- United States

- /

- Life Sciences

- /

- NYSE:MTD

Mettler-Toledo (MTD) Is Up 7.5% After Analysts Raise 2025 Earnings Forecasts Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In late September 2025, several analysts raised their earnings estimates for Mettler-Toledo International for fiscal 2025, reflecting higher predicted growth and stronger operating performance. This analyst optimism highlights increasing confidence in the company's ability to capture demand from pharmaceutical, food, and laboratory customers worldwide.

- We'll now examine how these upward earnings estimate revisions may further strengthen Mettler-Toledo’s investment narrative and perceived growth trajectory.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Mettler-Toledo International Investment Narrative Recap

To be a shareholder in Mettler-Toledo International, you need to believe in the company’s long-term ability to harness demand in pharmaceutical, food, and laboratory markets, driven by regulatory and automation trends. The recent wave of analyst earnings estimate upgrades for 2025 underscores increased confidence in strong near-term performance, but this optimism does not materially alter the biggest risk: persistent tariff volatility that could keep pressure on margins if trade friction remains unresolved.

Among recent company announcements, the August 2025 update on share repurchases stands out, as it demonstrates ongoing management commitment to capital return initiatives, which can support shareholder value even if near-term earnings remain exposed to external cost pressures. While the buyback activity highlights balance sheet strength, it is not a substitute for improvements in organic revenue growth, which remains sensitive to global economic cycles.

However, investors should remain aware that despite growing confidence, the ongoing threat from unpredictable tariffs could still disrupt margin recovery if...

Read the full narrative on Mettler-Toledo International (it's free!)

Mettler-Toledo International's narrative projects $4.4 billion revenue and $1.0 billion earnings by 2028. This requires 4.5% yearly revenue growth and a $170.2 million earnings increase from $829.8 million.

Uncover how Mettler-Toledo International's forecasts yield a $1295 fair value, in line with its current price.

Exploring Other Perspectives

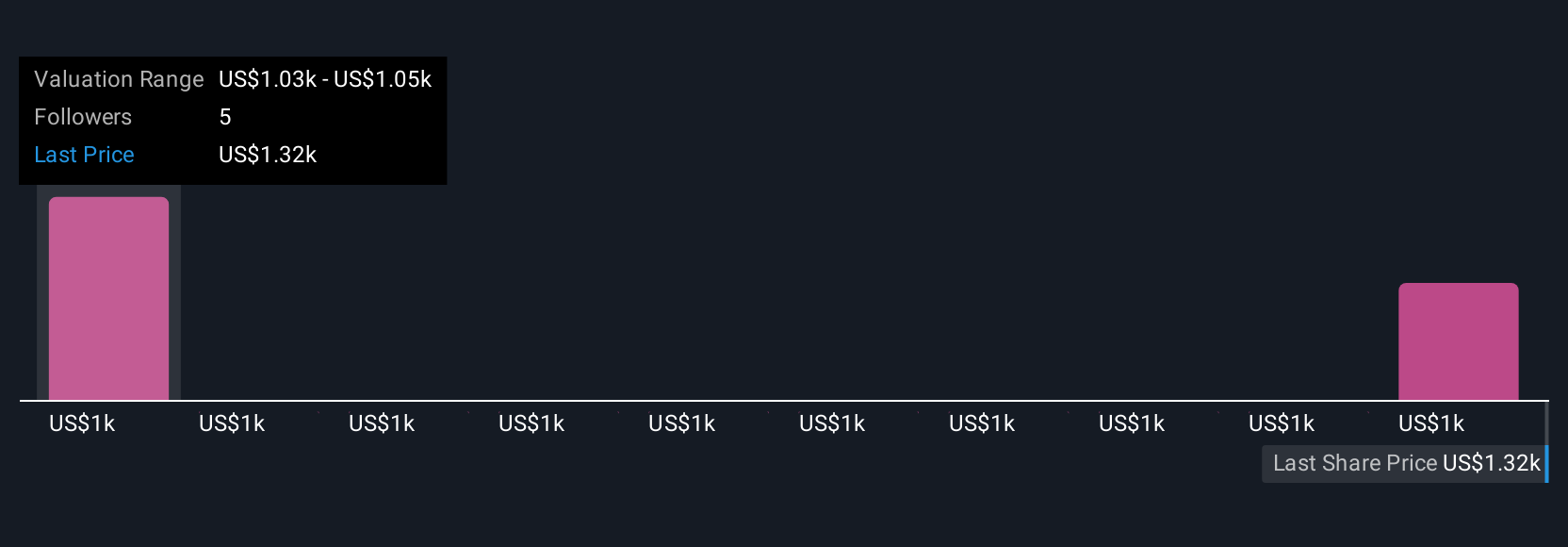

The Simply Wall St Community contributed two fair value estimates for Mettler-Toledo, ranging from US$998 to US$1,295 per share. While opinions differ significantly on potential upside or downside, persistent tariff risks could keep future margin expansion uncertain according to analyst consensus, so consider several viewpoints before making a decision.

Explore 2 other fair value estimates on Mettler-Toledo International - why the stock might be worth 23% less than the current price!

Build Your Own Mettler-Toledo International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mettler-Toledo International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mettler-Toledo International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mettler-Toledo International's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTD

Mettler-Toledo International

Manufactures and supplies precision instruments and services in the Americas, Europe, Asia, and internationally.

Acceptable track record with limited growth.

Similar Companies

Market Insights

Community Narratives