- United States

- /

- Pharma

- /

- NYSE:NUVB

Nuvation Bio (NUVB) Is Up 23.3% After First Patient Enrolled in Phase 3 TRUST-IV Trial

Reviewed by Sasha Jovanovic

- Nuvation Bio recently announced the enrollment of the first patient in TRUST-IV, its pivotal Phase 3 trial investigating IBTROZI™ (taletrectinib) as an adjuvant treatment for resected ROS1-positive non-small cell lung cancer, following cooperation with the FDA on study design.

- This clinical milestone comes closely on the heels of IBTROZI’s regulatory approvals for advanced ROS1-positive NSCLC in Japan, China, and the US, highlighting rapid global expansion of the program and increased international recognition of Nuvation Bio's drug development efforts.

- We’ll examine how this progress in late-stage clinical development and international approvals is shaping Nuvation Bio’s investment story.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Nuvation Bio's Investment Narrative?

The story with Nuvation Bio right now centers on IBTROZI’s momentum in global regulatory approvals and, crucially, this week’s start of the Phase 3 TRUST-IV trial in a new, earlier-stage lung cancer population. For shareholders, the big picture is belief in the growth potential of IBTROZI, already recognized with approvals in the US, Japan and China, and its ability to expand into new indications. The recent trial launch marks another important catalyst for investor attention, as it extends the addressable market and could support revenue growth over time. While the near-term commercial impact of TRUST-IV may be limited (given its long timeline), it does advance long-term value creation by feeding a robust clinical pipeline. The biggest risks remain Nuvation Bio’s ongoing losses and a young board with high turnover, which may challenge consistent execution as the company scales. The rapid share price rise also raises questions about sustainability, especially given ongoing volatility and that Nuvation is not expected to reach profitability soon.

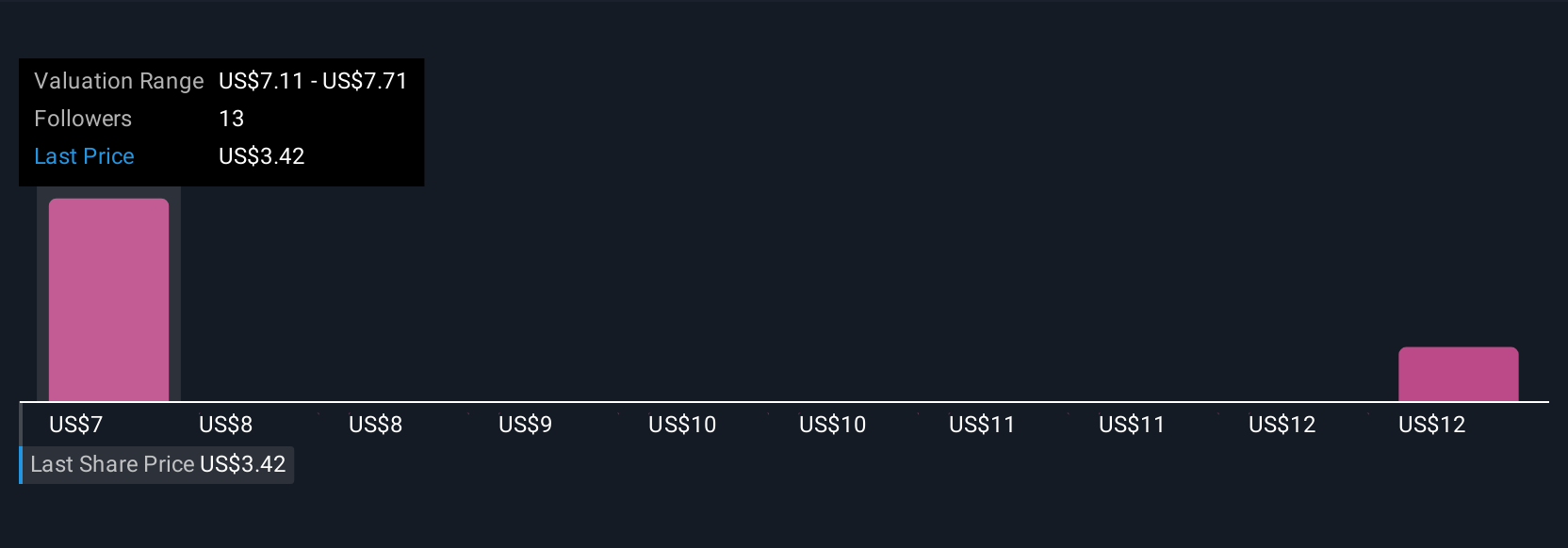

On the other hand, continued leadership changes could impact the company's future direction, an important detail investors should keep in mind. Nuvation Bio's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 5 other fair value estimates on Nuvation Bio - why the stock might be worth less than half the current price!

Build Your Own Nuvation Bio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nuvation Bio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nuvation Bio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nuvation Bio's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvation Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUVB

Nuvation Bio

A clinical-stage biopharmaceutical company, focuses on developing therapeutic candidates for oncology.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives