- United States

- /

- Life Sciences

- /

- NYSE:DHR

Danaher (DHR): Assessing Valuation After AI Product Launches and New US Pharma Tariff Tailwinds

Reviewed by Kshitija Bhandaru

Danaher (DHR) shares are getting a real boost as the company’s Leica Biosystems unit rolls out new AI-powered digital pathology solutions. This comes at a time when a change in US pharmaceutical tariffs is giving domestic players an edge.

See our latest analysis for Danaher.

Danaher’s share price has seen renewed momentum lately as investor sentiment shifted due to its AI-driven innovations and the new pharmaceutical tariffs. While the company’s 1-year total shareholder return is still down nearly 0.2%, these recent advances suggest a potential turnaround after a muted stretch. With fresh product launches and sector tailwinds, optimism around the stock’s long-term growth prospects is increasing.

If these industry shifts sparked your curiosity, it could be the perfect moment to explore more with our See the full list for free.

With Danaher’s impressive product launches and fresh policy tailwinds driving shares higher, investors are left wondering whether the stock is still undervalued or if the recent optimism has already been fully reflected in its price.

Most Popular Narrative: 14% Undervalued

Danaher’s most-followed narrative suggests the stock’s fair value is significantly higher than the last close price of $210.33, driven by expectations for growth and profitability to rebound after recent sector softness.

The sustained advancement of precision medicine and personalized therapies, including new AI-assisted diagnostic solutions and groundbreaking launches in genomics (like support for in vivo CRISPR therapies), positions Danaher's technology portfolio to capture higher-margin growth and drive long-term EBITDA expansion.

Want to know what bold financial forecasts justify this premium? Hints: future margins and a profit multiple more often seen in booming tech. Discover which pivotal growth bets form the backbone of this bullish outlook. The full narrative unpacks the numbers behind the optimism.

Result: Fair Value of $244.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainty around U.S. and China trade tensions and persistent weakness in early-stage biotech funding could delay the expected rebound in Danaher’s growth trajectory.

Find out about the key risks to this Danaher narrative.

Another View: High Earnings Multiple Raises Questions

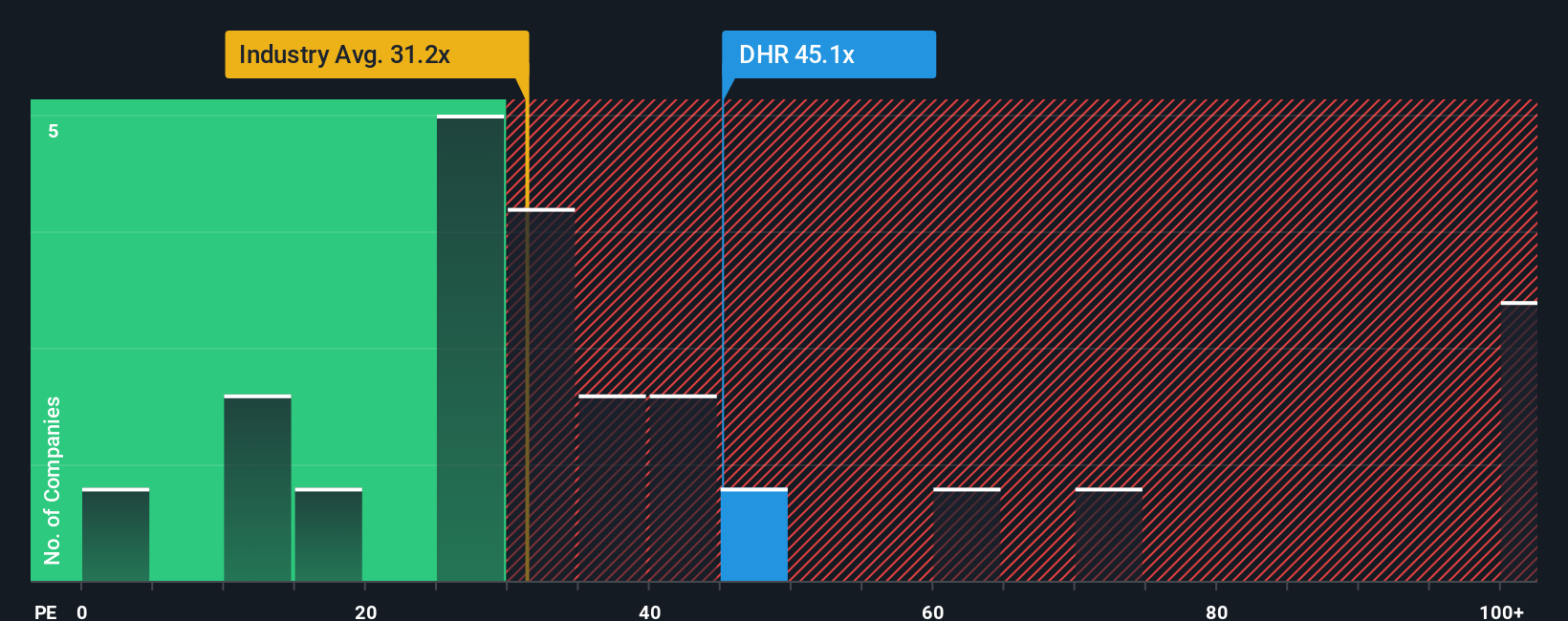

Looking from another angle, Danaher is currently trading at a much higher earnings multiple than both its industry and peer averages. Its ratio stands at 44.1x, well above the US Life Sciences industry average of 32.2x, the peer average of 30.7x, and even the fair ratio of 28.5x that the market could be expected to move toward. This sizable gap means investors are paying a premium for future growth, which can be rewarding if expectations are met but risky if momentum fades. Does this premium reflect enduring quality, or could it signal downside if the company’s growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danaher Narrative

Prefer hands-on analysis or want to dig deeper into Danaher’s figures? You can craft your own story in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Danaher.

Looking for More Investment Ideas?

Make your next smart investment move with ideas beyond Danaher. Missing these could mean overlooking some of the market’s most exciting opportunities right now.

- Grow your income with market standouts by checking out these 19 dividend stocks with yields > 3%, which offers attractive yields above 3% and robust fundamentals.

- Uncover pioneering companies transforming healthcare by using these 31 healthcare AI stocks to spot AI innovations that are redefining patient care and diagnostics.

- Find hidden gems early and position yourself for outsized gains with these 3567 penny stocks with strong financials, featuring remarkable potential and strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHR

Danaher

Designs, manufactures, and markets professional, medical, research, and industrial products and services in the United States, China, and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives