- United States

- /

- Pharma

- /

- NYSE:PFE

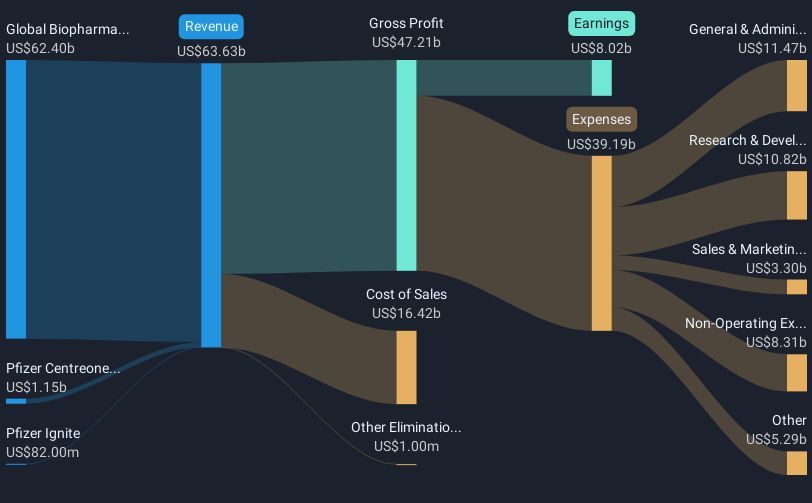

Pfizer (NYSE:PFE) Reports Q1 Earnings, Reaffirms 2025 Revenue Guidance at US$61-64 Billion

Reviewed by Simply Wall St

Pfizer (NYSE:PFE) reported a decline in its Q1 2025 earnings, with revenue dropping from the previous year, alongside stagnant share buyback activities. Despite reaffirming revenue guidance for 2025, these developments set the tone for Pfizer's share price fluctuation last week. Additionally, the company announced a $0.43 dividend which was in line with prior payouts. Over the same period, broader market trends showed a rise of 5.2%. Pfizer's 5.59% price move aligns with market movements, indicating that its specific events likely added weight to these broader market gains rather than causing any disconnected reaction.

The recent earnings report and dividend announcement reflect Pfizer's current challenges, including stagnant share buyback activity and a revenue decline, which have impacted its share price movement. Over the past year, Pfizer's total return, including dividends and share price changes, stood at a 1.32% decline, indicating an underperformance against the broader market's 9.9% gain and even the US Pharmaceuticals industry’s nominal growth of 0.5% over the same period. This suggests that while Pfizer is navigating broader industry and economic challenges, it may also be facing company-specific hurdles.

Pfizer’s current strategy, focusing on research and development productivity and cost savings, could slow revenue growth as these initiatives require time to yield financial benefits. With revenue pressures stemming from legislative changes and COVID-19 product stability, the company's revenue and earnings forecasts may fall below consensus expectations. The share price, currently at US$22.39, is at a discount to the consensus price target of US$29.06, reflecting the market's skepticism about realizing expected future returns. The bearish analyst cohort places a fair value closer to US$24.41, suggesting an alignment with market sentiment that assumes slower growth. If Pfizer can overcome these challenges, particularly in enhancing R&D outcomes and managing competition, it might improve both its earnings potential and alignment with analyst expectations.

The valuation report we've compiled suggests that Pfizer's current price could be quite moderate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives