- United States

- /

- Life Sciences

- /

- NYSE:QGEN

Why Qiagen (QGEN) Is Up 6.6% After FDA Clearance and Raised Sales Guidance

Reviewed by Sasha Jovanovic

- In early October 2025, Qiagen announced the global launch of the FDA-cleared QIAstat-Dx Rise syndromic testing system and expanded its next-generation sequencing offerings with the QIAseq xHYB Long Read Panels, while raising its full-year 2025 financial guidance to reflect higher net sales and core sales growth at constant exchange rates.

- This simultaneous expansion into over 100 countries and the enhanced guidance reveal Qiagen's confident outlook on market demand and operational momentum for its new product innovations.

- We'll now examine how Qiagen's FDA-cleared diagnostic system launch and updated sales outlook may influence its investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Qiagen Investment Narrative Recap

Qiagen’s investment case rests on confidence in the global shift to molecular diagnostics and robust recurring sales from innovative product lines. The recent global launch of QIAstat-Dx Rise and upgraded full-year guidance affirm increased operational momentum, potentially reinforcing the company’s position in syndromic testing, a key short-term catalyst. However, this news does not materially alter the most significant risk, which remains margin pressure from macro volatility and foreign exchange headwinds affecting overall profitability.

Among Qiagen’s recent milestones, the FDA-cleared QIAstat-Dx Rise system expansion into more than 100 countries stands out. This launch directly supports the company’s consumables-driven revenue model and addresses rising diagnostic demand, keeping the focus on recurring sales growth as a primary driver amid broader industry uncertainty.

In contrast, investors should be aware of persistent foreign exchange and margin pressures that could ...

Read the full narrative on Qiagen (it's free!)

Qiagen's narrative projects $2.5 billion in revenue and $554.3 million in earnings by 2028. This requires 6.9% yearly revenue growth and a $180.9 million earnings increase from the current $373.4 million.

Uncover how Qiagen's forecasts yield a $51.79 fair value, a 11% upside to its current price.

Exploring Other Perspectives

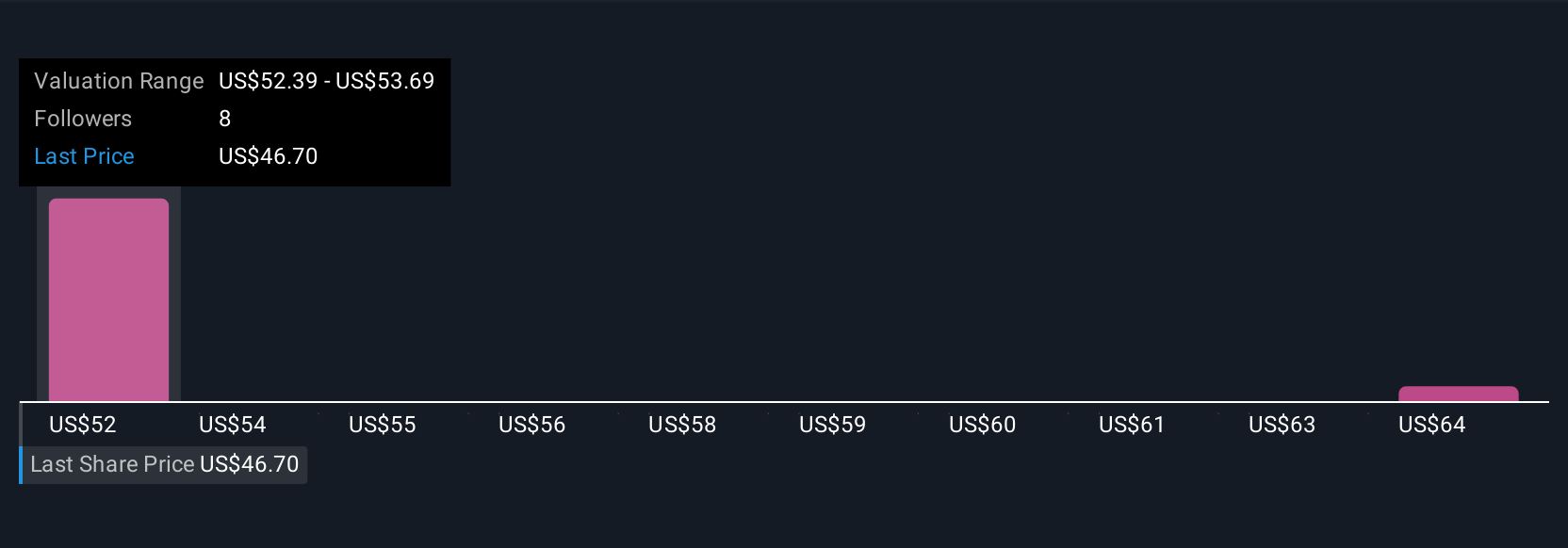

Simply Wall St Community members have published two fair value estimates for Qiagen, ranging from US$51.79 to US$62.63 per share. While operational catalysts are promising, ongoing currency and macro uncertainties highlight how widely opinions can differ, review more perspectives to inform your own view.

Explore 2 other fair value estimates on Qiagen - why the stock might be worth just $51.79!

Build Your Own Qiagen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qiagen research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Qiagen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qiagen's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qiagen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QGEN

Qiagen

Provides sample to insight solutions that transform biological samples into molecular insights in the Netherlands and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives