- United States

- /

- Pharma

- /

- NYSE:JNJ

These 4 Measures Indicate That Johnson & Johnson (NYSE:JNJ) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Johnson & Johnson (NYSE:JNJ) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Johnson & Johnson

What Is Johnson & Johnson's Debt?

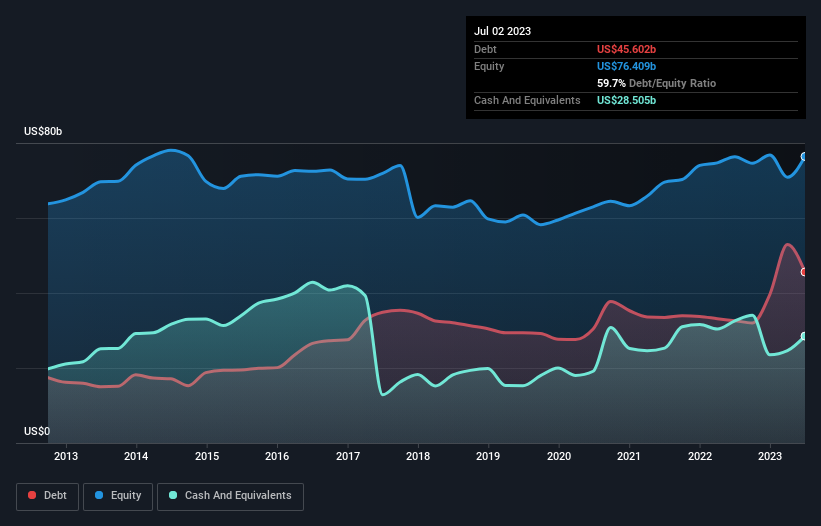

The image below, which you can click on for greater detail, shows that at July 2023 Johnson & Johnson had debt of US$45.6b, up from US$32.6b in one year. However, because it has a cash reserve of US$28.5b, its net debt is less, at about US$17.1b.

A Look At Johnson & Johnson's Liabilities

The latest balance sheet data shows that Johnson & Johnson had liabilities of US$54.2b due within a year, and liabilities of US$61.1b falling due after that. Offsetting these obligations, it had cash of US$28.5b as well as receivables valued at US$16.8b due within 12 months. So its liabilities total US$70.0b more than the combination of its cash and short-term receivables.

Of course, Johnson & Johnson has a titanic market capitalization of US$451.8b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Johnson & Johnson has a low debt to EBITDA ratio of only 0.50. And remarkably, despite having net debt, it actually received more in interest over the last twelve months than it had to pay. So it's fair to say it can handle debt like a hotshot teppanyaki chef handles cooking. The good news is that Johnson & Johnson has increased its EBIT by 6.6% over twelve months, which should ease any concerns about debt repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Johnson & Johnson can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Johnson & Johnson produced sturdy free cash flow equating to 75% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

The good news is that Johnson & Johnson's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. Zooming out, Johnson & Johnson seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for Johnson & Johnson you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives