- United States

- /

- Pharma

- /

- NYSE:ELAN

A Look at Elanco Animal Health’s Valuation After Securing FDA Emergency Use Nod for Credelio

Reviewed by Simply Wall St

Elanco Animal Health (NYSE:ELAN) just secured the first Emergency Use Authorization from the U.S. FDA for Credelio to treat New World screwworm infestations in dogs. This move puts Elanco at the forefront, as confirmed cases appear near the U.S.-Mexico border.

See our latest analysis for Elanco Animal Health.

The FDA’s decision lands as Elanco Animal Health enjoys a strong run, with its share price up over 53% in the past three months and a remarkable year-to-date share price return of 83%. While this momentum hints at growing investor optimism around regulatory wins and fresh product launches, long-term total shareholder return over five years remains in negative territory. This underscores the company’s need to turn recent breakthroughs into lasting gains.

If regulatory breakthroughs like this spark your interest, it might be the perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

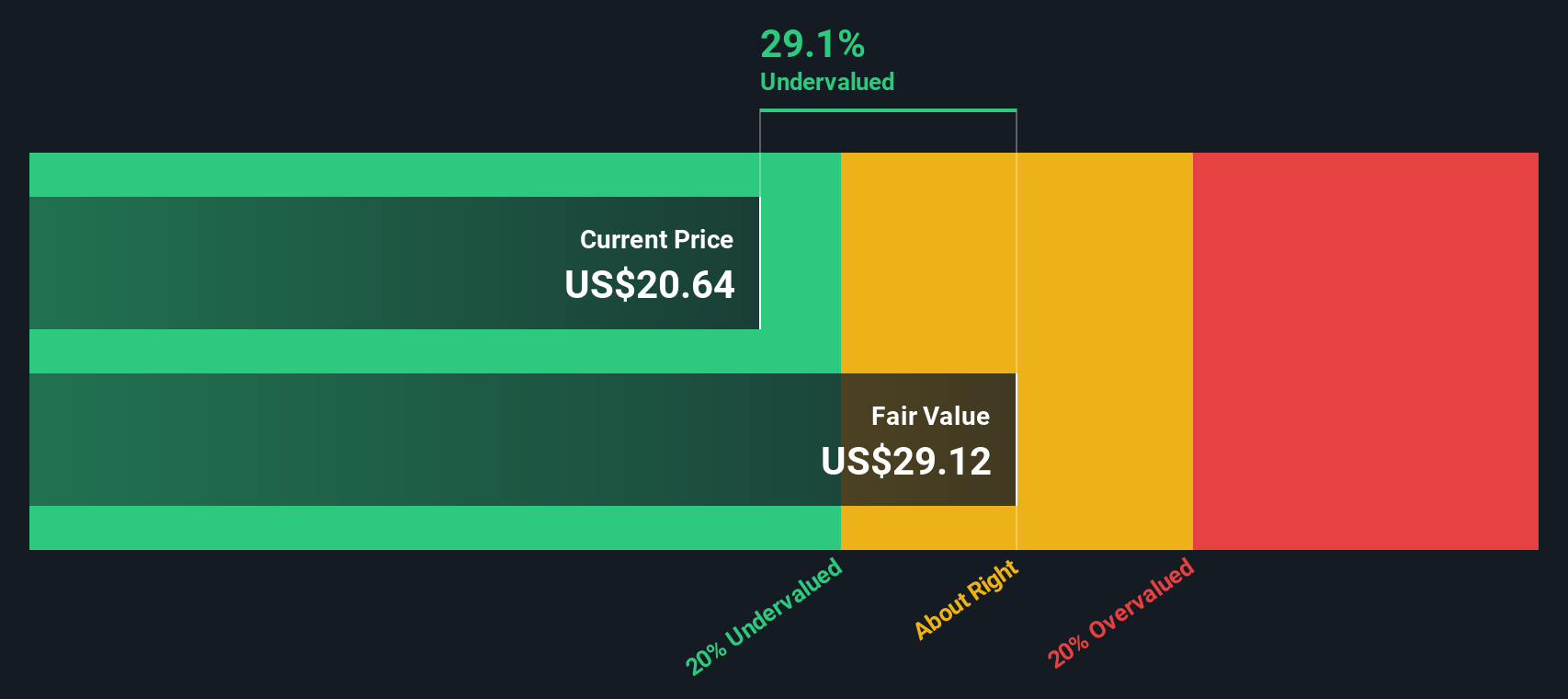

But after such a dramatic surge in the share price, is Elanco still undervalued, or have investors already factored in its future growth, leaving limited room for new buyers to benefit?

Most Popular Narrative: 4% Overvalued

Elanco Animal Health’s latest close of $22.05 now sits above the consensus narrative's fair value estimate of $21.18. The market appears to be pricing in healthy optimism for upcoming launches and operational growth, but it may be stretching just beyond what analysts’ fundamental assumptions currently support.

Elanco anticipates an acceleration in organic constant currency revenue growth of 4% to 6%, driven by innovation and market expansion. This will positively impact revenue growth. The successful launch of six potential blockbuster products and exceeding innovation revenue targets for 2024 positions Elanco for strong innovation contributions in 2025, expected to increase innovation revenue, positively influencing earnings.

Want the inside scoop on what justifies Elanco's ambitious price and what numbers are actually driving that calculation? The narrative’s fair value hinges on bold projections around product launches, future profit margins, and a premium future price-to-earnings ratio rarely seen outside leading growth stocks. See what has led analysts to this punchy forecast.

Result: Fair Value of $21.18 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks and lingering uncertainty around sustained margin expansion could quickly shift the outlook if these headwinds derail profitability improvements.

Find out about the key risks to this Elanco Animal Health narrative.

Another View: Deep Discount or Value Trap?

While analyst forecasts suggest Elanco is trading above its fair value, our DCF model paints a different picture. By modeling future cash flows, the SWS DCF model estimates Elanco’s fair value at $31.40, which is substantially higher than today's market price. Does this big gap signal a genuine opportunity or warn of risks hiding below the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Elanco Animal Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Elanco Animal Health Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can craft your own view of Elanco’s future in just a few minutes. Do it your way

A great starting point for your Elanco Animal Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Serious investors stay ahead by seizing unique trends. Don’t miss your best opportunities! Let Simply Wall St's powerful screener curate your next smart move:

- Start earning with stability by tapping into reliable income opportunities through these 17 dividend stocks with yields > 3% offering consistent yields above 3%.

- Accelerate your portfolio with innovation by checking out market disruptors among these 27 AI penny stocks capitalizing on the AI boom.

- Capture long-term growth potential by analyzing these 873 undervalued stocks based on cash flows that look attractively priced based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELAN

Elanco Animal Health

An animal health company, innovates, develops, manufactures, and markets products for pets and farm animals worldwide.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives