- United States

- /

- Pharma

- /

- NYSE:JNJ

Johnson & Johnson (JNJ) Is Up 8.2% After FDA Progress and Strong Q2 Earnings - What's Changed

Reviewed by Simply Wall St

- In the past week, Johnson & Johnson announced an FDA New Drug Application for icotrokinra in moderate to severe plaque psoriasis, FDA Priority Review for its TAR-200 bladder cancer therapy, and delivered second-quarter earnings that exceeded expectations with upgraded full-year guidance.

- These developments highlight the company's continued momentum in advancing its innovative medicines pipeline alongside robust financial performance.

- We’ll explore how the recent FDA advances, particularly the progress of icotrokinra and TAR-200, impact Johnson & Johnson’s long-term growth outlook.

Johnson & Johnson Investment Narrative Recap

Being a Johnson & Johnson shareholder involves trusting in the company’s ability to offset upcoming biosimilar competition for STELARA by delivering new innovative treatments and maintaining strong operating results. The recent FDA submissions for icotrokinra and TAR-200 could amplify near-term focus on pipeline execution as the primary catalyst, but they do not materially change the ongoing risk from STELARA’s loss of exclusivity, which remains a central question for revenue sustainability.

Among this week’s announcements, the FDA’s Priority Review for TAR-200 in high-risk non-muscle invasive bladder cancer stands out. Success here supports Johnson & Johnson’s strategy to drive growth in innovative medicine and reduce reliance on its legacy immunology portfolio, a key consideration as STELARA faces increasing biosimilar competition.

By contrast, investors need to stay aware of the implications if biosimilar competition to STELARA accelerates faster than expected...

Read the full narrative on Johnson & Johnson (it's free!)

Johnson & Johnson's outlook projects $99.6 billion in revenue and $22.9 billion in earnings by 2028. This scenario assumes a 3.7% annual revenue growth rate and a $1.1 billion increase in earnings from the current $21.8 billion.

Exploring Other Perspectives

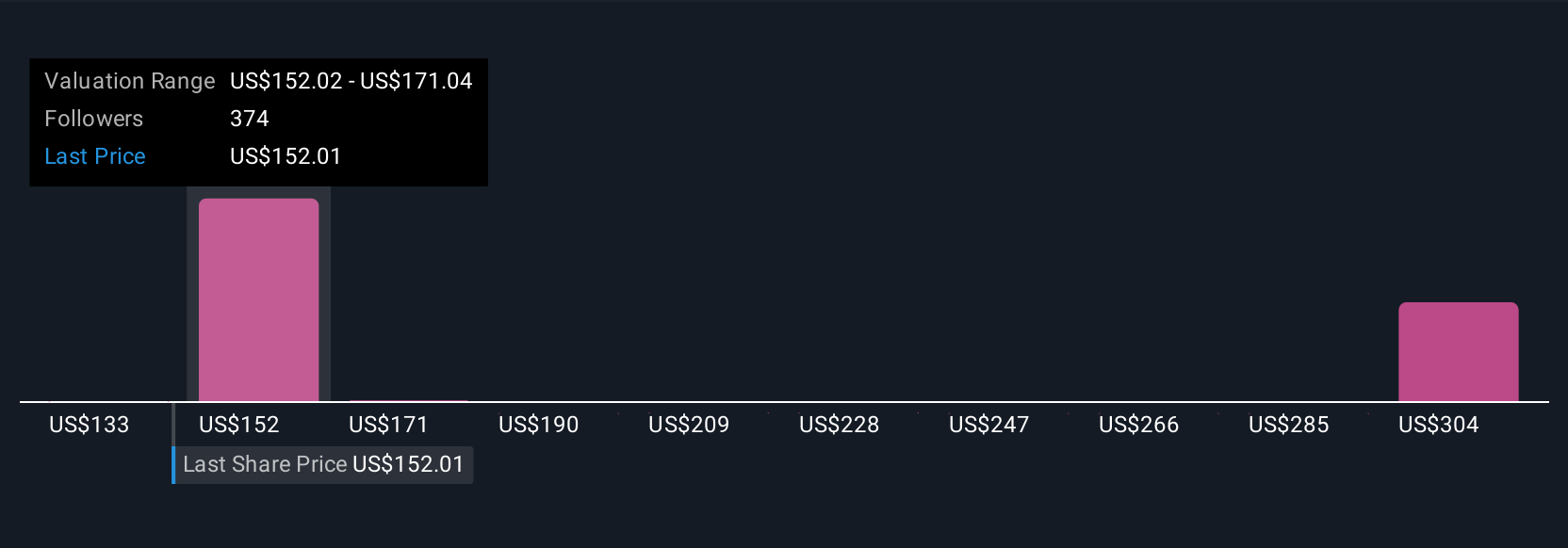

Twenty-six individual fair value estimates from the Simply Wall St Community range from US$133 to US$263 per share. While pipeline progress attracts some optimism among contributors, the wide spread signals just how differently people weigh risks like biosimilar erosion, inviting you to explore several alternative viewpoints.

Build Your Own Johnson & Johnson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Johnson & Johnson research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Johnson & Johnson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Johnson & Johnson's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives