- United States

- /

- Pharma

- /

- NYSE:LLY

Is Now the Time to Reassess Eli Lilly After 30.8% YTD Surge?

Reviewed by Bailey Pemberton

- If you’re wondering whether Eli Lilly is a good buy at its current price, you’re not alone; everyone wants to know if there’s still value left after such a run-up.

- Recently, shares have taken off, climbing 9.9% in the past week, 24.2% over the past month, and boasting an impressive 30.8% gain year-to-date.

- Driving this positive momentum, investors have been reacting to Eli Lilly’s regulatory wins and strong demand for its new obesity and diabetes treatments, which have dominated medical headlines. These developments have sparked renewed optimism about Eli Lilly’s growth prospects while also stirring up debates about whether the stock’s rapid rise is justified.

- But when we boil it down to the numbers, Eli Lilly currently scores a 1 out of 6 on our valuation checks, suggesting it passes only one test for being undervalued. So let’s dig into how that score is calculated, compare the usual ways investors judge value, and then reveal a smarter approach to deciding what’s really fair for Eli Lilly’s stock.

Eli Lilly scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Eli Lilly Discounted Cash Flow (DCF) Analysis

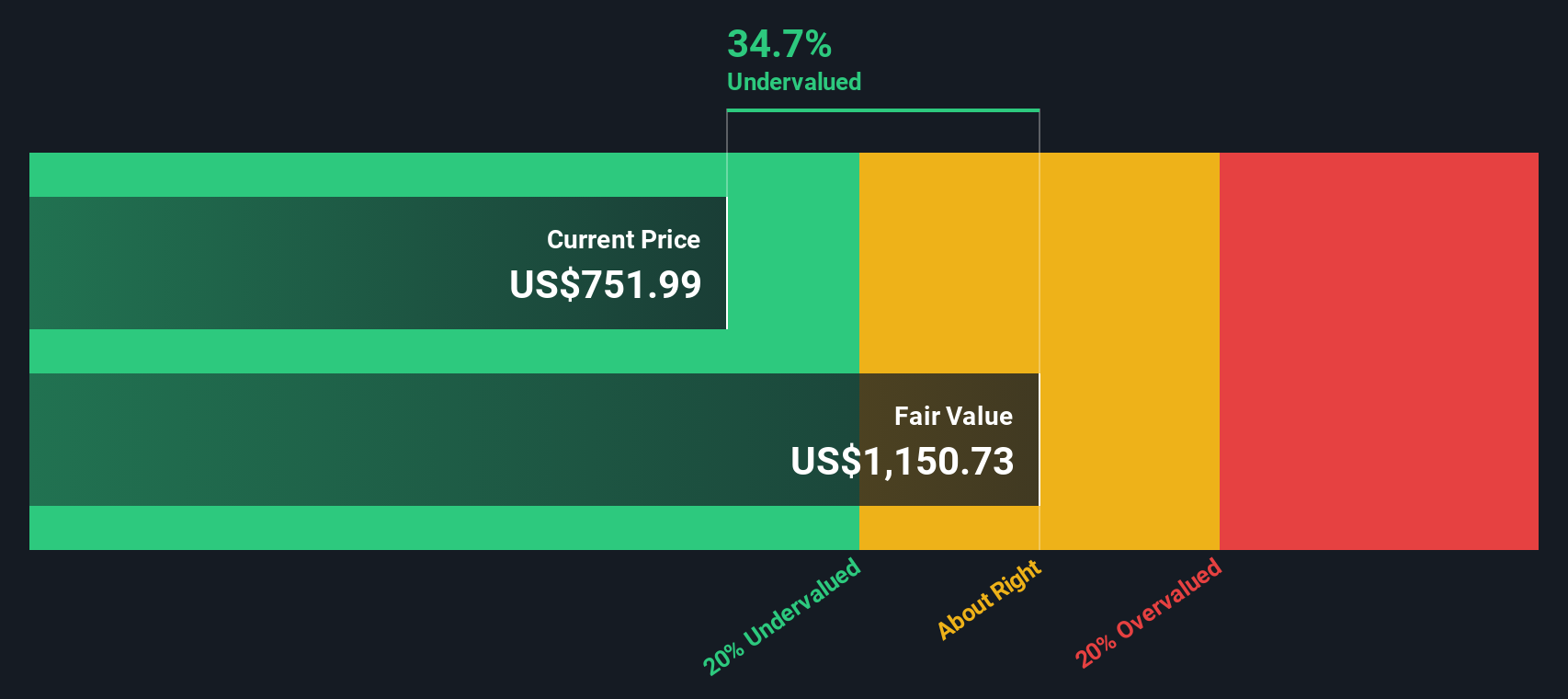

The Discounted Cash Flow (DCF) model is a commonly used valuation method that estimates what a company is worth today, based on projections of how much cash it will generate in the future. The basic idea is to forecast Eli Lilly's future free cash flows and then discount those amounts back to their present value using a suitable rate, reflecting both the value of money over time and the riskiness of the business.

For Eli Lilly, the calculation starts with its most recent annual free cash flow of about $6.15 Billion, suggesting a strong amount of cash generated by the business. Analysts provide forecasts for the next five years with free cash flow expected to grow rapidly, reaching roughly $36.56 Billion in 2029. Projections beyond the analyst estimates are extrapolated and indicate a continued uptrend.

When all these future cash flows are totaled and discounted back to present terms, the DCF model estimates Eli Lilly's intrinsic value at $1,240.11 per share. This places the stock at a 17.9% discount to its current price, suggesting the market may be undervaluing Eli Lilly relative to its long-term expected cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eli Lilly is undervalued by 17.9%. Track this in your watchlist or portfolio, or discover 883 more undervalued stocks based on cash flows.

Approach 2: Eli Lilly Price vs Earnings (PE)

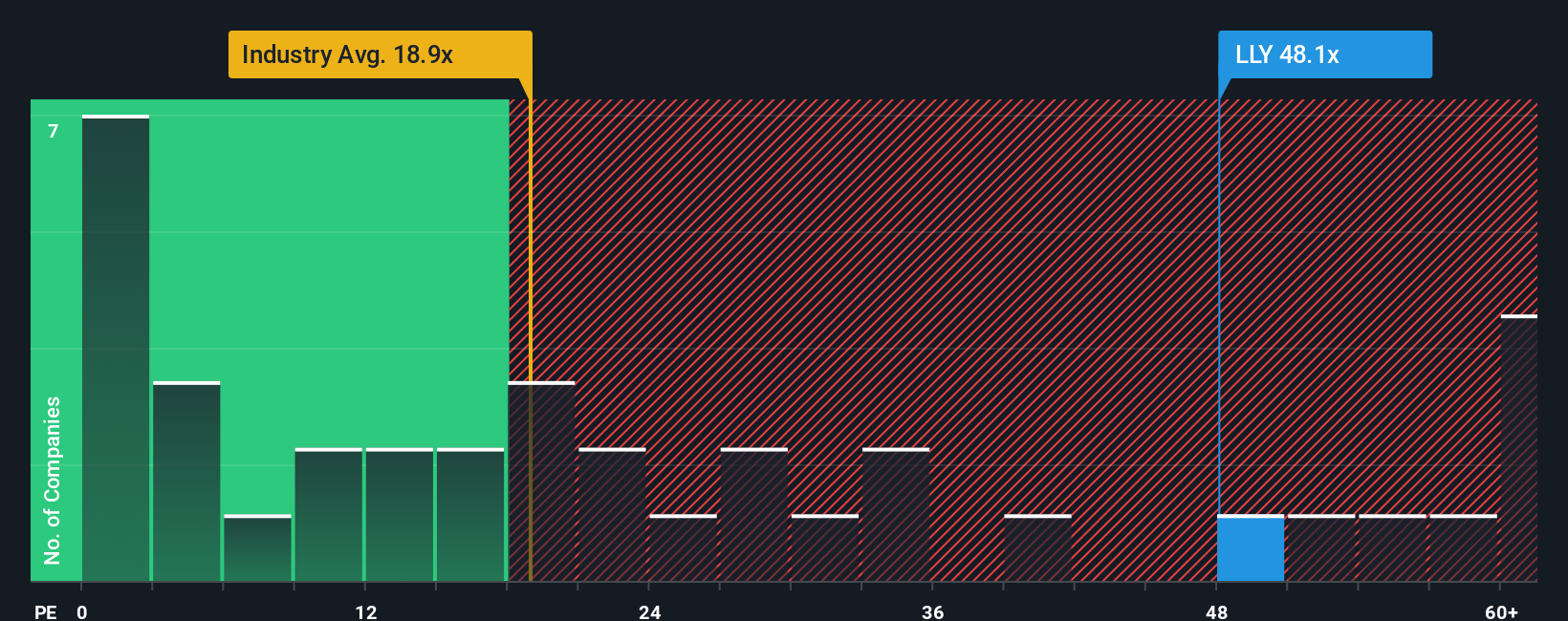

The Price-to-Earnings (PE) ratio is widely considered the gold standard for valuing profitable, established companies like Eli Lilly. It compares a company's current share price to its per-share earnings and provides a straightforward way to assess what investors are willing to pay today for a dollar of future profits.

However, the appropriate PE ratio for any company is not fixed. It depends on how quickly the company is expected to grow, as well as the risks it faces and the stability of its profits. Faster-growing companies usually command higher PE ratios, reflecting optimism about expanding earnings, while higher risk or unstable profits tend to moderate valuations.

Currently, Eli Lilly trades at a PE of 49.5x, which is substantially higher than both the pharmaceutical industry's average of 18.1x and its peer group average of 15.5x. This premium suggests the market expects Lilly's strong earnings growth to continue. To refine our view, we turn to Simply Wall St's proprietary "Fair Ratio," which stands at 43.7x for Eli Lilly. This figure is tailored for Lilly based on factors such as its projected growth, industry, profitability, and market size, making it a more nuanced benchmark than broad peer or industry comparisons.

Comparing Eli Lilly's current PE of 49.5x to its Fair Ratio of 43.7x indicates the market price is somewhat ahead of what Simply Wall St considers justified by the company's fundamentals, given current conditions.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

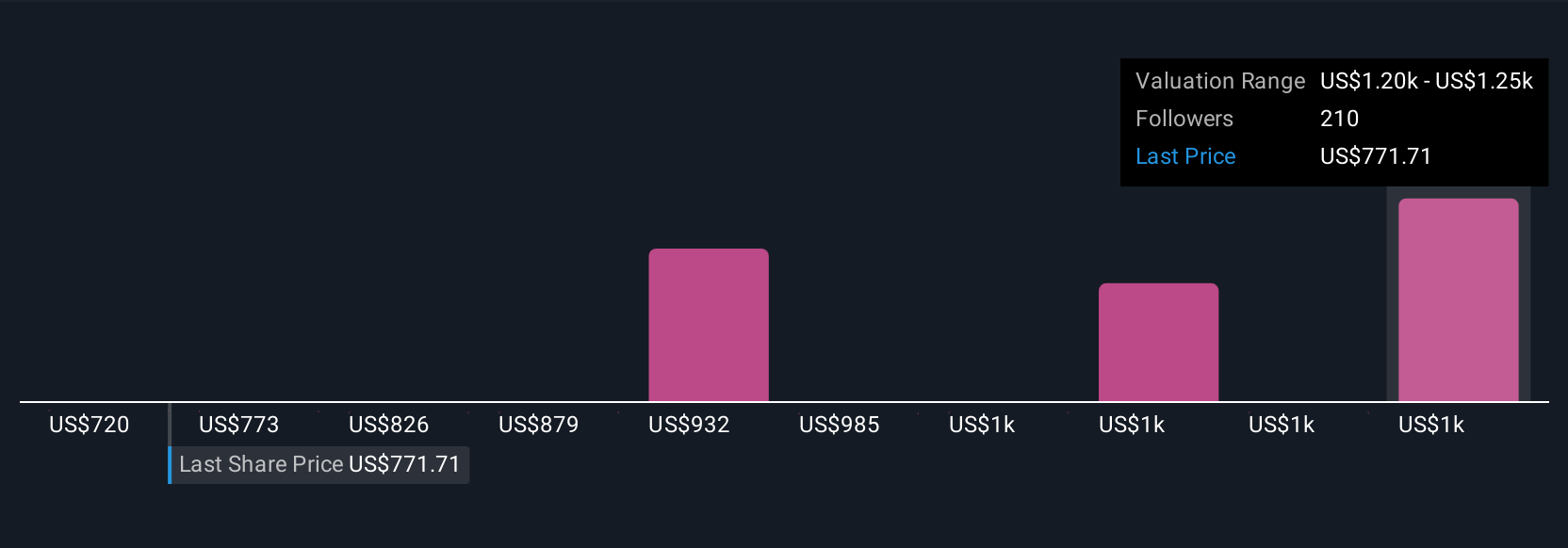

Upgrade Your Decision Making: Choose your Eli Lilly Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a smarter, more dynamic way to make investment decisions. A Narrative is simply your personal story or perspective on a company, combining your view of how Eli Lilly's business might evolve with financial forecasts and a fair value estimate. Narratives connect the company’s underlying story, such as blockbuster drug launches, market expansion, or competitive risks, to specific predictions for future revenue, margins, and prices. This approach makes your investment thesis explicit and actionable.

Narratives are designed to be accessible for everyone and are available on Simply Wall St’s Community page, where millions of investors share their perspectives. They help guide your buy or sell decisions by directly comparing your own view of Eli Lilly’s “Fair Value” with the current market price. Whenever new news or earnings results arise, Narratives update dynamically so your analysis stays relevant and reflects the latest developments.

For example, some investors see Eli Lilly’s fair value as high as $1,190 by banking on explosive obesity drug growth and years of patent protection, while others see it closer to $650 due to concerns about competition or pricing risks. Narratives let you transparently frame, explain, and refine your outlook, all in one place.

For Eli Lilly, however, we'll make it really easy for you with previews of two leading Eli Lilly Narratives:

- 🐂 Eli Lilly Bull Case

Fair Value: $1,189.18

Current Price is about 14.4% below this narrative's fair value estimate

Revenue Growth Rate: 20%

- Massive growth anticipated for Mounjaro and Zepbound, with expectations that Lilly’s tirzepatide sales will surpass competitors by 2026 due to strong demand and long-term patent protection.

- US market trends favor domestic drugmakers like Lilly and increasing insurance coverage is expanding the customer base for both diabetes and obesity treatments.

- Supply bottlenecks and premium pricing remain near-term challenges, but production capacity expansion and a projected 20 to 25 percent annual revenue growth could drive the share price toward $1,200 in the next few years.

- 🐻 Eli Lilly Bear Case

Fair Value: $919.33

Current Price is about 10.7% above this narrative's fair value estimate

Revenue Growth Rate: 16.3%

- Strong growth outlook based on ongoing obesity and diabetes drug launches, global manufacturing expansion, and robust clinical pipeline, but the stock trades at a material premium to the consensus fair value.

- Risks include pricing and reimbursement pressure in major markets, heavy reliance on a narrow portfolio of blockbuster drugs, and rising competition from generics and new entrants.

- Analysts’ fair value estimate has recently increased, reflecting higher growth and improved margins, but future returns may be capped if policy, competition, or clinical setbacks emerge.

Do you think there's more to the story for Eli Lilly? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives