- United States

- /

- Life Sciences

- /

- NYSE:IQV

Is IQVIA at a Turning Point After 17% Surge and New AI Partnerships?

Reviewed by Bailey Pemberton

Thinking about what to do with IQVIA Holdings stock right now? You would not be alone. The last month has seen shares climb a healthy 16.8%, and over just the past week the stock is up another 6.8%. These moves have caught the attention of both cautious skeptics and investors scanning for underappreciated opportunities. Yet, it is not all momentum and short-term excitement. Over the last year, shares have lagged by 4.2%, suggesting a pendulum swinging between optimism and concern.

Some of this back-and-forth is linked to the evolving healthcare landscape, where IQVIA continues to make headlines with new data platform partnerships and expanding AI-driven services. As these innovations ramp up, Wall Street is rethinking both the risks and potential rewards involved. No wonder the stock’s valuation has become a hot topic. By our scorecard, IQVIA is undervalued in 4 out of 6 key valuation checks, resulting in a solid value score of 4. That is worth a closer look for anyone wondering if this rally is built on real substance.

In the next section, I will walk you through each valuation approach and what it tells us about where IQVIA might be heading. Plus, I will share one perspective that goes beyond numbers and ratios to give you an even richer view of its true value.

Approach 1: IQVIA Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company’s future cash flows and then discounting those projections back to their present value. This helps estimate what the business is fundamentally worth today, based on the cash it is expected to generate in the years ahead.

For IQVIA Holdings, the current Free Cash Flow stands at $1.97 billion. Analysts provide estimates for up to five years, with projections extended further by Simply Wall St. By 2029, the Free Cash Flow is forecast to reach roughly $2.71 billion, and 10-year projections stretch close to $3.70 billion. These steady increases reflect anticipated growth in IQVIA’s business over the coming decade, underpinned by its investments in healthcare data and AI-driven services.

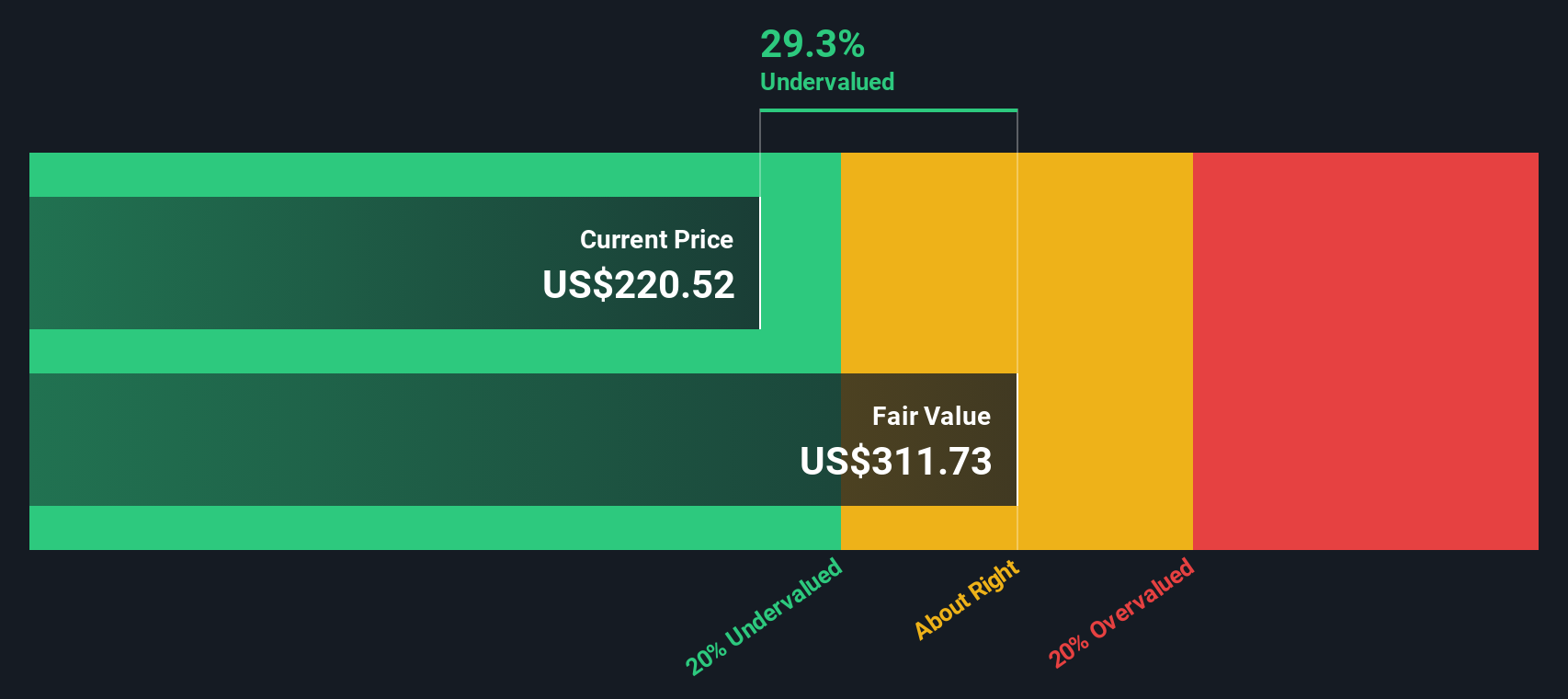

Crunching these numbers through the DCF model delivers an intrinsic value of $310.21 per share. Compared to the current trading price, this implies the stock is trading at a 29.5% discount, which is a notable margin of undervaluation if the underlying cash flow projections hold true.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests IQVIA Holdings is undervalued by 29.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: IQVIA Holdings Price vs Earnings

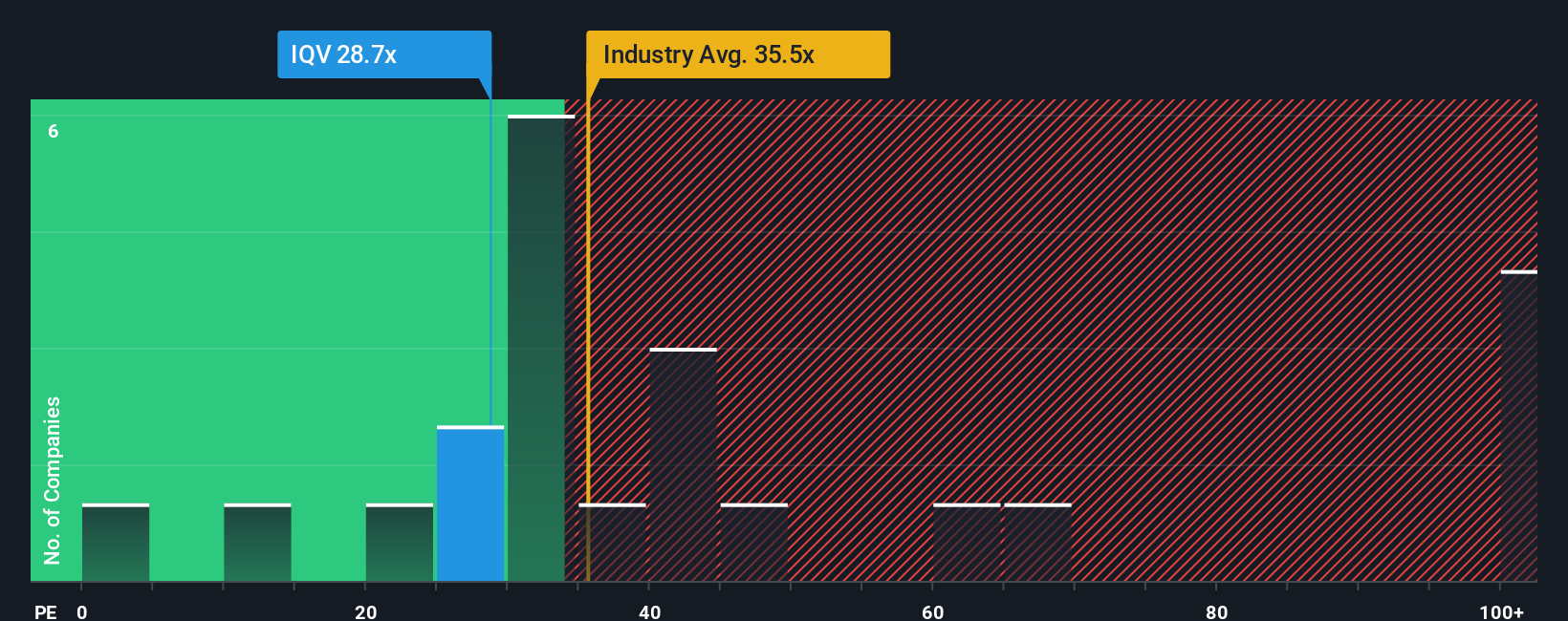

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like IQVIA Holdings because it helps investors gauge how much they are paying for each dollar of current earnings. For companies that are consistently generating profits, the PE ratio serves as a direct and meaningful comparison against other firms in the same sector.

However, what qualifies as a “normal” or “fair” PE ratio depends on various factors. Higher growth prospects or lower risks can justify a higher PE. Companies facing greater uncertainty or slower earnings expansion typically trade at lower multiples. As a result, benchmarks like the average PE across the Life Sciences industry (33.85x) and among direct peers (35.22x) provide useful context, but can be misleading when viewed in isolation.

Currently, IQVIA Holdings trades at a PE of 30.05x. To refine this comparison, Simply Wall St’s proprietary “Fair Ratio” comes into play. The Fair Ratio for IQVIA is 24.15x, accounting for company-specific factors such as expected earnings growth, margins, overall market cap, and associated risks. Unlike broad industry or peer averages, the Fair Ratio leverages deeper, forward-looking insights to offer a more rigorous and individualized benchmark for valuation.

Comparing IQVIA’s current PE of 30.05x to its Fair Ratio of 24.15x suggests the shares are trading above their fair value based on fundamentals and company-specific outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your IQVIA Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful way to express your view on a company, connecting the story behind the business with your own forecasts for future revenue, earnings, and margins, and then calculating a fair value that reflects your perspective.

Narratives bridge the gap between numbers and meaning, letting you link IQVIA’s unique journey, such as its push into AI analytics or new industry partnerships, to a concrete financial outcome and investment decision. On Simply Wall St’s Community page, Narratives are available to all investors and are designed to be user-friendly. This “story-to-value” process is accessible whether you are just learning or have years of experience.

Narratives allow you to assess whether IQVIA Holdings is a buy, hold, or sell by continuously comparing your calculated Fair Value to the live market price. Your view stays up to date automatically as earnings reports, news, or company updates roll in.

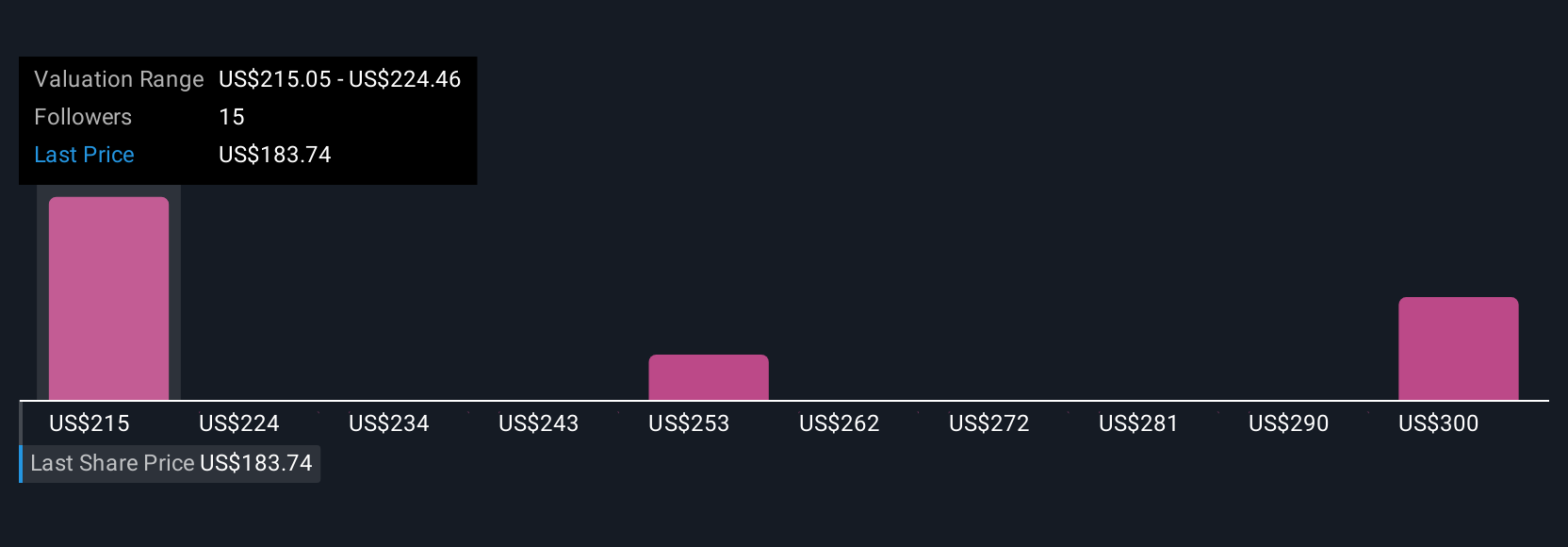

For example, one investor may craft a bullish Narrative around IQVIA’s accelerated AI adoption and strategic partnerships, supporting a high price target of $268.00. Another could focus on rising competition and regulatory risks for a more cautious target of $177.00, with each scenario backed by their chosen financial forecasts and assumptions.

Do you think there's more to the story for IQVIA Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IQV

IQVIA Holdings

Provides clinical research services, commercial insights, and healthcare intelligence to the life sciences and healthcare industries in the Americas, Europe, Africa, and the Asia-Pacific.

Good value with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion