- United States

- /

- Life Sciences

- /

- NYSE:CRL

Why Is Charles River Labs (CRL) Collaborating on Antibody-Drug Conjugates and Alternative Research Now?

Reviewed by Sasha Jovanovic

- In October 2025, Charles River Laboratories International announced major collaborations with The Francis Crick Institute to accelerate Antibody-Drug Conjugate development and with X-Chem, Inc. to enhance hit identification, as well as the creation of a global Scientific Advisory Board focused on alternative research methodologies.

- These moves signal a concerted push into advanced drug discovery services and innovative non-animal research techniques, positioning the company at the forefront of evolving biopharma research needs.

- We'll explore how Charles River Laboratories International's expanded strategic alliances and scientific leadership may reshape the company's long-term growth outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Charles River Laboratories International Investment Narrative Recap

To own Charles River Laboratories International stock, you need confidence in the global growth of drug discovery services, especially as innovation in advanced therapies fuels demand for specialized preclinical solutions. The recent collaborations with The Francis Crick Institute and X-Chem bolster Charles River’s portfolio and scientific edge but don’t immediately resolve the most pressing short-term challenge: the persistent softness in new bookings and an elevated cancellation rate, which continues to weigh on revenue visibility and near-term earnings recovery.

The formation of a global Scientific Advisory Board on New Approach Methodologies is especially relevant, given mounting regulatory and client pressures to transition away from animal testing. This move highlights Charles River’s push to diversify its service mix, potentially mitigating long-term risks tied to evolving industry standards, even as demand for traditional preclinical solutions remains volatile.

By contrast, investors should be aware that reliance on animal-based research still exposes the company to future regulatory and market shifts...

Read the full narrative on Charles River Laboratories International (it's free!)

Charles River Laboratories International's outlook anticipates $4.4 billion in revenue and $483.2 million in earnings by 2028. This projection is based on an annual revenue growth rate of 2.8% and an earnings increase of approximately $552.4 million from the current earnings of -$69.2 million.

Uncover how Charles River Laboratories International's forecasts yield a $185.87 fair value, a 5% downside to its current price.

Exploring Other Perspectives

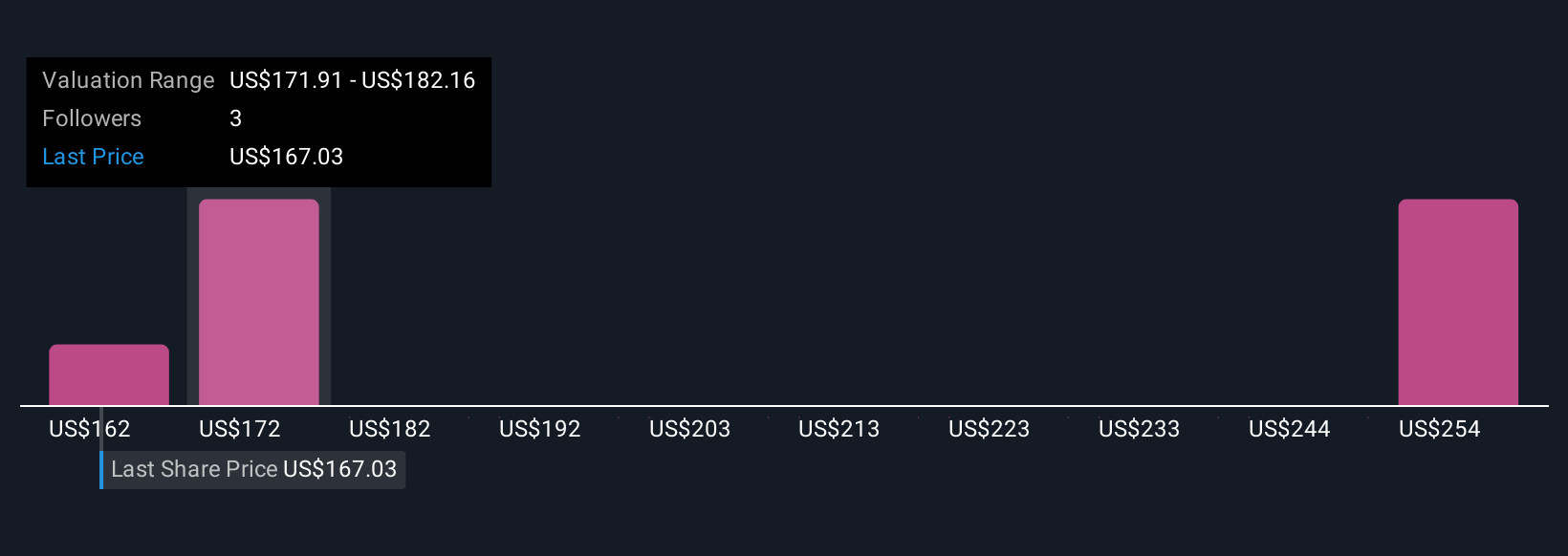

Simply Wall St Community members see fair value estimates for Charles River Laboratories ranging from US$185.87 to US$267.38, illustrating a broad spectrum of expectations from just two contributors. Persistent softness in new bookings and cancellations remains a key factor shaping your outlook, so consider multiple viewpoints before making decisions.

Explore 2 other fair value estimates on Charles River Laboratories International - why the stock might be worth just $185.87!

Build Your Own Charles River Laboratories International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charles River Laboratories International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charles River Laboratories International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charles River Laboratories International's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRL

Charles River Laboratories International

Charles River Laboratories International, Inc.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives