- United States

- /

- Pharma

- /

- NYSE:PBH

Prestige Consumer Healthcare (PBH): Examining Valuation Following Recent Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for Prestige Consumer Healthcare.

This latest pullback comes after a year when Prestige Consumer Healthcare’s share price drifted lower, with a 1-year total shareholder return of -14.06%. While the longer-term trajectory still shows healthy gains, including an 88% five-year total return, recent momentum has clearly faded as investors weigh growth prospects against shifting market sentiment.

If you’re looking for what’s next, consider expanding your search and discover fast growing stocks with high insider ownership.

With the stock now trading at a noteworthy discount to analyst targets, the question is whether Prestige Consumer Healthcare is a bargain in disguise or if the market has fully accounted for its future prospects.

Most Popular Narrative: 22.5% Undervalued

Prestige Consumer Healthcare's widely followed fair value estimate stands well above the latest closing price, suggesting a gap between the market outlook and the narrative's expectations. This difference provides an opportunity to examine what is driving the optimism behind the numbers.

Prestige's strong and consistent free cash flow generation (approximately $245 million projected for the year) provides financial flexibility for continued deleveraging and opportunistic share repurchases, supporting future earnings per share (EPS) growth and value for shareholders.

What bold assumptions are fueling this double-digit valuation premium? The narrative's fair value is based on steady growth and a confident profit outlook, along with higher future valuation multiples compared to industry averages. Interested in the projections and financial flexibility that support these headlines? The numbers behind this price target might surprise you.

Result: Fair Value of $80.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain disruptions affecting key brands, along with reliance on a few mature products, remain real risks that could challenge these bullish assumptions.

Find out about the key risks to this Prestige Consumer Healthcare narrative.

Another View: What Do the Numbers Say?

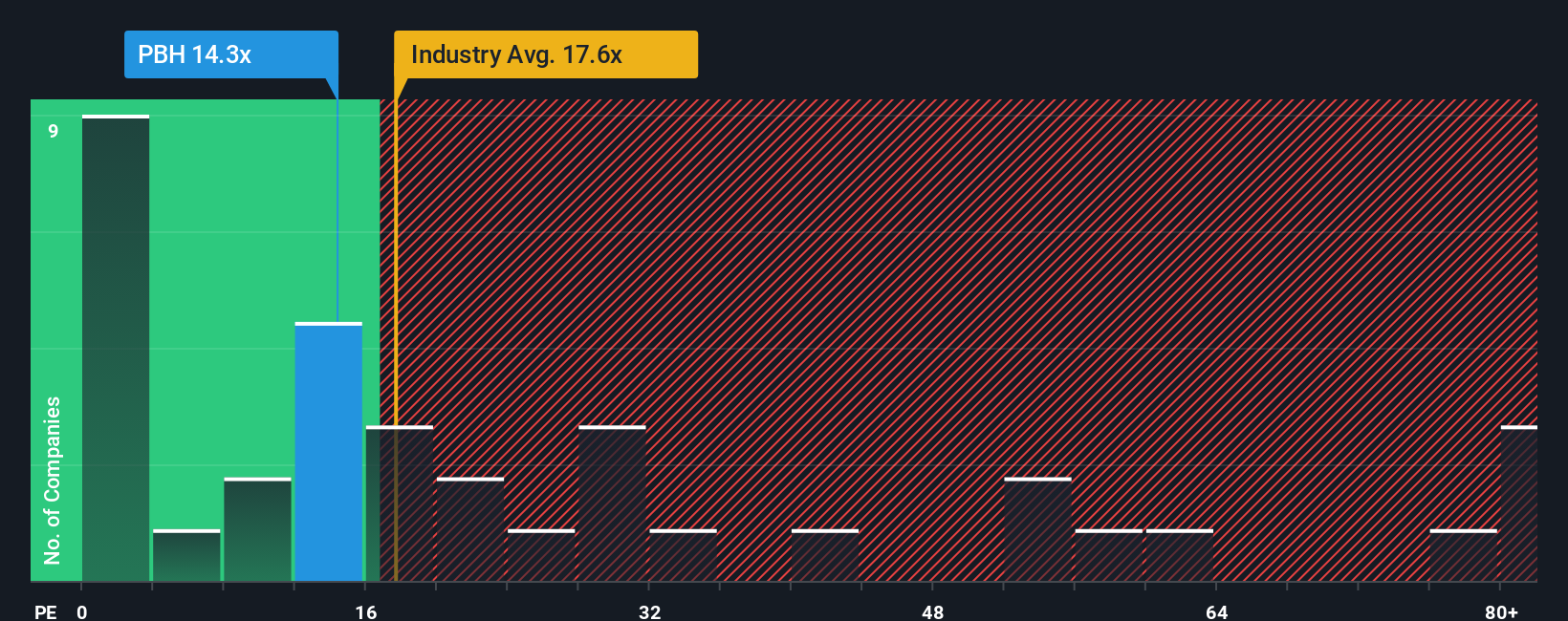

Looking from a valuation ratio perspective, Prestige Consumer Healthcare trades at a price-to-earnings ratio of 14.5x. This is far below both the industry average of 18.5x and similar peers at 33x, but just above its fair ratio of 14.3x. With such gaps between the market and "what's fair," does this signal undervaluation or is there more lurking in the fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prestige Consumer Healthcare Narrative

If you want a different angle or prefer to dig into the numbers yourself, you can craft your own perspective in just a few minutes, starting with Do it your way.

A great starting point for your Prestige Consumer Healthcare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye on fresh opportunities. Don't let the market's best ideas pass you by when the next breakthrough could be just a click away.

- Boost income potential and see which companies stand out in these 17 dividend stocks with yields > 3% for strong, reliable yields above 3%.

- Accelerate your portfolio's future by targeting AI leaders through these 27 AI penny stocks, where innovation and growth go hand in hand.

- Capture unique value by selecting from these 27 quantum computing stocks at the forefront of quantum computing's rise and the next wave of technological disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PBH

Prestige Consumer Healthcare

Develops, manufactures, markets, distributes, and sells over the counter (OTC) health and personal care products in North America, Australia, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives