- United States

- /

- Pharma

- /

- NYSE:ELAN

FDA Emergency Use Nod for Credelio Might Change the Case for Investing in Elanco (ELAN)

Reviewed by Sasha Jovanovic

- Earlier this week, Elanco Animal Health Incorporated announced it has received Emergency Use Authorization from the U.S. FDA for Credelio to treat New World screwworm infestations in dogs, marking the first time such approval has been granted for this condition in dogs.

- This milestone positions Elanco as a key provider of an urgently needed treatment as New World screwworm cases were recently detected near the U.S.-Mexico border, addressing a growing animal and public health concern.

- We’ll explore how this unprecedented FDA authorization of Credelio could reshape Elanco’s investment narrative, especially amid heightened market attention.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Elanco Animal Health Investment Narrative Recap

To own Elanco Animal Health stock, investors need confidence in management’s ability to generate organic revenue growth through product innovation and market expansion. The recent FDA Emergency Use Authorization for Credelio as a treatment for New World screwworm in dogs adds a potentially valuable product to Elanco’s portfolio, but is not likely to dramatically impact the company’s biggest short-term catalyst: the ramp-up and adoption of new blockbusters like Zenrelia and Credelio Quattro, nor does it reduce key execution risks in those launches.

Among several recent updates, the September label approval for Zenrelia stands out as highly relevant. The removal of certain label warnings could aid adoption and help drive the innovation-driven growth that Elanco and analysts have flagged as central to its near-term performance targets, especially as new health threats like the screwworm highlight the value of rapid product development and regulatory approval.

Yet, in contrast to these innovation wins, investors should also keep in mind the execution risks around achieving rapid adoption and the impact this could have if market penetration falls short of expectations...

Read the full narrative on Elanco Animal Health (it's free!)

Elanco Animal Health's outlook anticipates $5.1 billion in revenue and $186.7 million in earnings by 2028. This projection is based on a 4.5% annual revenue growth rate but a sharp earnings decline of $247.3 million from the current $434.0 million.

Uncover how Elanco Animal Health's forecasts yield a $20.55 fair value, a 7% downside to its current price.

Exploring Other Perspectives

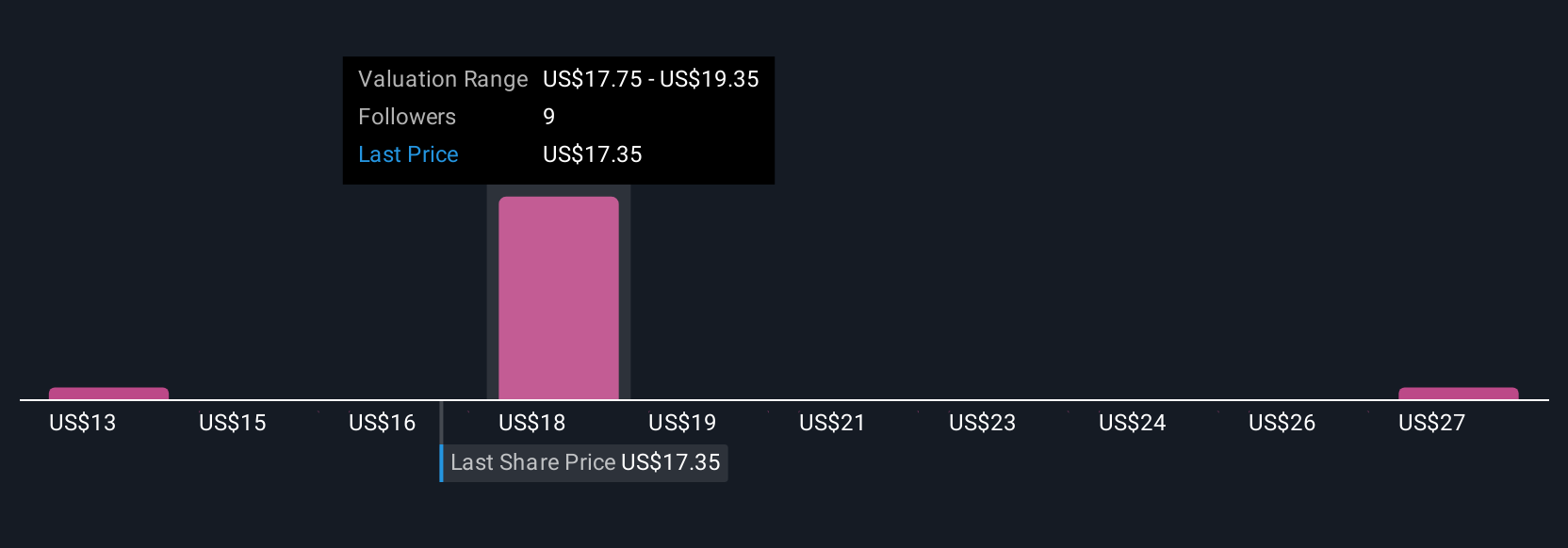

Fair value estimates from three Simply Wall St Community users span US$12.93 to US$31.40, revealing a wide set of potential outcomes. While opinions are split, the focus on successful blockbuster launches remains a key factor influencing future results, so consider how community and analyst perspectives can both expand your understanding of Elanco’s prospects.

Explore 3 other fair value estimates on Elanco Animal Health - why the stock might be worth as much as 42% more than the current price!

Build Your Own Elanco Animal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elanco Animal Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Elanco Animal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elanco Animal Health's overall financial health at a glance.

No Opportunity In Elanco Animal Health?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELAN

Elanco Animal Health

An animal health company, innovates, develops, manufactures, and markets products for pets and farm animals worldwide.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives