- United States

- /

- Pharma

- /

- NYSE:OGN

Are Margin Pressures Reshaping Organon’s (OGN) Long-Term Competitive Position?

Reviewed by Sasha Jovanovic

- Organon & Co. recently reported third quarter 2025 earnings, showing sales of US$1.60 billion and net income of US$160 million, while also lowering its full-year revenue guidance to a range of US$6.20 billion to US$6.25 billion.

- The company's latest results reflected a significant drop in net income compared to the prior year, signaling that margin pressures and revised expectations are influencing its financial outlook.

- We'll explore how Organon's reduced full-year revenue outlook and margin challenges affect the company's investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Organon Investment Narrative Recap

To be comfortable owning Organon, investors need confidence in the company’s ability to stabilize margins and reignite growth through fresh product launches and market expansion, despite reliance on legacy brands. The recent Q3 earnings report and lower revenue guidance sharpen the focus on execution risks, but the core catalyst, the success of launches like VTAMA and biosimilars, remains unchanged for now, while margin pressures stand out as the most immediate challenge.

The headline from the last week is Organon's lowered full-year revenue guidance. This development ties directly to the company’s biggest near-term risk: the impact of persistent pricing pressure on mature products and ongoing gross margin constraints. While disappointing, this guidance adjustment does not appear to change the importance of new product adoption and the pace of margin recovery as primary factors influencing the outlook.

In contrast, what may surprise investors is just how much near-term profitability could still be affected by...

Read the full narrative on Organon (it's free!)

Organon's outlook forecasts $6.5 billion in revenue and $990.3 million in earnings by 2028. This is based on an assumed annual revenue growth rate of 1.2% and reflects an earnings increase of $290 million from the current $700.0 million.

Uncover how Organon's forecasts yield a $10.33 fair value, a 37% upside to its current price.

Exploring Other Perspectives

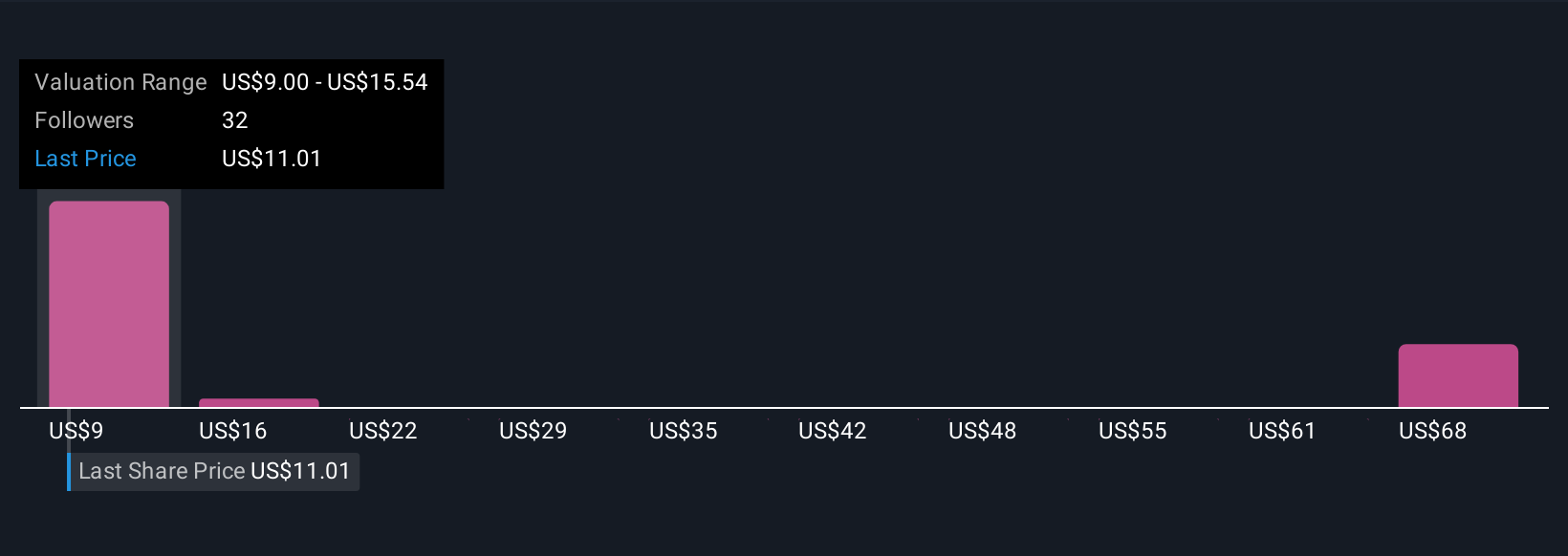

Simply Wall St Community members estimate Organon’s fair value anywhere from US$9 to US$65.53, based on 8 unique analyses. With margin pressure now in sharper relief after the recent earnings, you can see why opinions on future performance differ and why it’s worth exploring several viewpoints before deciding.

Explore 8 other fair value estimates on Organon - why the stock might be worth over 8x more than the current price!

Build Your Own Organon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Organon research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Organon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Organon's overall financial health at a glance.

No Opportunity In Organon?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGN

Organon

Develops and delivers health solutions through prescription therapies and medical devices in the United States, Europe, Canada, Japan, rest of the Asia Pacific, Latin America, the Middle East, Russia, Africa, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives