- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (LLY) Is Up 7.8% After Expanding Access and Partnerships in Obesity and Metabolic Therapies

Reviewed by Sasha Jovanovic

- In recent days, Eli Lilly announced a series of major collaborations expanding access to obesity medicines, most notably, a deal to lower prices in return for expanded Medicare and Medicaid coverage in the U.S., while also entering high-profile partnerships with SanegeneBio and Insilico Medicine to advance innovative metabolic disease therapies.

- These moves are set to broaden Eli Lilly’s therapeutic pipeline and addressable market, leveraging both emerging AI technologies and next-generation RNAi drug platforms in addition to creating easier access for millions of patients through direct-to-consumer and retail pharmacy networks.

- We'll examine how Eli Lilly's expanded government partnerships and tech-driven alliances could reshape its investment narrative and growth potential.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Eli Lilly Investment Narrative Recap

To be a shareholder in Eli Lilly today, an investor needs to believe that its leadership in treating obesity and cardiometabolic diseases, backed by strong product innovation and broadening market access, will offset the risks tied to pricing pressure and competition. The latest deal to lower the price of weight-loss drugs in exchange for expanded Medicare and Medicaid coverage in the US could accelerate adoption, but it sharpens the spotlight on whether lower prices may pressure margins, the most important catalyst and risk right now remain accessibility-driven growth versus regulatory-driven margin compression.

Among the recent announcements, the collaboration with Walmart to expand direct-to-consumer pricing for Zepbound stands out. This move is tightly linked to the pricing and access narrative, as it brings Lilly’s most important obesity therapy to more patients at reduced prices, supporting the same near-term growth catalyst highlighted by its government deals. However, investors should also be alert to mounting risks as broader access, while positive for growth, may further test margin resilience if pricing pressures intensify...

Read the full narrative on Eli Lilly (it's free!)

Eli Lilly's outlook anticipates $89.1 billion in revenue and $34.2 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 18.7% and an earnings increase of $20.4 billion from the current earnings of $13.8 billion.

Uncover how Eli Lilly's forecasts yield a $919.33 fair value, a 5% downside to its current price.

Exploring Other Perspectives

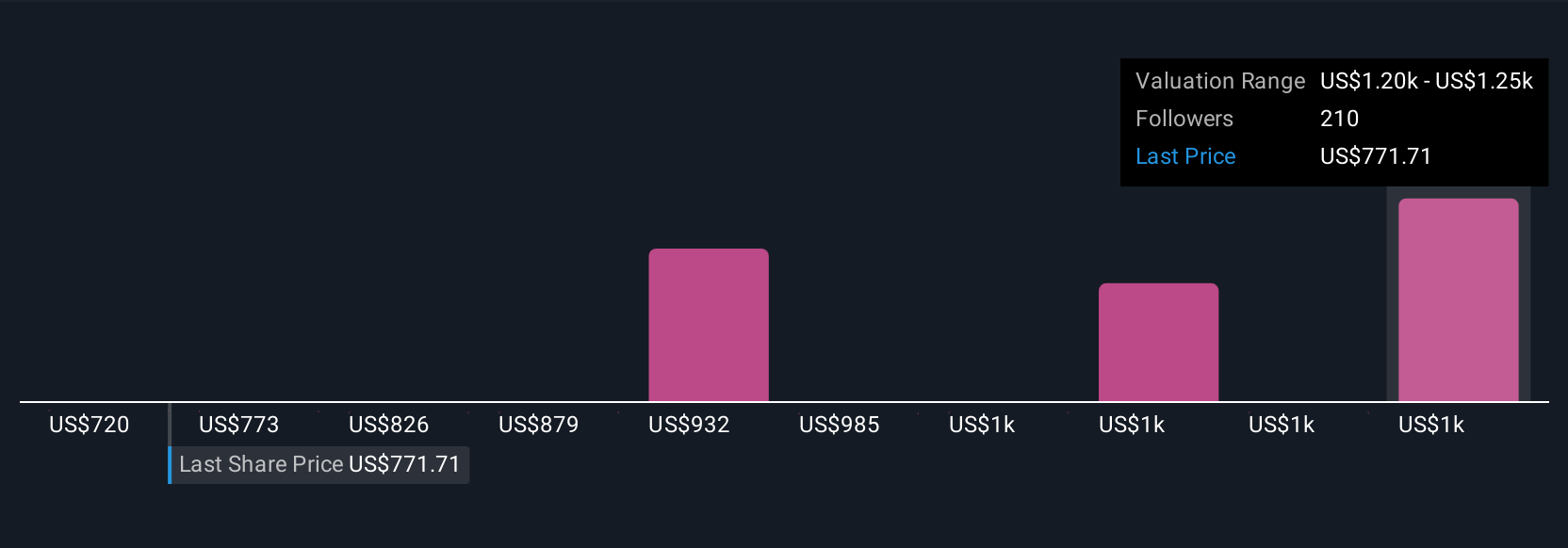

Fair value estimates from 30 Simply Wall St Community members range widely from US$650 to US$1,216.86. As pricing reforms expand patient access, consider how shifts in margin might shape future performance.

Explore 30 other fair value estimates on Eli Lilly - why the stock might be worth as much as 26% more than the current price!

Build Your Own Eli Lilly Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eli Lilly research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eli Lilly's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives