- United States

- /

- Pharma

- /

- NYSE:BMY

The Bull Case For Bristol-Myers Squibb (BMY) Could Change Following Real-World Camzyos Data at ESC 2025

Reviewed by Simply Wall St

- In late August 2025, Bristol Myers Squibb presented real-world data from the COLLIGO-HCM study at the European Society of Cardiology Congress, showing Camzyos (mavacamten) reduced left ventricular outflow tract obstruction and improved symptoms in diverse patients with symptomatic obstructive hypertrophic cardiomyopathy across seven countries.

- The findings validated Camzyos' effectiveness and safety in real-world settings and reinforced its position as a standard of care, supporting its inclusion in major clinical guidelines for patients who do not respond to first-line therapy.

- We'll now explore how these new data on Camzyos in diverse real-world patients may influence Bristol Myers Squibb’s investment outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Bristol-Myers Squibb Investment Narrative Recap

Owning Bristol-Myers Squibb means believing in its ability to offset upcoming patent expiries on core drugs like Eliquis by innovating and successfully commercializing new therapies across major disease areas. The recent positive real-world results for Camzyos are supportive for expansion in heart disease, but do not significantly alter the most pressing short-term catalyst, which is execution on new product launches to mitigate revenue concentration risks; patent cliffs and regulatory headwinds remain the biggest challenges.

Among recent company announcements, the FDA Priority Review for Breyanzi in marginal zone lymphoma stands out as closely related. Like Camzyos, Breyanzi exemplifies efforts to diversify Bristol-Myers Squibb’s revenue base and drive growth from new indications within its pipeline, which is critical given pressure on legacy brands and evolving competitive threats.

Yet, in contrast, investors should not overlook the heightened risk of generic and biosimilar competition targeting key earners like Eliquis and Opdivo...

Read the full narrative on Bristol-Myers Squibb (it's free!)

Bristol-Myers Squibb's projections see revenues declining to $41.3 billion and earnings rising to $9.2 billion by 2028. This scenario assumes a 4.7% annual decrease in revenue and a $4.2 billion increase in earnings from the current $5.0 billion level.

Uncover how Bristol-Myers Squibb's forecasts yield a $53.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

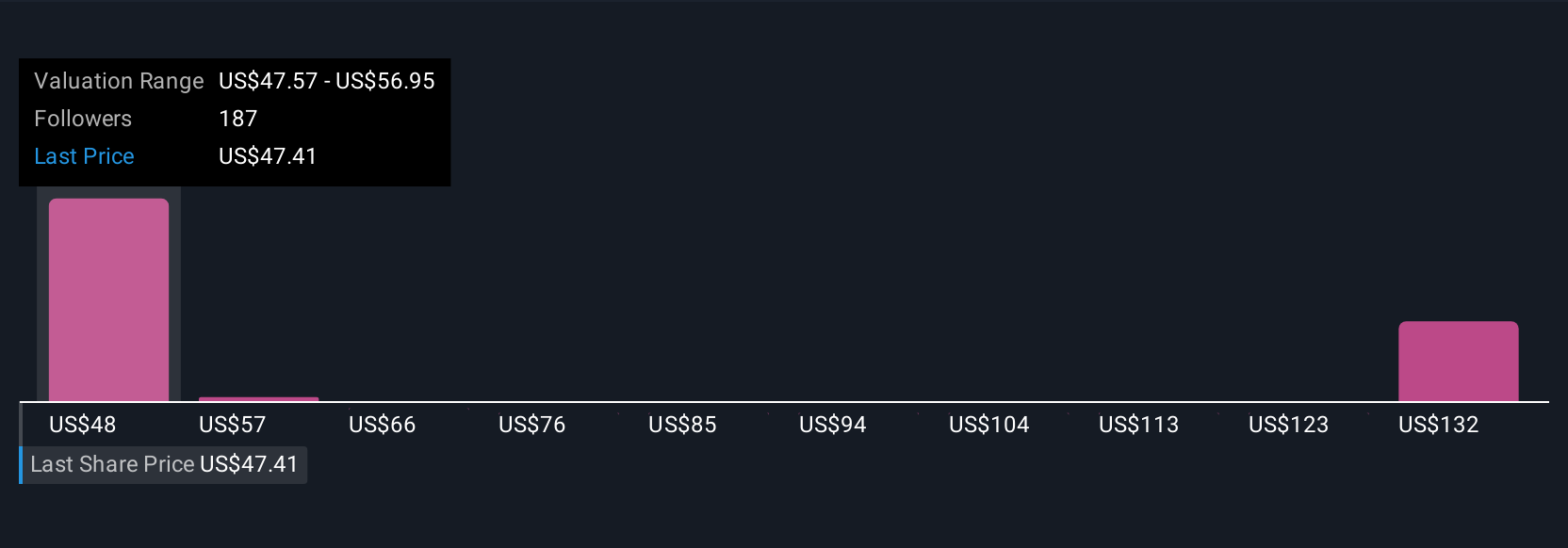

Thirteen members of the Simply Wall St Community have published fair value estimates for Bristol-Myers Squibb ranging from US$47.57 to US$141.36 per share. While many see room for growth driven by an expanding late-stage pipeline, looming patent expiries could impact the company’s ability to sustain revenue and margin strength, so it’s important to consider several perspectives before making up your mind.

Explore 13 other fair value estimates on Bristol-Myers Squibb - why the stock might be worth just $47.57!

Build Your Own Bristol-Myers Squibb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bristol-Myers Squibb research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bristol-Myers Squibb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bristol-Myers Squibb's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives