- United States

- /

- Biotech

- /

- NYSE:EBS

There's No Escaping Emergent BioSolutions Inc.'s (NYSE:EBS) Muted Revenues Despite A 26% Share Price Rise

Emergent BioSolutions Inc. (NYSE:EBS) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. This latest share price bounce rounds out a remarkable 419% gain over the last twelve months.

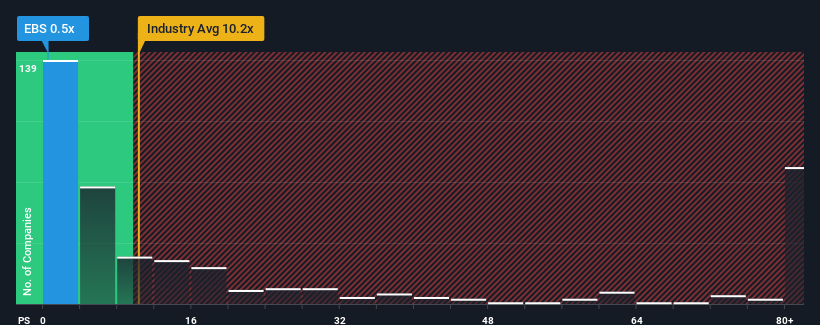

In spite of the firm bounce in price, Emergent BioSolutions may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 10.4x and even P/S higher than 62x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Emergent BioSolutions

What Does Emergent BioSolutions' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Emergent BioSolutions has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Emergent BioSolutions will help you uncover what's on the horizon.How Is Emergent BioSolutions' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Emergent BioSolutions' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 32% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 3.4% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 131% per year, which is noticeably more attractive.

With this in consideration, its clear as to why Emergent BioSolutions' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Emergent BioSolutions' P/S

Even after such a strong price move, Emergent BioSolutions' P/S still trails the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Emergent BioSolutions' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Emergent BioSolutions you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Emergent BioSolutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EBS

Emergent BioSolutions

A life sciences company, provides preparedness and response solutions for accidental, deliberate, and naturally occurring public health threats in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.