- United States

- /

- Pharma

- /

- NYSE:ELAN

Is Elanco Animal Health’s Rally Justified After Regulatory Approvals and an 83% Price Surge?

Reviewed by Bailey Pemberton

If you’re trying to decide what to do with shares of Elanco Animal Health, you’re not alone. The company’s stock price has had a wild ride lately, shooting up 17.6% over the last month and an impressive 83.0% year-to-date. That’s enough to grab the attention of anyone eyeing growth in the animal health sector. After lagging for several years, with the 5-year return still at -28.9%, this recent surge has plenty of investors wondering whether this newfound momentum is justified.

Some of the optimism can be traced to recent announcements about Elanco’s expanded product pipeline and regulatory approvals, which have brightened the company’s growth outlook. Meanwhile, an improved debt profile and continued focus on operational efficiency seem to have shifted risk perceptions in the company’s favor, at least for now. These developments have brought in fresh buyers, with short-term returns up 2.9% in the last week alone and a remarkable 77.7% over the past twelve months.

But does that mean Elanco is undervalued, fairly valued, or is the run-up too good to be true? Based on a widely-used six-point valuation checklist, Elanco scores a 3, meaning it is undervalued in half the key metrics tracked. Let’s break down how each valuation approach weighs in on the stock, and stick around because there is a way to see beyond the numbers that could put the whole story in perspective.

Approach 1: Elanco Animal Health Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and then discounting them back to their present value. In Elanco Animal Health’s case, this means projecting how much cash the company will generate in the coming years and determining what that future income is worth today, taking into account the time value of money.

Currently, Elanco generates a Free Cash Flow (FCF) of $382.5 million. Analyst projections suggest that FCF will steadily climb over the next several years, reaching $677 million by 2029. While solid analyst estimates are available for the first five years, projections for the following years are extrapolated based on industry growth trends. The 10-year outlook anticipates cash flows trending higher, supported by operational improvements and a strengthened product pipeline.

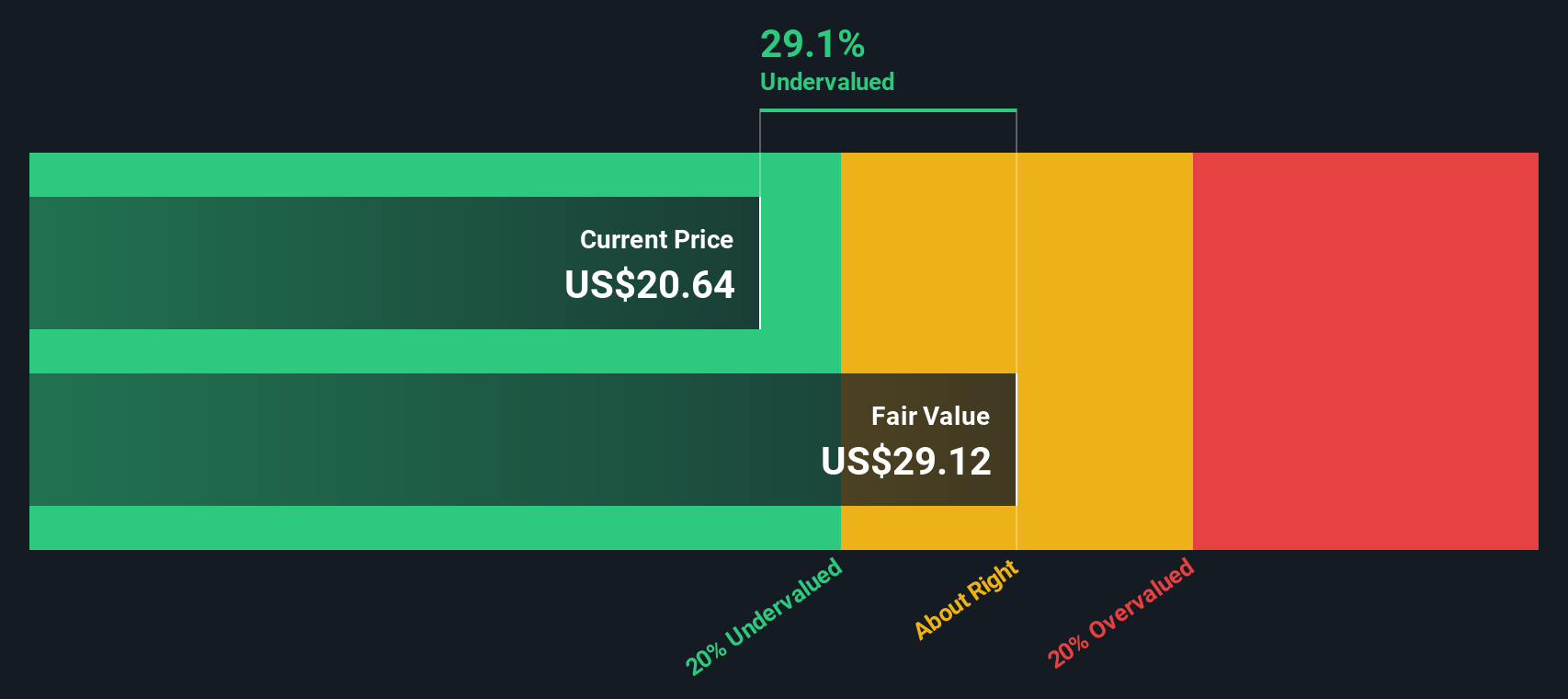

With these projections and after applying appropriate discount rates, the DCF model estimates Elanco’s intrinsic value at $31.40 per share. Compared to the company’s current trading price, this represents a 29.8% discount and suggests that Elanco shares are notably undervalued based on this metric.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Elanco Animal Health is undervalued by 29.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Elanco Animal Health Price vs Earnings (PE)

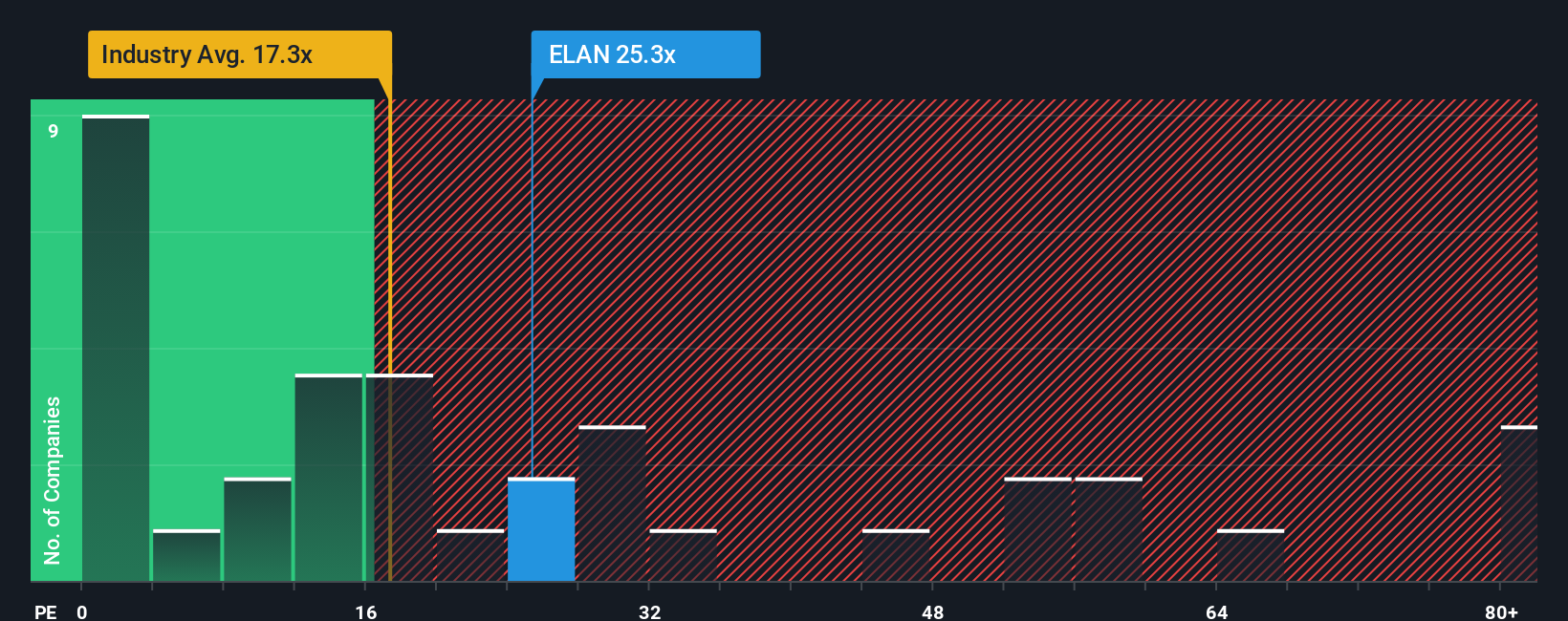

When analyzing profitable companies, the price-to-earnings (PE) ratio is often the preferred valuation tool. It offers a snapshot of how much investors are paying for each dollar of the company’s earnings, which is especially useful when the business has consistent profits. Investors typically use the PE ratio to gauge how the market values a company’s earnings compared to others in the same sector or with similar growth profiles.

The appropriate or “normal” PE ratio depends not just on the company’s industry, but also on its future earnings growth potential and the risks associated with achieving that growth. Higher expected growth or lower risk usually justifies a higher PE, while more uncertainty or slower prospects typically bring the benchmark down.

Elanco Animal Health currently trades at a PE ratio of 25x. This is notably above the industry average of 17.7x, but below the average for its direct peers at 33.5x. However, to get a more accurate sense of value, Simply Wall St introduces the “Fair Ratio,” which considers Elanco’s own growth outlook, profit margins, size, and risks, leading to a fair PE of 18.5x for the company. This proprietary Fair Ratio is considered an improvement over simple peer or industry comparisons, since it adapts to Elanco’s specific fundamentals and market environment.

Comparing the Fair Ratio of 18.5x to the actual PE of 25x, Elanco currently appears overvalued based on this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Elanco Animal Health Narrative

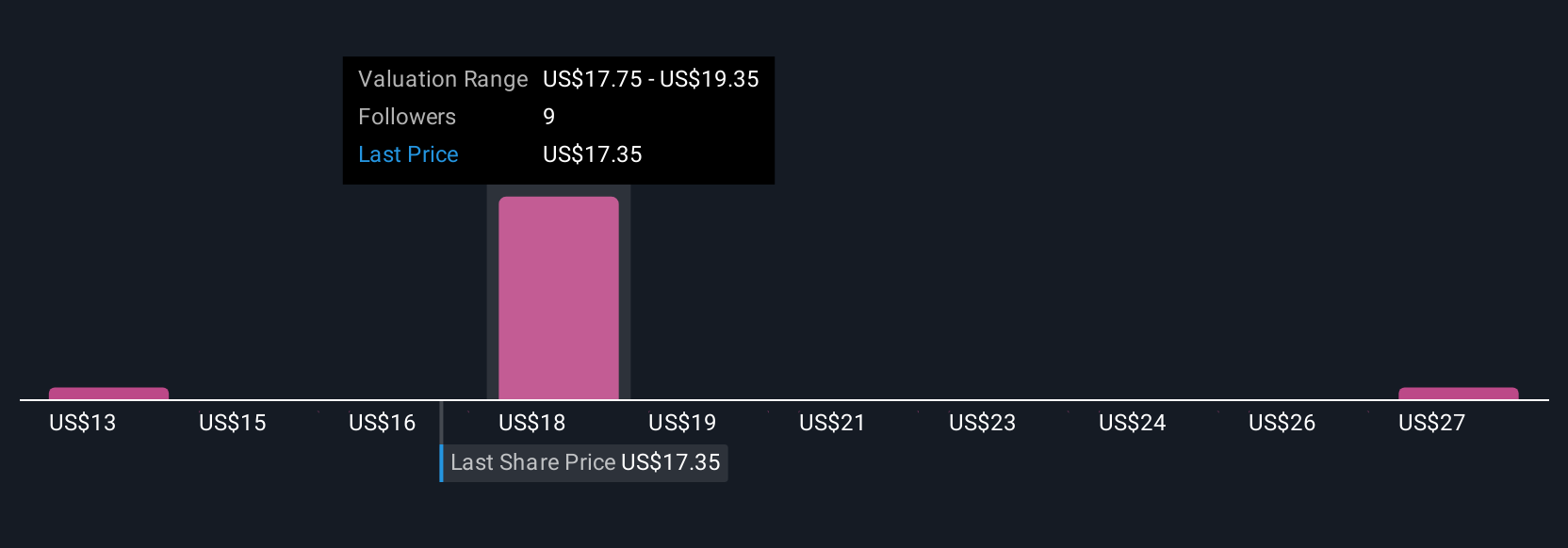

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or perspective about a company; it’s the connection between the business drivers you care about and the numbers, like future revenue and earnings. Narratives give you a space to make your own assumptions, linking those beliefs to a financial forecast and a resulting Fair Value, showing you where opportunity may exist beyond traditional models.

On Simply Wall St’s Community page, Narratives are used by millions of investors as an intuitive and practical tool. They are quick to set up, easy to update, and always reflect the latest news or earnings. Narratives help you decide when to buy or sell by comparing your Fair Value (based on your story) to the current share price, empowering you to act confidently as the facts change. For example, some Elanco Animal Health Narratives expect a fair value of $21.00, reflecting optimism about blockbuster product launches and robust growth, while others see a value closer to $14.00, reflecting caution about FX headwinds or margin risks. You can craft your own Narrative to see where your view fits and take action when the numbers move in your favor.

Do you think there's more to the story for Elanco Animal Health? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELAN

Elanco Animal Health

An animal health company, innovates, develops, manufactures, and markets products for pets and farm animals worldwide.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives