- United States

- /

- Pharma

- /

- NYSE:BMY

What Does the Delayed Trump Tariff Decision Mean for Bristol-Myers Squibb’s Valuation?

Reviewed by Simply Wall St

Deciding what to do with Bristol-Myers Squibb stock right now might feel like a coin toss, but there is more than luck at play. The stock closed recently at $47.15, and if you have been watching the rollercoaster of news out of Washington and Brussels, you know the ride has been eventful. Over the past year, the share price has moved up just 1.6%, with more dramatic swings when you zoom out and in: it is down 17.0% year-to-date and has dropped 24.0% over the last three years.

So what is driving these changes? Lately, a mix of headlines from the U.S. administration has cast a long shadow over pharma, including Bristol-Myers Squibb. Discussions about possibly charging patent holders an extra 1% to 5% fee, rumblings about sector-specific tariffs, and debates on raising medicine prices abroad all added uncertainty. And while the market did bounce 2.7% in the last month, possibly pricing in delays to new tariffs, investors remain cautious given the bigger regulatory picture.

Still, as tempting as it is to focus just on headlines or short-term price moves, long-term investors know valuation tells the real story. Bristol-Myers Squibb currently lands a value score of 3 out of 6, so it passes half of the usual undervaluation checks, but not all. Now, let us dig into those valuation methods, what they really mean for investors like you, and later, I will share an even deeper approach to make sense of the numbers.

Bristol-Myers Squibb delivered 1.6% returns over the last year. See how this stacks up to the rest of the Pharmaceuticals industry.Approach 1: Bristol-Myers Squibb Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a cornerstone of valuation, estimating a company's worth by projecting its future free cash flows and discounting them back to their present value. For Bristol-Myers Squibb, this approach helps investors look beyond market noise and focus on the fundamentals: how much cash the company is expected to generate for shareholders over time.

Currently, Bristol-Myers Squibb produces $14.6 billion in Free Cash Flow. Analysts project that Free Cash Flow will gradually decline, estimating about $12.5 billion by 2029. Since projections from analysts typically stop at around five years, further annual numbers are extrapolated using established trend models. Each projection is already discounted to account for the time value of money, giving a conservative, realistic calculation.

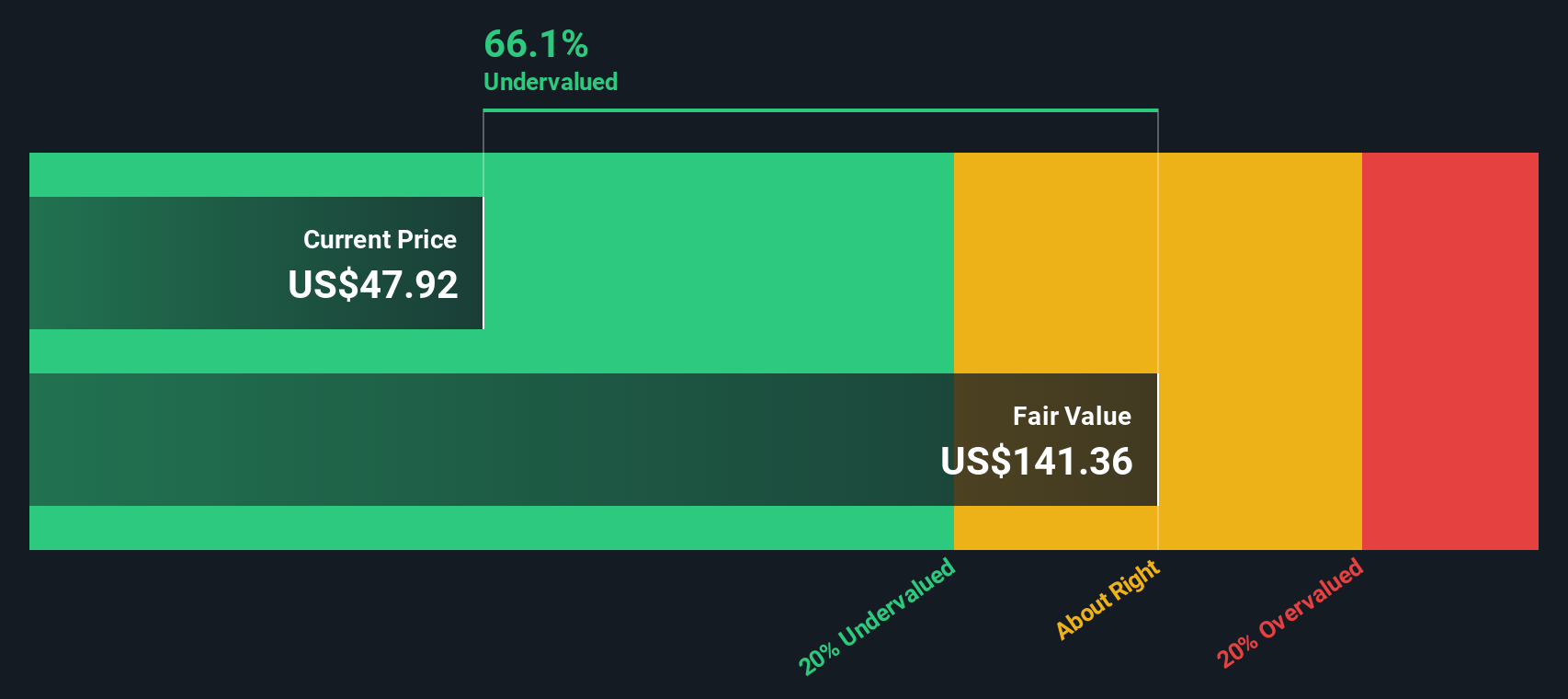

Based on these projections, the DCF model arrives at an intrinsic value of $141.36 per share for Bristol-Myers Squibb. This is significantly higher than its recent share price of $47.15, reflecting a 66.6% estimated discount to fair value. The DCF suggests the stock is deeply undervalued, which may indicate potential upside for long-term investors who trust in the company's ability to sustain cash flows.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Bristol-Myers Squibb.

Approach 2: Bristol-Myers Squibb Price vs Earnings

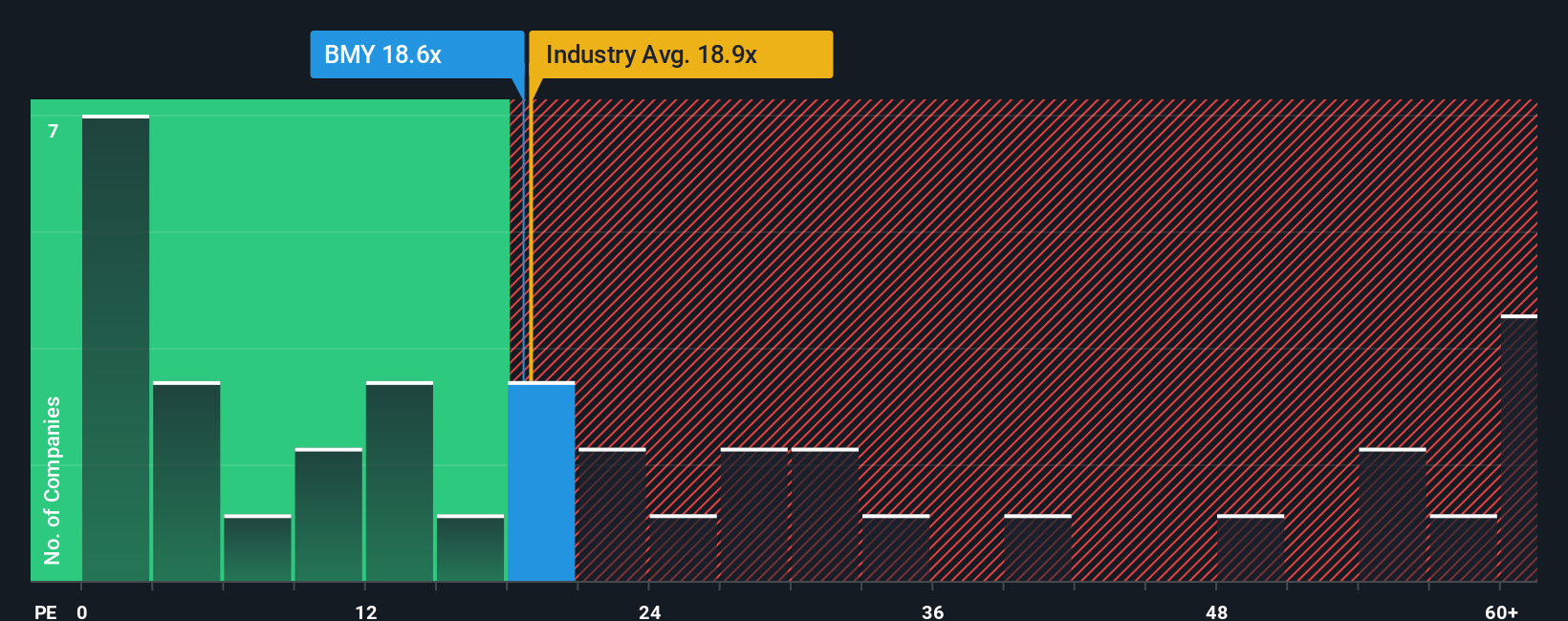

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies because it directly links a company’s current share price to its earnings power. For established firms like Bristol-Myers Squibb, which consistently report profits, PE serves as a straightforward gauge of what investors are willing to pay today for a dollar of earnings.

However, what counts as a “normal” or “fair” PE ratio can vary. Companies with stronger growth prospects or lower risk profiles are often rewarded with higher PE multiples, while firms with slower growth or more uncertainty usually trade at lower ratios. Risk appetite, competitive dynamics, and profitability all influence where a company’s PE should land relative to benchmarks.

Currently, Bristol-Myers Squibb trades at a PE of 19x. This is slightly above the pharmaceutical industry average of about 18.8x, and also above the average of its closest peers at 16.6x. For more context, the Simply Wall St “Fair Ratio” considers the company’s growth outlook, profit margins, market cap, industry context, and any unique risks. For Bristol-Myers Squibb, the Fair Ratio is calculated at 24.2x. This means that, despite a PE slightly higher than peers and industry, shares are actually trading well below their fundamental value as measured by this more holistic metric.

Because the fair PE ratio is several points above where the stock trades today and it incorporates factors beyond the broad averages, it suggests that Bristol-Myers Squibb is currently undervalued on this multiple, not just compared to benchmarks but also relative to its own financial prospects.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Bristol-Myers Squibb Narrative

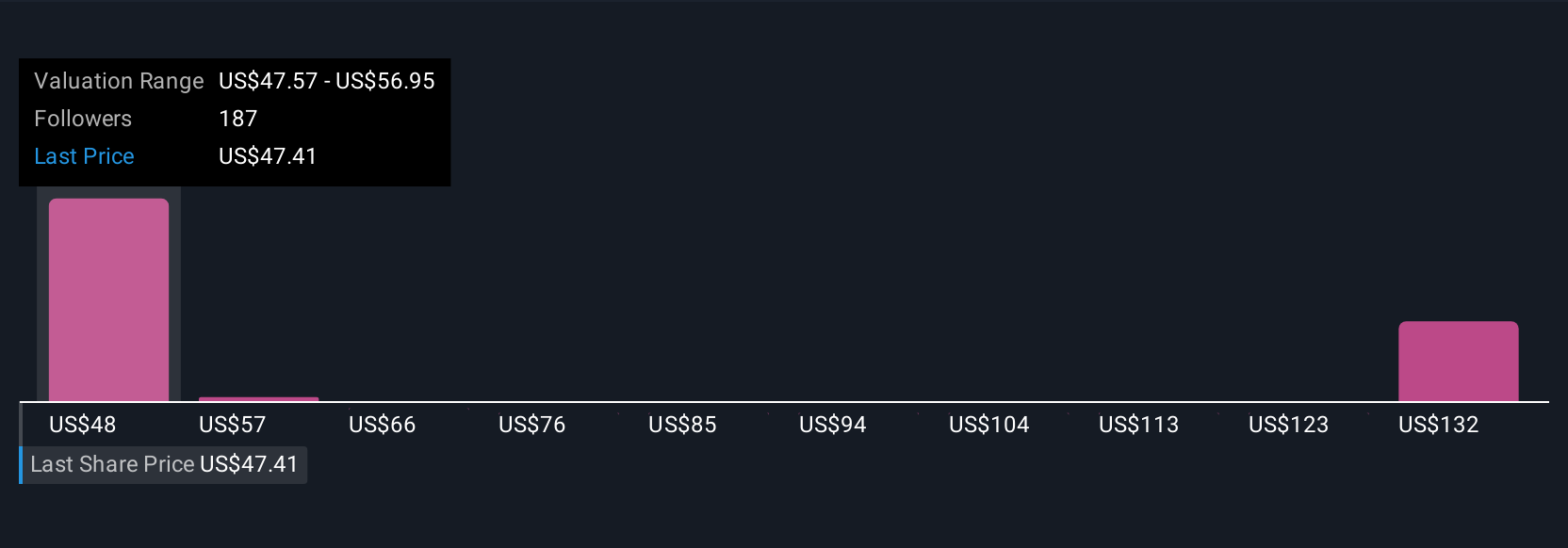

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story behind the numbers. It connects your view of Bristol-Myers Squibb’s future growth, margins, and risks with a financial forecast, and translates that directly into your own fair value.

With Narratives on Simply Wall St’s Community page, you’re not just looking at static models or consensus forecasts; you’re empowered to create and adjust your own perspective using an intuitive, step-by-step tool trusted by millions of investors. Narratives make the process of evaluating when to buy or sell simple because they compare your fair value against the current share price so you can act when the numbers and your story line up.

What makes Narratives even more powerful is that they dynamically update as news breaks or company results are announced, so your view stays relevant in real time. For example, some investors see Bristol-Myers Squibb as worth $68 a share thanks to bullish new drug launches, while others land at $34, being more cautious about patent cliffs and margins. Narratives help you anchor every decision in your own evidence-based logic, not just a headline or a hunch.

Do you think there's more to the story for Bristol-Myers Squibb? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives