- United States

- /

- Pharma

- /

- NYSE:MRK

Merck (MRK) Valuation: Assessing New Growth Prospects Following Key Pipeline Successes

Reviewed by Simply Wall St

If you have been watching Merck (MRK), the latest string of clinical trial victories may have you revisiting your assumptions about the stock. In just the past week, Merck reported strong Phase 3 results for its CAPVAXIVE vaccine in younger populations, a promising Phase 2 readout and new regulatory designation for ifinatamab deruxtecan in difficult-to-treat lung cancer, and fresh evidence backing its PCSK9 inhibitor enlicitide. Taken together, these wins signal serious momentum in some of Merck’s highest-potential pipeline areas.

These new developments arrive against a backdrop of sluggish performance for Merck’s stock over the past year. The company continues to push forward on scientific and regulatory fronts. The share price has slipped nearly 26% in the past twelve months but showed small gains over the past three months, which hints that market sentiment could be shifting as positive news accumulates. Compared to the broader market and some pharma peers, MRK’s long-term returns have been steady but less eye-catching. This may keep the stock under the radar for some investors.

Now, with a year’s worth of underperformance and a recent burst of pipeline progress, is there fresh value brewing in Merck’s shares or has the market already begun to price in these future growth prospects?

Most Popular Narrative: 19.1% Undervalued

According to the most popular narrative, Merck is currently viewed as undervalued by analysts, largely due to its expanding pipeline, projected profit growth, and optimistic forecasts about future earnings and margins. This assessment draws from consensus analyst assumptions about achievable earnings levels and anticipated long-term growth.

Merck plans to bring over 20 new growth drivers to market in the coming years. Most of these have blockbuster potential and could significantly boost future revenue. The company is making strategic investments in manufacturing, including $9 billion in U.S. projects through 2028. These investments may improve net margins by optimizing supply chains and reducing potential tariff impacts.

Craving a look behind the numbers? This narrative hints at ambitious expansion plans, blockbuster launches, and bold profit projections. Yet the most crucial assumption fueling that attractive fair value might surprise you. The story of Merck's possible upside lies in a forecast few realize, and the details could defy expectations. Want to see which financial leap made analysts call it undervalued by nearly 20%? Go inside the full narrative for the specifics that have Wall Street buzzing.

Result: Fair Value of $102.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges such as declining GARDASIL sales in China and the looming loss of KEYTRUDA exclusivity could still shift Merck’s outlook considerably.

Find out about the key risks to this Merck narrative.Another View: Testing the DCF Model

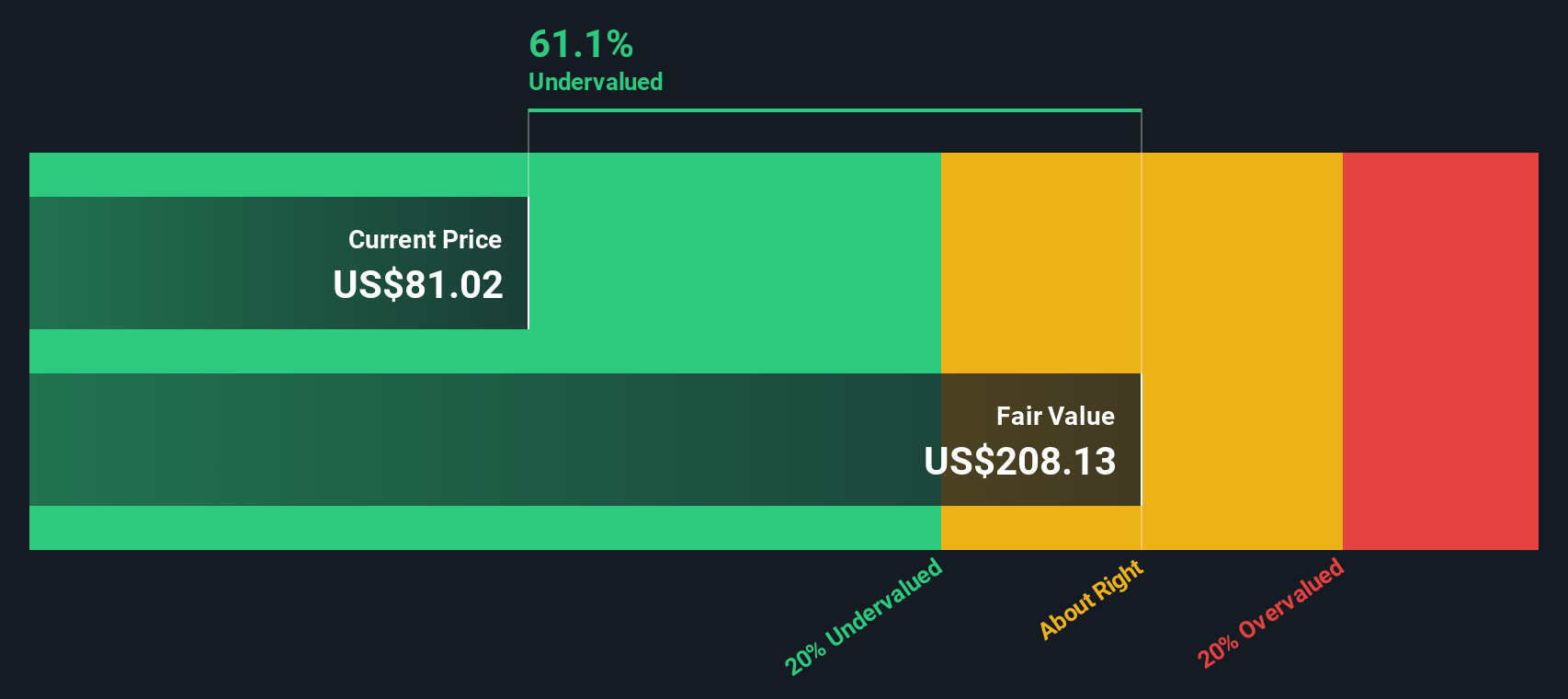

While analyst price targets point to value, our SWS DCF model arrives at a similar conclusion by using future cash flow projections based on different methods rather than analyst assumptions. Both approaches suggest the shares are trading below fair value. However, is the SWS DCF model too optimistic, or is it identifying something that the market has overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Merck for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Merck Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft your own view on Merck’s outlook in just a few minutes. Do it your way.

A great starting point for your Merck research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their options open. Don’t let market opportunities slip by. Use the powerful Simply Wall Street Screener to uncover unique companies gearing up for growth, innovation, and steady returns.

- Boost your portfolio's resilience by targeting steady income streams with dividend stocks with yields > 3% that consistently deliver attractive yields above 3%.

- Tap into the future of medicine with healthcare AI stocks and invest in companies pioneering breakthroughs at the intersection of AI and healthcare.

- Capitalize on potential hidden gems by seizing opportunities in penny stocks with strong financials that combine affordability with robust financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives