- United States

- /

- Life Sciences

- /

- NYSE:DHR

Danaher (DHR): How AI Diagnostics and Tariff Tailwinds Are Shaping Its Valuation

Reviewed by Kshitija Bhandaru

Danaher (NYSE:DHR) shares have climbed after its subsidiary, Leica Biosystems, rolled out new AI-powered digital pathology solutions. The move comes at a time when the US is introducing substantial tariffs on imported pharmaceuticals, which could give domestic producers, including Danaher, a competitive edge.

See our latest analysis for Danaher.

Danaher’s recent buzz has brought renewed attention to the stock, which has managed a modest upswing amidst a backdrop of innovation and shifting regulatory tailwinds. While the launch of next-generation pathology technology and the looming US pharmaceutical tariffs sparked short-term momentum, longer-term total shareholder returns still trail the broader market, with a slight loss of 0.2% over the past year. Investors appear cautiously optimistic, betting that strategic investments and policy shifts could translate to more robust growth ahead.

If Danaher's blend of new technologies and industry catalysts has you curious about other healthcare leaders, the logical next step is to explore See the full list for free.

But with shares up on recent news and still trading below analyst targets, the question remains: Is Danaher truly undervalued, or is the market already factoring in future growth, leaving little room for upside?

Most Popular Narrative: 14% Undervalued

Compared to Danaher’s last close at $210.33, the most widely followed estimate sees fair value considerably higher, suggesting upside from today’s price. The rationale behind the calculation hinges on a specific outlook for high-margin growth and global expansion. One key driver stands out below.

The sustained advancement of precision medicine and personalized therapies, including new AI-assisted diagnostic solutions and groundbreaking launches in genomics (like support for in vivo CRISPR therapies), positions Danaher's technology portfolio to capture higher-margin growth and drive long-term EBITDA expansion.

What’s the secret ingredient behind this premium? Analysts are betting that Danaher’s futuristic bets on diagnostics and novel therapies will power years of outperformance. Curious which major growth assumptions make this target possible? Unlock the full narrative and discover the surprising financial projections fueling this bullish call.

Result: Fair Value of $244.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global trade tensions and weak early-stage biotech demand could undermine Danaher's margin growth and slow its ambitious expansion.

Find out about the key risks to this Danaher narrative.

Another View: Looking Beyond Analyst Targets

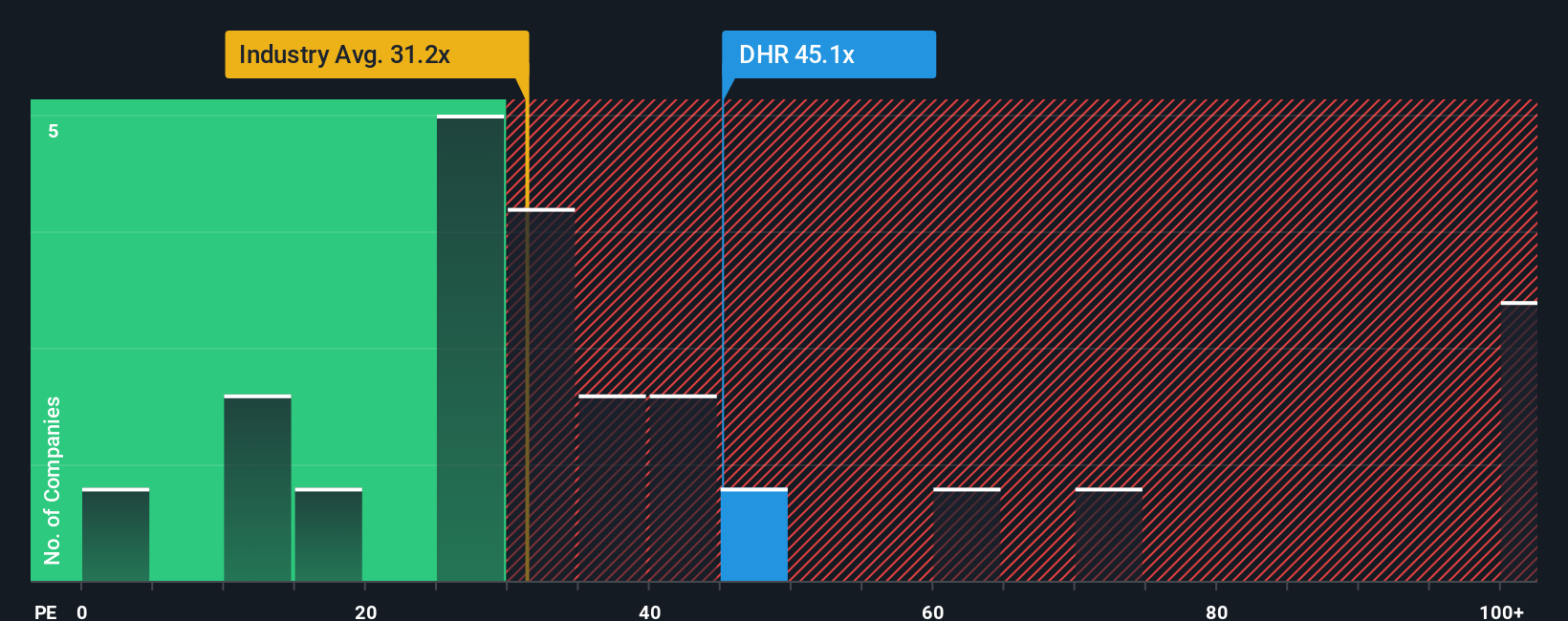

While analyst price targets suggest Danaher is undervalued, a look at its price-to-earnings ratio tells a different story. Danaher is trading at 44.1 times earnings, sharply higher than both its peer average (30.7x) and the broader industry (32.2x). This gap could signal potential valuation risk if sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danaher Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft your own Danaher view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Danaher.

Looking for More Investment Ideas?

Don't let great opportunities pass you by. Try these powerful strategies to pinpoint your next winning stock and level up your portfolio today.

- Boost your passive income by targeting attractive yield opportunities with these 19 dividend stocks with yields > 3%. These offer solid returns from companies generating strong, consistent dividends.

- Outpace the market by finding promising technology upstarts among these 24 AI penny stocks. AI innovation is reshaping industries and unlocking new growth.

- Zero in on value by checking out these 910 undervalued stocks based on cash flows. This is a smart way to spot stocks trading below their fair worth and ripe for upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHR

Danaher

Designs, manufactures, and markets professional, medical, research, and industrial products and services in the United States, China, and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives