- United States

- /

- Pharma

- /

- NYSE:JNJ

Johnson & Johnson (NYSE:JNJ) Has a Potential to Outperform the Prolonged Downturn

In the last 2 years, Johnson & Johnson (NYSE: JNJ) didn't do as well as the broad market, gaining a modest 30%. Yet, in 2022, the company's health has indeed been wealth for its investors.

So far, it has comfortably outperformed through a market correction, and after a dividend hike, investors will be looking for more of the same.

View our latest analysis for Johnson & Johnson

First-quarter 2022 results

- EPS: US$1.93 (down from US$2.36 in 1Q 2021).

- Revenue: US$23.4b (up 5.0% from 1Q 2021).

- Net income: US$5.15b (down 17% from 1Q 2021).

- Profit margin: 22% (down from 28% in 1Q 2021). Higher expenses drove the decrease in the margin.

The pharmaceutical division market had the largest growth (+6.3% Y/Y), while the Consumer Health segment reported a decline of 1.5% Y/Y. Revenue was in line with analyst estimates. Earnings per share (EPS) missed analyst estimates by 16%.

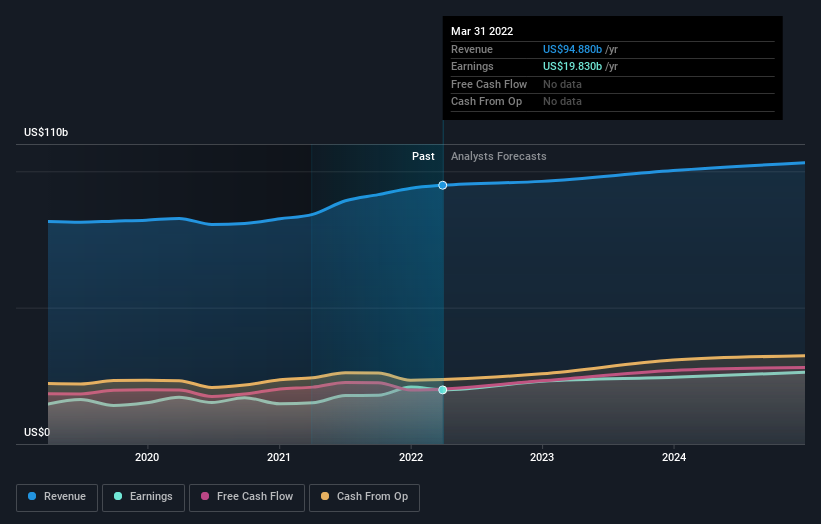

Over the next year, revenue is forecast to grow 2.5%, compared to a 14% growth forecast for the industry in the US. Over the last 3 years, on average, earnings per share have increased by 10% per year, whereas the company’s share price has risen by 9% per year.

Is Johnson & Johnson still cheap?

According to our valuation model, the intrinsic value for the stock is $266.22, which is above what the market is valuing the company at the moment. This indicates a potential opportunity to buy low.

What’s more interesting is that Johnson & Johnson’s share price is relatively stable, which could mean two things: firstly, it may take the share price a while to move to its intrinsic value, and secondly, there may be fewer chances to buy low in the future once it reaches that value. This is because the stock is less volatile than the broader market, given its low beta.

Can we expect growth from Johnson & Johnson?

Future outlook is an important aspect when you’re buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a low price.

With profit expected to grow by 33% over the next couple of years, the future seems bright for Johnson & Johnson. Higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

Latest Developments & Implications

Following the earnings report, the company adjusted the EPS guidance downwards, from US$10.4-10.60 to US$10.15-10.35. The company maintained 2022 full-year guidance for adjusted operational EPS and expected operational sales to be in the range of US$97.3b-98.3b.

One year after the approval of the single-shot COVID-19 vaccine, a final analysis showed it provided 52.9% protection against moderate-to-severe disease. The company is now suspending COVID-19 vaccine sales guidance without impacting adjusted operational EPS guidance. Furthermore, the company stated that the ongoing economic sanctions against Russia would not impact revenue but might delay some clinical trials.

Meanwhile, the company increased the dividend by 6.6%. This increase takes the quarterly payment up from US$1.06 to US$1.13, giving it a forward yield of 2.5%. The dividend is payable on June 7, and going ex-dividend on May 23. Dividend raise is significant because it is meaningful enough to dampen the effect of inflation. In turn, it makes it an even more attractive opportunity for pure dividend investors.

What this means for you:

If you're a shareholder, you are likely pleased by the performance over the last months since the stock is moving up while the broad market is declining.

If you're looking to boost your stake or invest for the first time, you might do further research to evaluate whether the optimistic growth prospects make sense. It would help if you considered that JNJ stock moves slower than the market on average. Thus, there might be fewer attractive opportunities to buy during the year. But before you make any investment decisions, consider other factors such as the track record of its management team to make a well-informed buy.

If you'd like to know more about the business, it's essential to be aware of any risks. Case in point: We've spotted 1 warning sign for Johnson & Johnson you should be aware of.

If you are no longer interested in Johnson & Johnson, you can use our free platform to see our list of over 50 other stocks with high growth potential.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives