- United States

- /

- Pharma

- /

- NYSE:JNJ

Johnson & Johnson (JNJ) Valuation in Focus After Major FDA Wins Expand Tremfya's Market Potential

Reviewed by Kshitija Bhandaru

Johnson & Johnson, a global healthcare leader, has drawn strong attention after receiving back-to-back FDA approvals that broaden the reach of its immunology drug Tremfya. The new indications cover pediatric psoriasis and a subcutaneous induction protocol for ulcerative colitis, giving Tremfya first-in-class status.

See our latest analysis for Johnson & Johnson.

Johnson & Johnson has seen renewed investor enthusiasm following these regulatory wins, which have helped lift shares alongside other pharma names as the sector regains momentum. Even as broader market conditions have been choppy, J&J's 1-year total shareholder return stands at just under 0.2%. This is a modest figure, but the company's diversified strengths and upgraded pipelines are drawing fresh attention to its long-term story.

If Johnson & Johnson’s progress has you thinking about healthcare’s next era, there’s plenty more to discover with our See the full list for free.

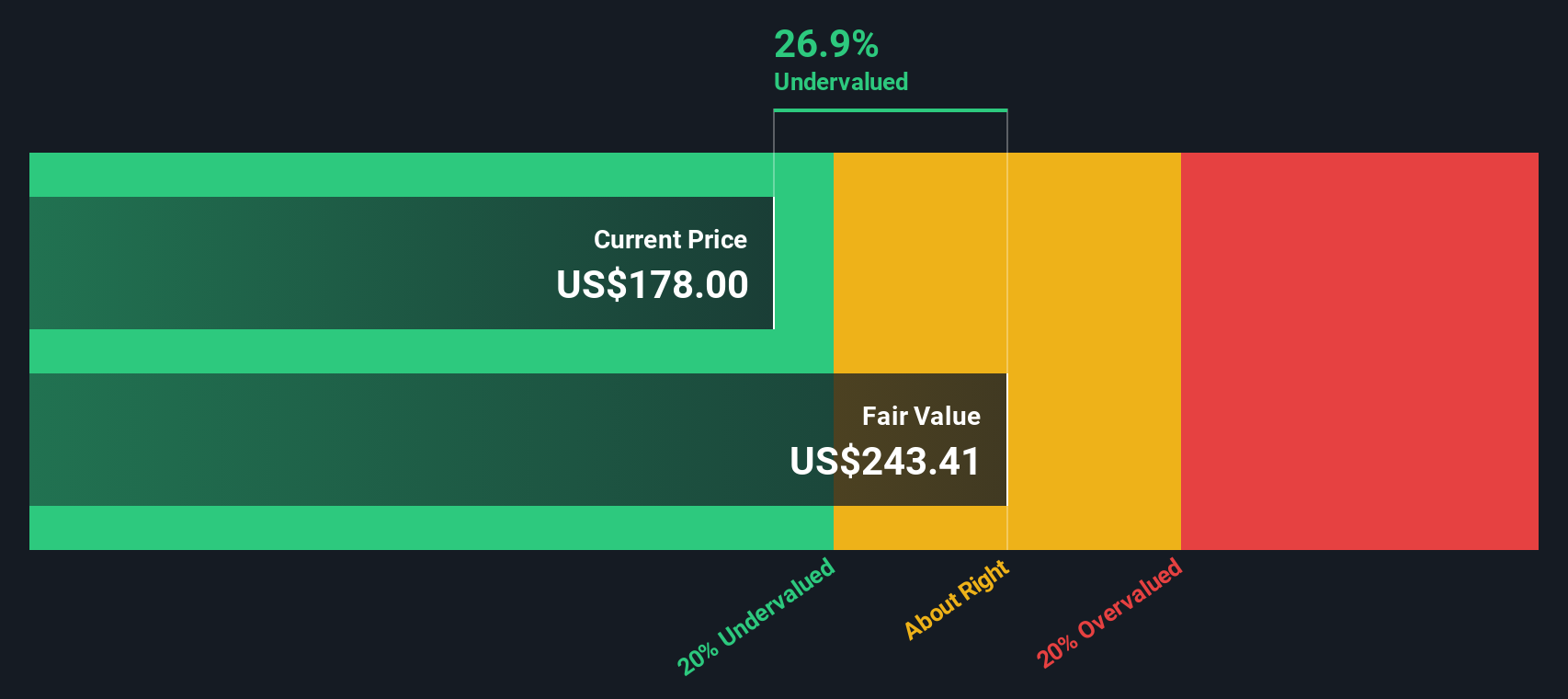

With these advances, a crucial question emerges: is Johnson & Johnson’s recent run a sign that the stock is still undervalued, or is the market already pricing in all the future growth these wins imply?

Most Popular Narrative: 3.5% Overvalued

With Johnson & Johnson shares closing at $185.98, the most popular narrative values the fair price at $179.64. That is a slight premium to where consensus thinks the stock should be traded, hinting at some market optimism ahead of analyst projections.

The analysts have a consensus price target of $177.468 for Johnson & Johnson based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement among analysts, with the most bullish reporting a price target of $200.0, and the most bearish reporting a price target of just $155.0.

Want to know the critical assumptions behind this valuation? The real story is built on a tug-of-war between future profit margins and the kind of growth rates usually reserved for fast-moving sectors. Find out which numbers are driving this fair value and why analysts are divided on what comes next.

Result: Fair Value of $179.64 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing litigation and the looming threat from biosimilar competition could quickly disrupt current growth expectations and challenge Johnson & Johnson’s future profit margins.

Find out about the key risks to this Johnson & Johnson narrative.

Another View: SWS DCF Model Shows Hidden Value

Looking through the lens of our DCF model, Johnson & Johnson appears significantly undervalued. The SWS DCF estimate puts fair value at $442.56, which is far above today’s market price. This large gap suggests the market may be overlooking long-term cash flow potential. Are growth setbacks temporary, or is there real opportunity here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Johnson & Johnson Narrative

If you'd rather come to your own conclusion or dive deeper into the figures, you have the tools to craft a personalized take in just minutes with our Do it your way

A great starting point for your Johnson & Johnson research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let remarkable opportunities pass you by. Take the lead and build a smarter portfolio with handpicked stocks you won’t find anywhere else.

- Amplify your returns by exploring these 19 dividend stocks with yields > 3%, which highlights companies delivering yields above 3% to reward your investment strategy.

- Accelerate your growth potential by targeting these 24 AI penny stocks, where emerging AI leaders are redefining entire industries and driving tomorrow’s innovations.

- Strengthen your search for value by reviewing these 904 undervalued stocks based on cash flows, featuring stocks considered underpriced based on rigorous cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives