- United States

- /

- Biotech

- /

- NYSE:EBS

Emergent BioSolutions Inc. (NYSE:EBS) Held Back By Insufficient Growth Even After Shares Climb 41%

Emergent BioSolutions Inc. (NYSE:EBS) shares have continued their recent momentum with a 41% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

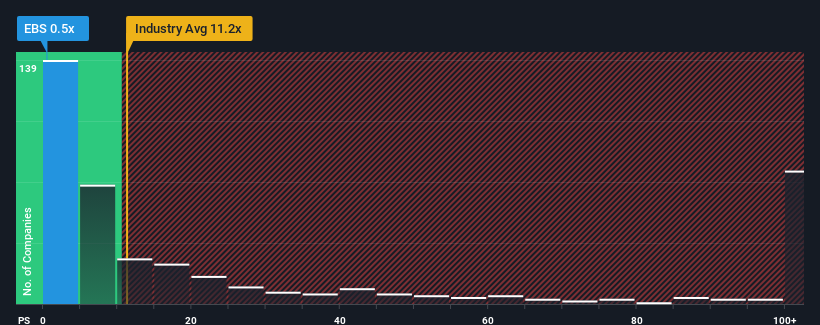

In spite of the firm bounce in price, Emergent BioSolutions' price-to-sales (or "P/S") ratio of 0.5x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 11.2x and even P/S above 63x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Emergent BioSolutions

What Does Emergent BioSolutions' P/S Mean For Shareholders?

Emergent BioSolutions could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Emergent BioSolutions will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Emergent BioSolutions' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. Still, revenue has fallen 31% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 11% during the coming year according to the dual analysts following the company. That's not great when the rest of the industry is expected to grow by 243%.

With this information, we are not surprised that Emergent BioSolutions is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Emergent BioSolutions' P/S

Even after such a strong price move, Emergent BioSolutions' P/S still trails the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that Emergent BioSolutions maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You need to take note of risks, for example - Emergent BioSolutions has 3 warning signs (and 2 which are significant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Emergent BioSolutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EBS

Emergent BioSolutions

A life sciences company, provides preparedness and response solutions for accidental, deliberate, and naturally occurring public health threats in the United States.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives