- United States

- /

- Pharma

- /

- NYSE:PFE

Does the Recent 3% Gain Signal a Turning Point for Pfizer Shares?

Reviewed by Bailey Pemberton

Thinking about what to do with Pfizer stock right now? You’re not alone, and frankly, it’s been a fascinating ride. After lagging for much of the past three years, Pfizer’s share price has shown a subtle change in mood lately. The stock edged up 1.3% over the last week and 3.4% this past month, which might catch your eye, especially after a rocky year marked by a -6.6% dip year-to-date and a -7.8% slide over the last twelve months. Those numbers might look daunting, but every story has more than one chapter.

There’s more at play than just sentiment. Key partnerships on new drug development and several pipeline updates have provided fresh optimism, hinting at growth potential beyond the COVID era. Yet, the shadow of long-term underperformance lingers, with the stock down nearly 36% over three years. It’s a mix of renewed hope and cautious realism, which makes Pfizer so interesting for value-focused investors.

But are the current headlines, price moves, and changing risk perceptions accounted for in Pfizer’s valuation? Turns out, the company passes 5 out of 6 major undervaluation checks, earning it an impressive value score of 5. Next, let’s break down exactly how Pfizer stacks up across classic valuation approaches, and why there might be an even better way to judge its true worth at the end of this article.

Why Pfizer is lagging behind its peers

Approach 1: Pfizer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its expected cash profits into the future and bringing those back to today's value. This approach relies on the logic that a business is ultimately worth the sum of all its future cash flows, adjusted for time and risk.

For Pfizer, analysts currently estimate Free Cash Flow at around $12.0 Billion per year. Looking ahead, consensus forecasts expect this to grow steadily, reaching approximately $16.8 Billion in 2029. Simply Wall St then extends these estimates out another five years using moderate growth assumptions, showing sustained strength in Pfizer's cash generation.

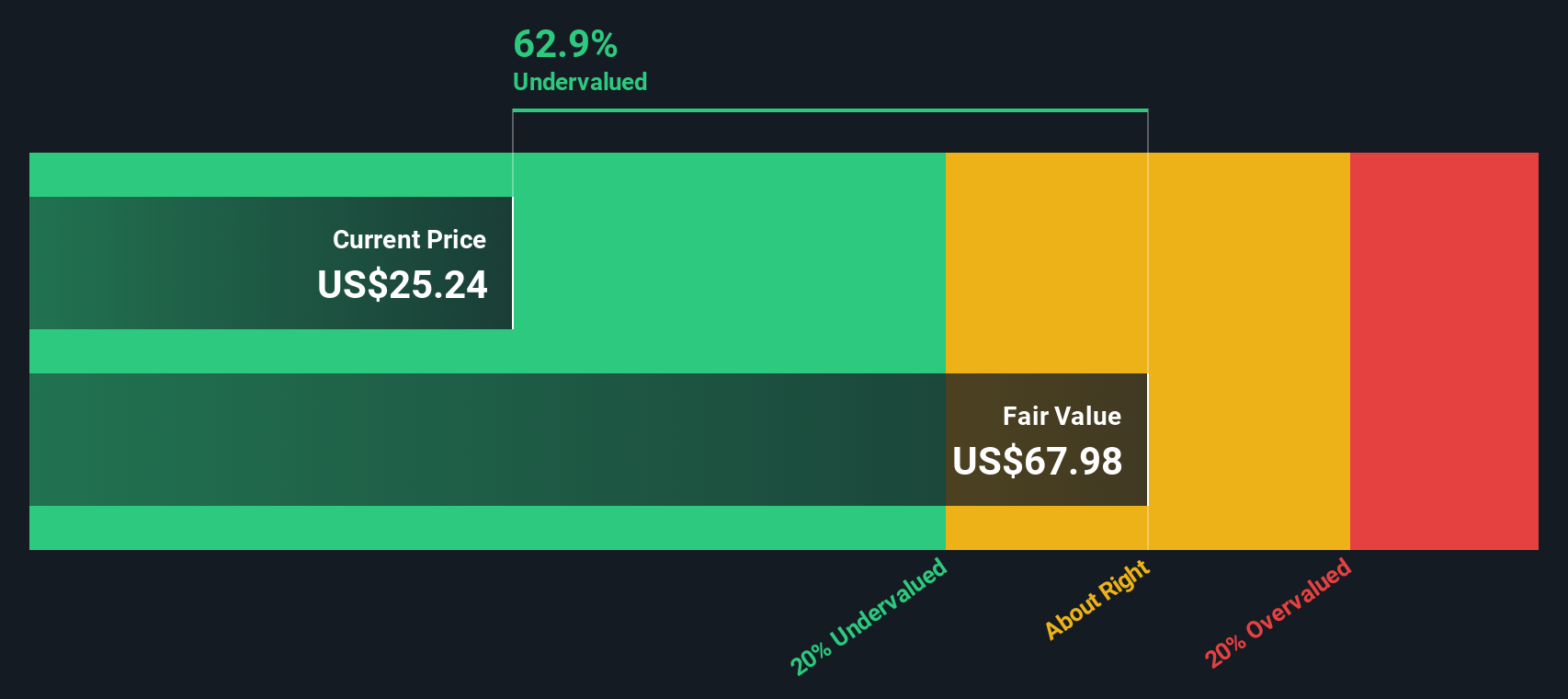

According to this DCF model, Pfizer's fair value comes in at $68 per share. With the stock currently trading at a steep discount, this represents a calculated undervaluation of 63.4 percent, which is a significant gap. The implication is clear: Based on cash flow potential alone, Pfizer appears much cheaper than its long-term prospects suggest.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pfizer is undervalued by 63.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Pfizer Price vs Earnings

The Price-to-Earnings (PE) ratio is a time-tested metric for evaluating profitable companies like Pfizer because it shows how much investors are paying today for each dollar of current earnings. This makes it particularly useful when a company’s earnings are steady and transparent, as is typically the case in the pharmaceutical sector.

What makes a “normal” PE ratio can vary, influenced by factors like a company's growth prospects, the stability of its revenue, and the broader risks facing its industry. Higher growth or lower risk tends to justify a higher PE ratio, while slumping growth or rising risk can drag it down.

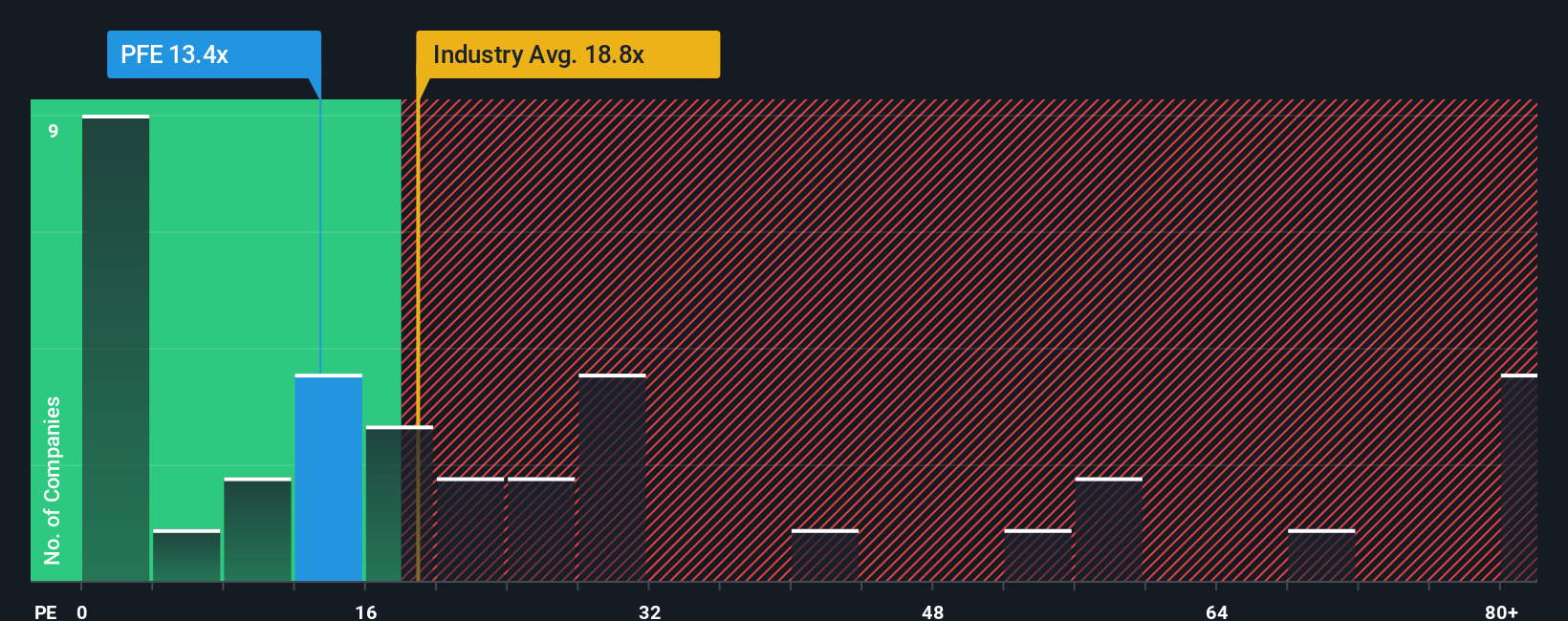

Pfizer currently trades at a PE ratio of 13.2x. For context, the average for its pharmaceutical industry peers stands at around 18.6x, and the broader industry itself averages about 18.6x as well. This means Pfizer is well below both peer and industry benchmarks, initially suggesting a discount.

However, Simply Wall St’s “Fair Ratio” digs deeper by blending company-specific growth forecasts, profit margins, risk levels, and market size into a custom benchmark. In Pfizer’s case, the Fair PE Ratio is calculated at 22.3x, significantly higher than the current ratio. By accounting for more than just averages, the Fair Ratio offers a much clearer picture of what Pfizer’s shares should reasonably trade at, given everything that makes it unique.

Since Pfizer’s actual PE ratio is considerably below its Fair Ratio, the analysis again points to the stock being undervalued at current prices.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pfizer Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own story and perspective about a company, connecting what you believe about Pfizer’s future, from new drug launches to changing industry dynamics, to your own estimates of its future revenue, margins, and fair value.

Narratives make valuation more practical and personal by linking these forward-looking stories directly to numbers, letting you see what Pfizer should be worth based on your assumptions, not just analyst consensus. On Simply Wall St’s Community page, millions of investors use Narratives to quickly see, update, and compare their outlooks, with no complex models required.

They help you decide when to buy or sell by showing at a glance whether your Narrative’s Fair Value is above or below the current Price. Because all Narratives update dynamically as new news or earnings data arrives, your view can stay relevant as the facts change.

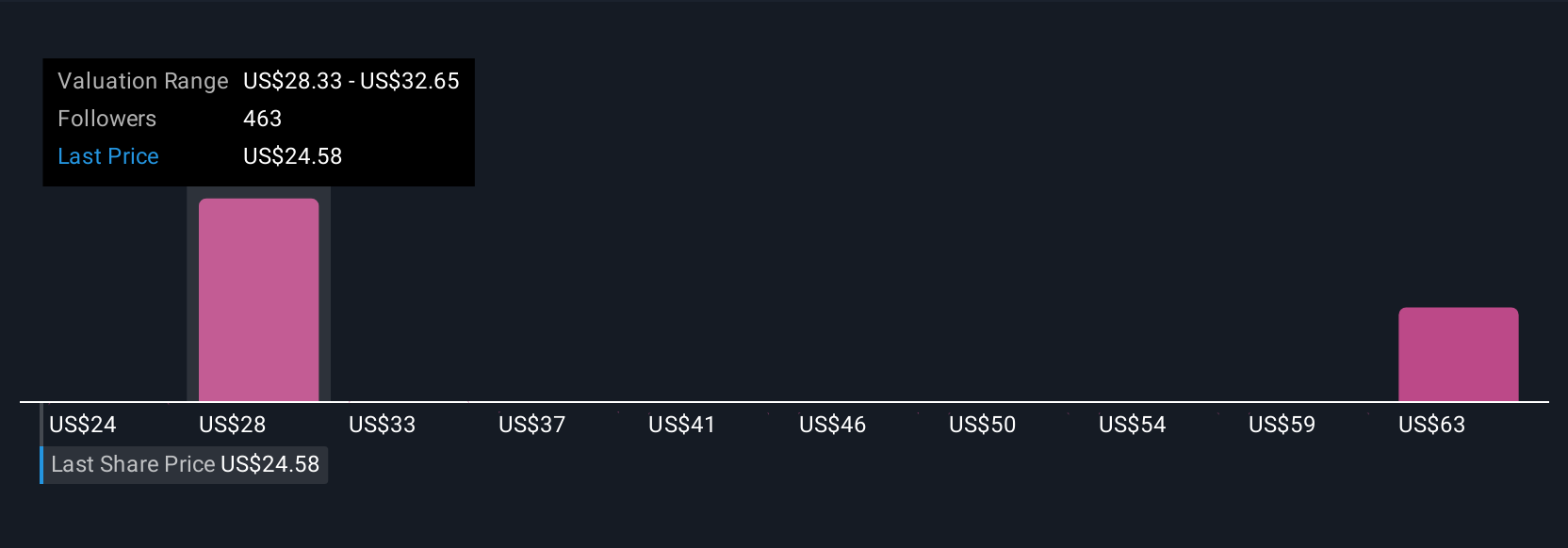

For example, some investors see Pfizer’s fair value as high as $36 based on a robust post-pandemic recovery and margin gains, while others set it closer to $24 amid concerns about regulatory headwinds and shrinking revenue. This shows how Narratives can flexibly reflect your optimism, caution, or anywhere in between.

For Pfizer, we'll make it really easy for you with previews of two leading Pfizer Narratives:

Fair Value: $28.86

Current price is 13.9% below this fair value

Expected revenue growth: -2.2%

- Expansion in innovative therapies, biologics, and digitalization positions Pfizer for long-term growth and resilience despite patent expirations and industry pressures.

- Strategic growth in emerging markets, coupled with operational efficiencies from digitalization and business development, is expected to drive increased margins and broaden revenue opportunities.

- Key risks include regulatory actions, patent cliffs for major drugs, and rising competition. Analysts project higher future profit margins and earnings with a price target 14.4% above current price.

Fair Value: $24.00

Current price is 3.5% above this fair value

Expected revenue growth: -4.2%

- Rising regulatory hurdles and aggressive drug pricing reforms are forecast to constrain revenue growth and compress profit margins, particularly as key drugs lose market exclusivity.

- Heavy reliance on new R&D assets to replace aging blockbusters brings risk, with doubts that innovative launches can offset losses from patents expiring by 2027.

- The bearish view assumes continued top-line sales erosion and earnings pressure. The fair value is near current price, signaling the possibility that downside risks are not yet fully reflected in the market.

Do you think there's more to the story for Pfizer? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives