- United States

- /

- Life Sciences

- /

- NYSE:DHR

Danaher (DHR): Assessing Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

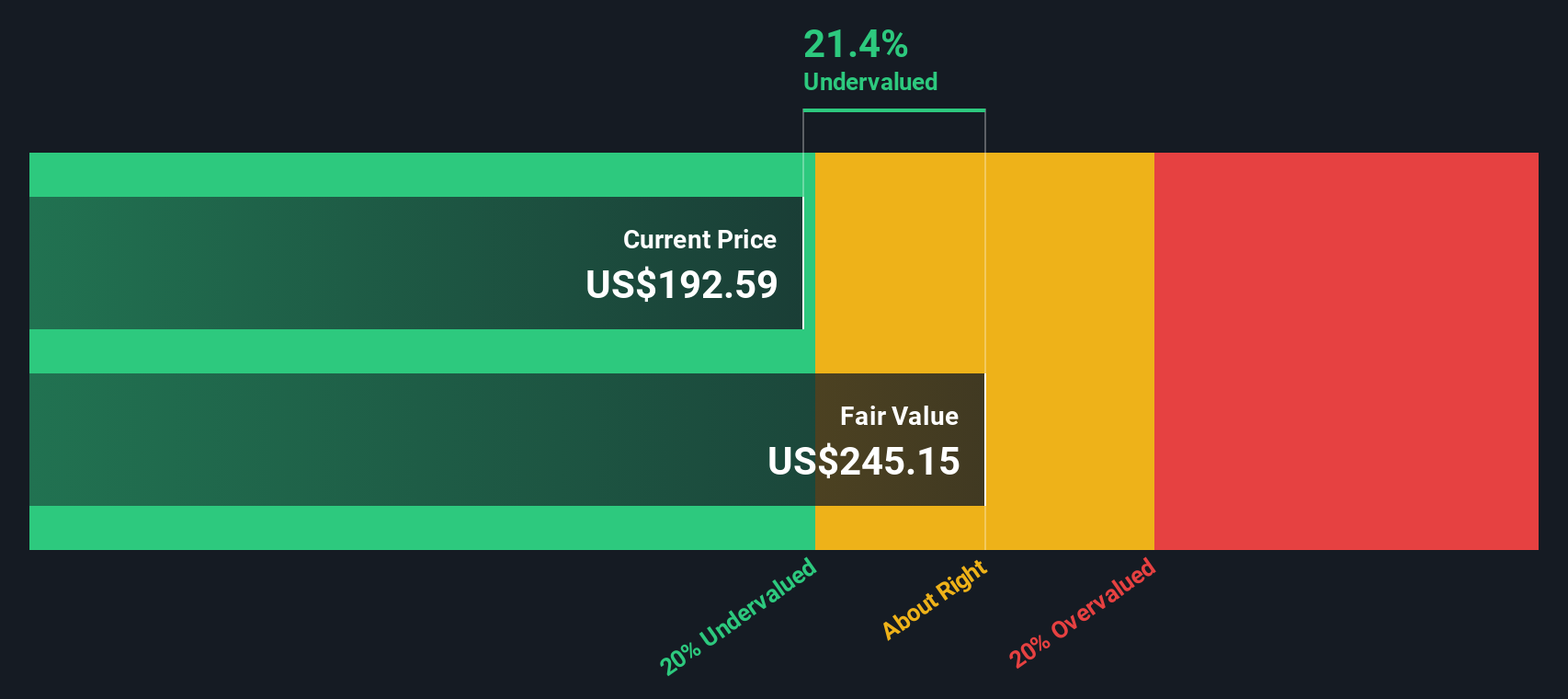

Danaher (NYSE:DHR) has been on the radar for many investors lately, thanks to a sharp shift in the company’s share price in the past month. The life sciences and diagnostics giant has climbed 12% since early May, even as the broader market has moved sideways. This movement could catch investors’ attention and prompt questions about what, if anything, has changed for the business beyond the numbers on the screen.

Looking at the past year, Danaher’s stock has been under pressure, dropping 22%. However, short-term momentum has turned positive with double-digit growth over the past month, which marks a notable reversal from its sluggish start to 2024. The company’s annual revenue and net income growth rates remain in positive territory, suggesting operational stability despite market skepticism. Recent updates have focused mostly on the company's strategy in core markets, with no single headline event driving the rebound.

With this bounce in the share price, investors might be wondering if Danaher is finally turning a corner and trading at a discount, or if the market is already pricing in the company’s next wave of growth.

Most Popular Narrative: 14% Undervalued

According to community narrative, Danaher is considered undervalued based on its future earnings potential and current share price discount. Analysts see significant upside that could attract attention from growth-focused investors.

The sustained advancement of precision medicine and personalized therapies, including new AI-assisted diagnostic solutions and groundbreaking launches in genomics (such as support for in vivo CRISPR therapies), positions Danaher's technology portfolio to capture higher-margin growth and drive long-term EBITDA expansion.

Looking for the key factor fueling Danaher's bullish valuation outlook? Learn about the transformation driving the company's high-margin profile. The fair value projection is based on significant progress in revenue, profit, and operational efficiency. What needs to happen for Danaher to close this valuation gap? Explore the essential financial milestones that could define its next phase.

Result: Fair Value of $245.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent trade tensions and regulatory shifts in China could quickly derail Danaher’s growth outlook, which may put both revenue and margins at risk.

Find out about the key risks to this Danaher narrative.Another View: What About the DCF?

Looking beyond earnings multiples, our DCF model tells a similar story. It finds Danaher to be undervalued when future cash flows are projected. Do both methods point to true value, or is there more beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Danaher Narrative

If our take does not align with your perspective, or you would rather dive into the numbers yourself, you can easily build your own view in just a few minutes and do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Danaher.

Looking for More Smart Investment Opportunities?

Don’t let a single stock define your portfolio’s potential. With so many powerful trends shaping today’s markets, now is the time to seize your edge and find those companies that could set you apart from the crowd. Let Simply Wall Street help you uncover hidden gems and standout performers:

- Tap into rising yields and steady payments by checking out dividend stocks with yields > 3% to secure your income stream for the years ahead.

- Fuel your growth ambitions by exploring AI penny stocks, where companies are pioneering breakthroughs in artificial intelligence and shaping entire industries.

- Supercharge your portfolio with undervalued stocks based on cash flows so you can get ahead of the next wave of value opportunities before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHR

Danaher

Designs, manufactures, and markets professional, medical, research, and industrial products and services in the United States, China, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives