- United States

- /

- Pharma

- /

- NYSE:NUVB

Is Nuvation Bio's (NUVB) Pipeline Pivot a Strategic Bet on Precision Oncology Assets?

Reviewed by Sasha Jovanovic

- Nuvation Bio recently announced it is halting development of NUV-1511, its initial drug-drug conjugate candidate, due to inconsistent efficacy, while prioritizing resources on other assets in its oncology pipeline including safusidenib and IBTROZI.

- This move represents a significant shift in the company's research and development focus, particularly as it highlights promising Phase 2 results for safusidenib in treating IDH1-mutant gliomas.

- We'll explore how the increased emphasis on safusidenib and pipeline advancement reframes Nuvation Bio's investment narrative following these developments.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Nuvation Bio's Investment Narrative?

To be a shareholder in Nuvation Bio right now, you need to be comfortable centering your outlook on the success of the oncology pipeline, especially safusidenib, which just reported encouraging Phase 2 results in glioma patients. The decision to halt NUV-1511 following inconsistent efficacy marks an important pivot in the company’s R&D priorities and shifts investor focus squarely onto late-stage clinical milestones and potential regulatory catalysts for both safusidenib and IBTROZI. This news materially increases the weight placed on safusidenib’s future performance and accelerates attention toward its ongoing Phase 3 global study. Near-term, risk is heightened by the unprofitability and Nuvation’s dependence on a few key drug candidates, which is reflected in recent share price volatility. While the market response has been positive, the removal of one pipeline asset makes trial outcomes and safety findings for the remaining drugs even more critical. On the other hand, investors should carefully consider the implications of increased concentration risk in the R&D pipeline.

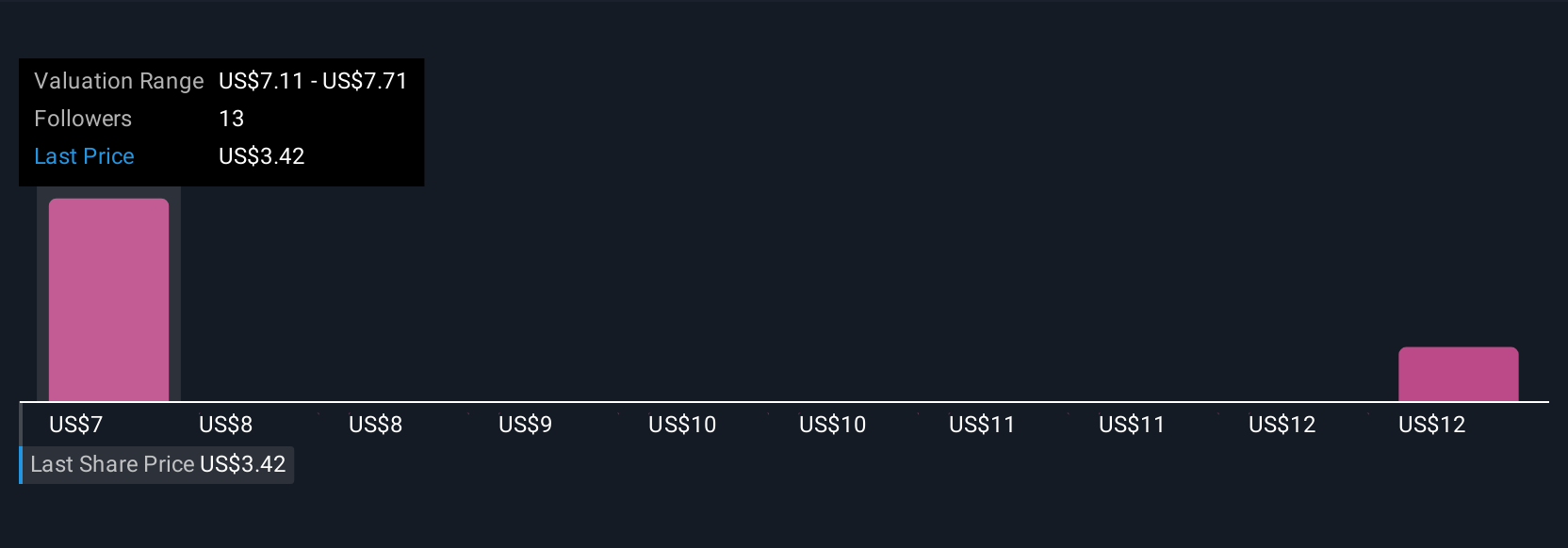

Nuvation Bio's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 5 other fair value estimates on Nuvation Bio - why the stock might be worth over 3x more than the current price!

Build Your Own Nuvation Bio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nuvation Bio research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nuvation Bio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nuvation Bio's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvation Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUVB

Nuvation Bio

A clinical-stage biopharmaceutical company, focuses on developing therapeutic candidates for oncology.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.