.9% Undervalued

According to the most widely followed narrative, Arcus Biosciences’ fair value is set notably higher than its last close price of $16.47. The market’s bullish expectations reflect big hopes for the company’s clinical pipeline and future earnings potential.

The company plans to present further data throughout 2025 from ongoing studies, which are expected to demonstrate favorable outcomes such as improved overall response rate (ORR) and progression-free survival (PFS). These outcomes could significantly impact future revenue growth as the positive data could drive market share gains.

Curious what is driving these bold projections? The narrative’s optimism depends on rapid sales expansion and a major turnaround in profitability, leading to an eye-catching future earnings multiple. Want to see the assumptions behind this valuation leap? Dive in for the numbers and the reasoning that set this high fair value.

Result: Fair Value of $29.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory hurdles and tough competition could quickly challenge the bullish case for Arcus Biosciences if clinical progress slows or if rivals advance.

Find out about the key risks to this Arcus Biosciences narrative.

Another View: Market Multiples Tell a Different Story

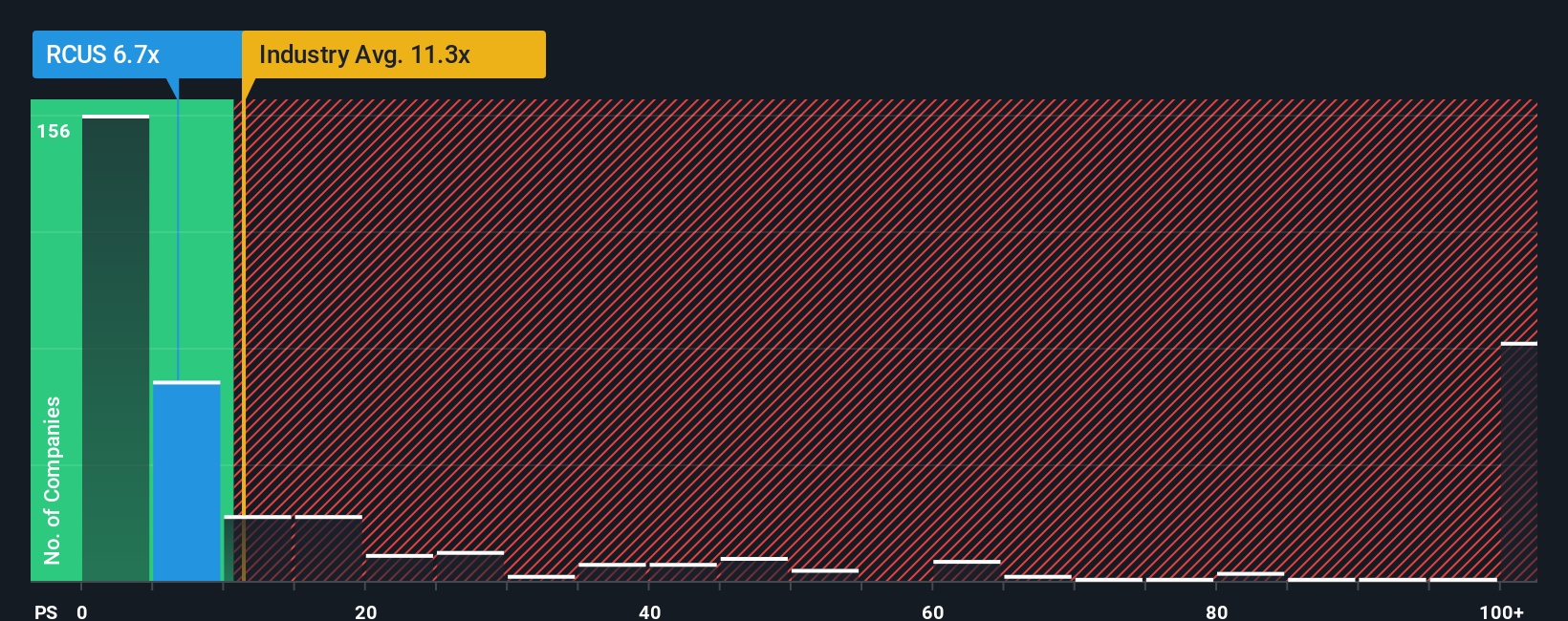

While one valuation approach sees Arcus Biosciences as deeply undervalued, a look at its price-to-sales ratio paints a more cautious picture. At 6.7x, the company is trading below the peer group average of 9.3x and the industry average of 11.3x. However, both of these still sit far above the fair ratio of 1x, suggesting the market is pricing in substantial future growth. Is this optimism justified, or does it leave little room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arcus Biosciences Narrative

If you’re looking to dig deeper or develop your own perspective, you can explore all the numbers and build a custom story in just minutes, Do it your way.

A great starting point for your Arcus Biosciences research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investing Ideas?

Don’t settle for just one opportunity. Uncover standout stocks and new trends with these powerful tools and stay ahead as markets shift quickly.

- Kickstart your search for generational returns by checking out these 3592 penny stocks with strong financials that are gaining momentum and flying under Wall Street’s radar.

- Power up your portfolio with exposure to breakthroughs in automation and data analysis through these 24 AI penny stocks, where tomorrow’s tech leaders are emerging today.

- Lock in steady income potential as you browse these 18 dividend stocks with yields > 3% offering yields that outpace the market. Smart investors never miss out on reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCUS

Arcus Biosciences

A clinical-stage biopharmaceutical company, develops and commercializes cancer therapies in the United States.

Good value with adequate balance sheet.

Market Insights

Community Narratives