- United States

- /

- Life Sciences

- /

- NYSE:DHR

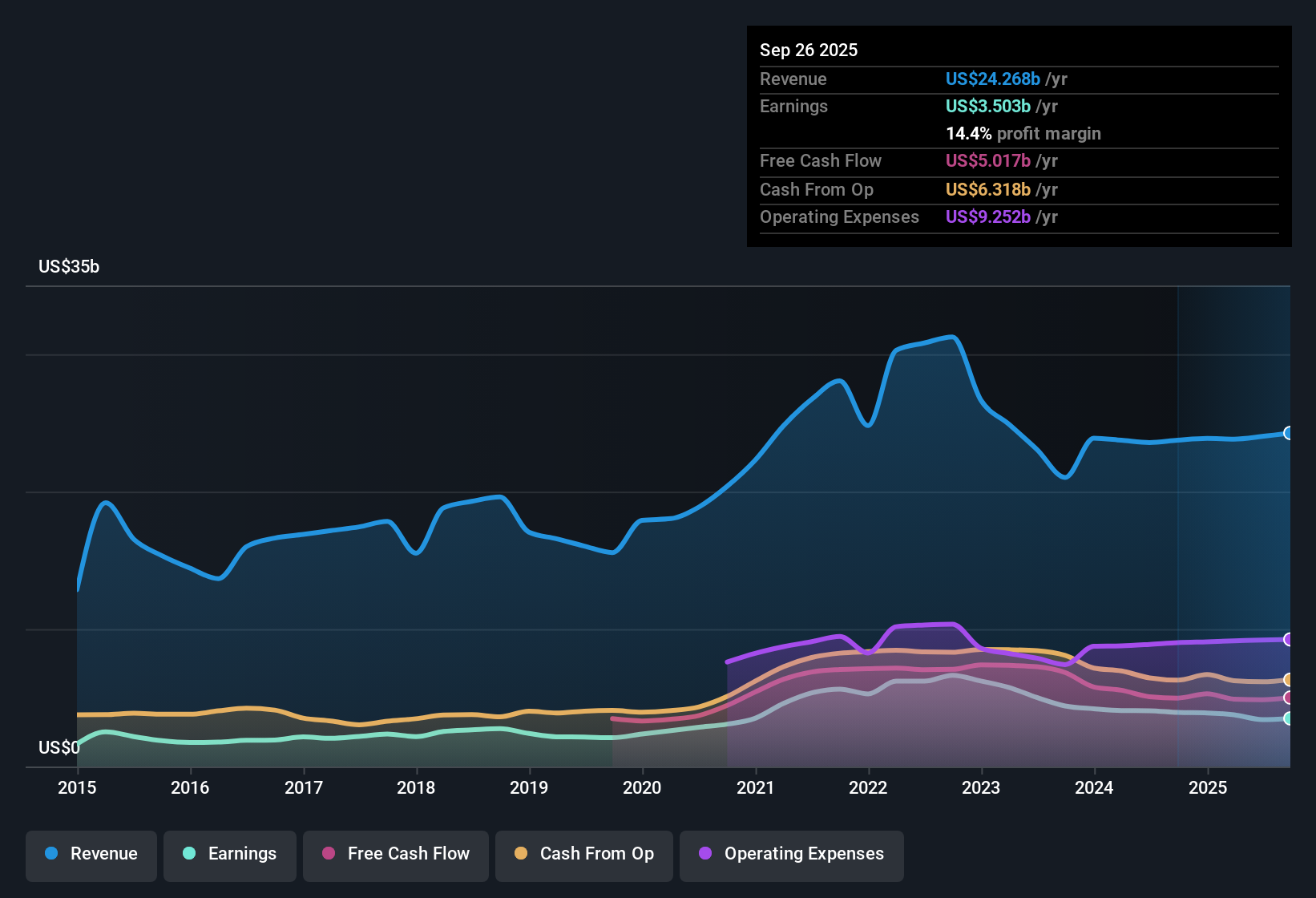

Danaher (DHR): Profit Margins Decline to 14.4% Challenges Quality Premium Narrative

Reviewed by Simply Wall St

Danaher (DHR) saw its earnings decline by 5.6% per year over the past five years, and most recently reported negative earnings growth again. Net profit margins narrowed to 14.4%, down from 16.6% last year, while shares currently trade at $218.10, below the estimated fair value of $233.28. Revenue is expected to grow at 5.2% per year, which trails the US market average of 10%. However, earnings are forecast to accelerate at 16.7% annually, outpacing the 15.5% average for the broader market. Investors now face a mixed picture as upbeat earnings growth forecasts are weighed against tighter margins and a premium valuation.

See our full analysis for Danaher.Next, we will compare these headline numbers to the wide range of narratives that investors and analysts follow. This will highlight where expectations match reality and where the story might be shifting.

See what the community is saying about Danaher

Profit Margin Recovery Projected by 2028

- Analysts expect profit margins to climb significantly from 14.2% today to 19.6% in just three years, signaling a focus on operational efficiency and cost productivity.

- According to the analysts' consensus narrative, margin gains are supported by disciplined execution of the Danaher Business System and robust demand in advanced diagnostics.

- Over 80% of revenue now stems from recurring sources like consumables and services, backing both top-line and margin stability.

- Operational efficiencies and innovative product launches position Danaher to capture high-margin growth amidst evolving global healthcare needs.

- For an in-depth look at how profit margin improvements could shape Danaher's future, discover the full range of consensus perspectives and key numbers on the company's story. 📊 Read the full Danaher Consensus Narrative.

Analyst Price Target Sits 16.7% Above Current Share Price

- With Danaher trading at $218.10 and the analyst consensus price target at $254.40, the implied upside based on current expectations is about 16.7%.

- Analysts' consensus view frames these price targets around anticipated earnings of $5.7 billion by 2028, which would require Danaher to trade at a 37.0x PE ratio.

- This future multiple is much higher than the current Life Sciences industry average of 29.3x, underscoring confidence in Danaher's growth, but also setting a higher hurdle for valuation justification.

- The wide range in price targets, from $205.00 bearish to $310.00 bullish, reflects the debate over whether Danaher's trajectory warrants its valuation premium compared to both industry and peers.

Premium Valuation Despite Slower Revenue Growth

- Danaher’s current PE ratio of 44x is well above the US Life Sciences industry average of 33.5x and peer average of 32.7x, while revenue growth forecasts remain at 5.2% per year, trailing the broader market.

- Analysts' consensus narrative points to high quality earnings and recurring revenue as factors justifying the premium, yet the gap between Danaher’s growth rates and its valuation multiples demands long-term delivery.

- Defending the premium rests on continued success in innovation and expanding global healthcare demand, but projections of slower revenue growth increase pressure for outperformance in high-margin segments.

- Rising operating costs and potential risks from policy changes in Asia add further complexity to the story, highlighting why some investors remain cautious about sustaining a premium valuation without margin and revenue acceleration.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Danaher on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a distinct take on the data? Share your perspective and craft a unique narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Danaher.

See What Else Is Out There

While Danaher’s profit margin recovery depends on consistent execution, its slower revenue growth and high valuation could limit near-term upside.

If you’re concerned about paying a premium without stronger growth, consider these 871 undervalued stocks based on cash flows to find attractively valued companies where the numbers back up the story.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHR

Danaher

Designs, manufactures, and markets professional, medical, research, and industrial products and services in the United States, China, and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives