- United States

- /

- Pharma

- /

- NYSE:MRK

Merck (MRK) Declares Fourth Dividend US$0.81; Keytruda Gains Approval for Cervical Cancer

Reviewed by Simply Wall St

Merck (MRK) recently announced a dividend of $0.81 per share for Q4 2025 and gained Health Canada approval for KEYTRUDA® in treating cervical cancer. These developments align with Merck’s ongoing strategy to enhance shareholder value and expand its therapeutic offerings. Despite these positive milestones, Merck's stock price remained flat over the last quarter. This aligns with broader market behavior, as the S&P 500 and Nasdaq recently retreated from record highs. While the company's advancements in product approvals and consistent dividend payouts added weight to the broader market's movements, they did not noticeably differentiate its stock performance during this period.

Be aware that Merck is showing 1 warning sign in our investment analysis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

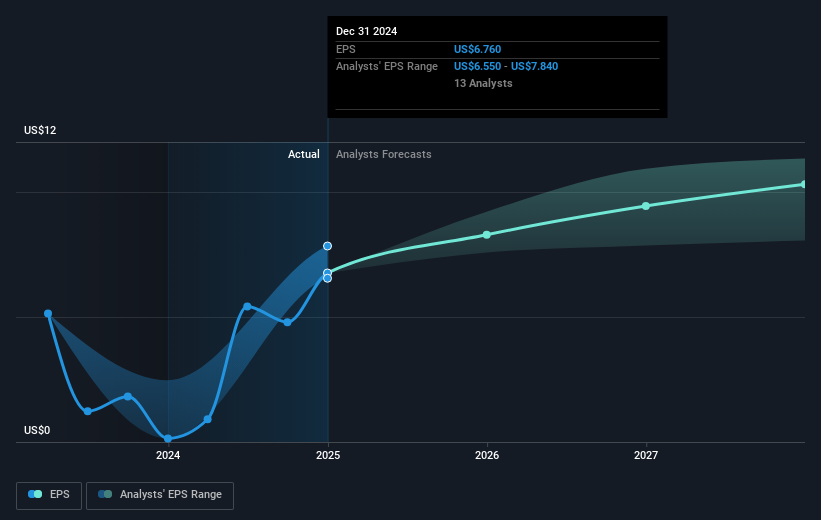

The recent developments, including Merck's dividend announcement and regulatory approval for KEYTRUDA® in Canada, underscore the company's ongoing efforts to enhance shareholder value and expand its oncology portfolio. These actions are expected to bolster long-term revenue and earnings forecasts, as Merck aims to maintain its leadership in the oncology sector. The approval of KEYTRUDA® could contribute positively to revenue streams by expanding market access, although the immediate impact on earnings may not be significant until sales ramp up.

Over a longer-term period of five years, Merck’s shares have delivered a total return of 23.11%, which provides a broader context for its current performance. While the current share price of US$79.31 reflects a discount to the analysts' price target of US$101.79, representing a potential upside, it remains important to consider this in light of the company's revenue growth projections and market pressure. Relative to the past year's performance, Merck underperformed both the US market, which returned 13.7%, and the US Pharmaceuticals industry, which saw a 10.8% decline. This highlights the competitive challenges Merck faces even as it pursues growth through its extensive product pipeline and strategic investments.

Navigate through the intricacies of Merck with our comprehensive balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives