- United States

- /

- Life Sciences

- /

- NYSE:QGEN

Qiagen (NYSE:QGEN) Valuation in Focus After FDA Clearance of High-Throughput QIAstat-Dx Rise System

Reviewed by Simply Wall St

Most Popular Narrative: 9.2% Undervalued

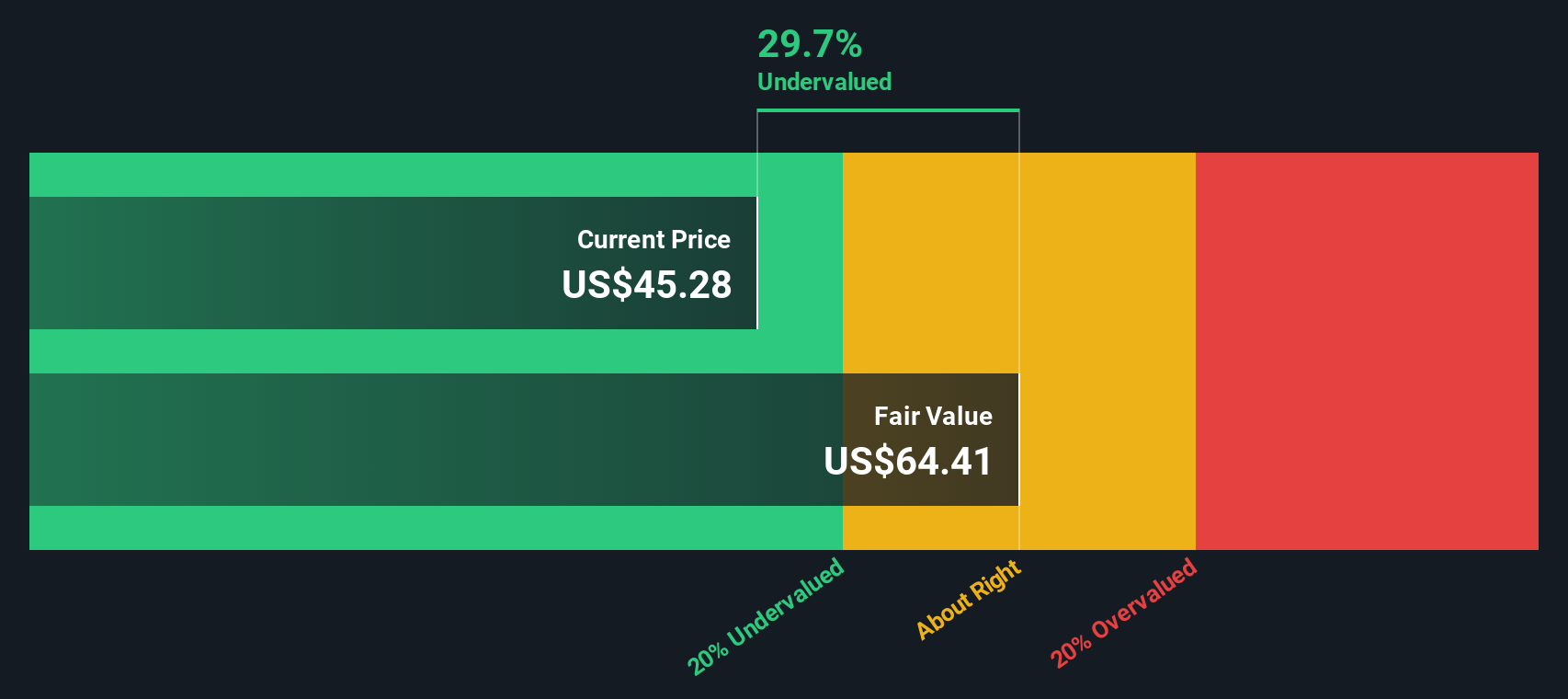

According to the most widely followed narrative, Qiagen's current share price sits below its estimated fair value, indicating an undervalued opportunity based on future growth prospects and margins.

"The accelerated adoption of automation and digital workflows in both clinical and research settings, as seen with the development and imminent launch of three new high-throughput, digitally connected automated sample prep systems, positions Qiagen to address increasing throughput and efficiency needs, supporting both top-line growth and operating margin improvement in coming years."

What is really driving this bullish valuation call? There is a secret recipe of sales expansion and higher profit margins baked into the analysis, and it leans on a bold set of financial forecasts. Which numbers move the needle and just how much further could earnings soar? Find out how these projections shape the case for value well above today's price.

Result: Fair Value of $52.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in life sciences funding and rising competition in diagnostics could quickly challenge this optimistic outlook for Qiagen’s future growth.

Find out about the key risks to this Qiagen narrative.Another View: Our DCF Model

Taking a different approach, the SWS DCF model also weighs in on Qiagen’s value by using long-term cash flow projections instead of earnings multiples. This method suggests undervaluation as well, but whose assumptions are more realistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Qiagen for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Qiagen Narrative

If these views don’t match your own, or you want to dig deeper into the data and chart your own course, you can build a personalized take on Qiagen’s outlook in just a few minutes. Do it your way

A great starting point for your Qiagen research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Step up your investing game by checking out handpicked stocks set to make an impact right now. Don’t let high-potential opportunities slip past while you focus on just one company. Use these tailored ideas to help your portfolio reach the next level.

- Tap into companies shaking up artificial intelligence in medicine by checking out breakthroughs using healthcare AI stocks.

- Get ahead of the market with strong-yielding stocks. Seize the chance to spot dividend stocks with yields > 3% before others do.

- Spot undervalued gems the market has overlooked and make smarter picks with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qiagen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:QGEN

Qiagen

Provides sample to insight solutions that transform biological samples into molecular insights in the Netherlands and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives