- United States

- /

- Pharma

- /

- NYSE:PFE

FDA Accepts Pfizer (PFE) Vepdegestrant NDA for Breast Cancer, Fast Track Designation Awarded

Reviewed by Simply Wall St

Pfizer (PFE) recently announced that the U.S. Food and Drug Administration accepted the New Drug Application for vepdegestrant, offering potential new treatment options for certain breast cancer patients with a PDUFA action date in June 2026. During the last quarter, Pfizer's share price rose by 10%, a movement that stands out against a broader market rise, driven by strong earnings reported across various sectors. Notably, the FDA's acceptance and other positive product-related announcements, like the favorable results for the XTANDI and HYMPAVZI™, would have supported the share price improvements, aligning with the company's expanding product pipeline.

Be aware that Pfizer is showing 2 warning signs in our investment analysis.

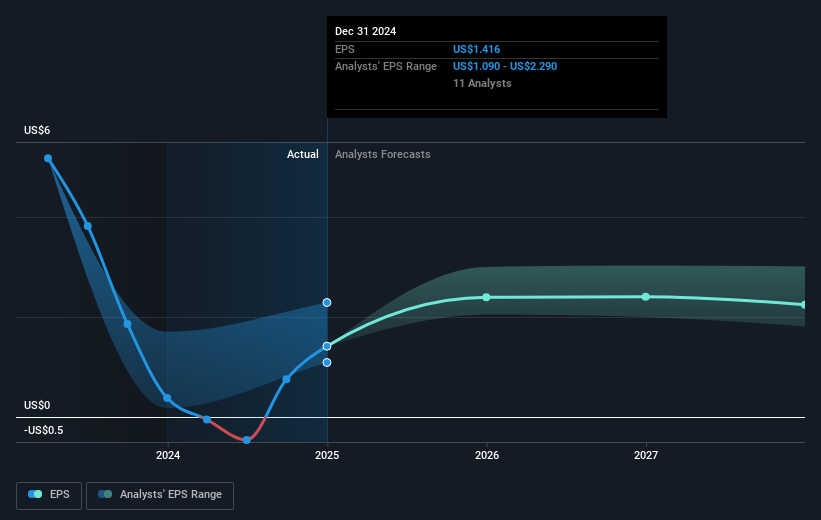

The FDA's acceptance of Pfizer's New Drug Application for vepdegestrant offers an opportunity to impact revenue and earnings positively by expanding treatment options in oncology. Investors observing a 10% share price increase in the last quarter would find this development potentially supportive of further growth, though the longer-term total return over the past year remains a 7.86% decline. This period outlines the challenges Pfizer faces, contrasting with a 20.2% market return and a US Pharmaceuticals industry return of 16.4% over the same timeframe, highlighting competitive pressures and reduced utilization of key drugs impacting its historical performance.

The projected revenue decline, estimated at 3% annually for the next three years, weighs on future prospects, threatening earnings if cost efficiencies fail to counterbalance. Meanwhile, market sentiment priced the shares at US$24.58, below the consensus target of US$28.86, suggesting some skepticism remains about Pfizer's growth trajectory. However, the FDA's favorable actions could support projections depending on successful commercial execution and the realization of cost efficiencies, tightening the gap between current valuation and analyst price targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives