- United States

- /

- Pharma

- /

- NYSE:BMY

Is Bristol Myers Squibb’s AI Collaboration a Catalyst After Shares Drop 20% in 2025?

Reviewed by Bailey Pemberton

Trying to figure out what Bristol-Myers Squibb’s next move means for your portfolio? You are not alone. Over the last several months, the stock has taken investors on a bit of a rollercoaster. There is no ignoring the fact that Bristol-Myers shares have slipped by 20.0% year-to-date and by 11.6% over the last year. The longer-term picture is not pretty either, with the stock down 25.5% in three years and 10.7% over the last five.

But let’s not count this pharmaceutical giant out just yet. There are signs of momentum bubbling below the surface. Just in the past week, Bristol-Myers shares ticked up 3.0%, hinting at renewed interest perhaps spurred by news like their collaboration with Takeda and Astex on cutting-edge AI drug discovery tools. Plus, policy moves around Medicare drug price talks keep shaking up sentiment and risk perception across the industry.

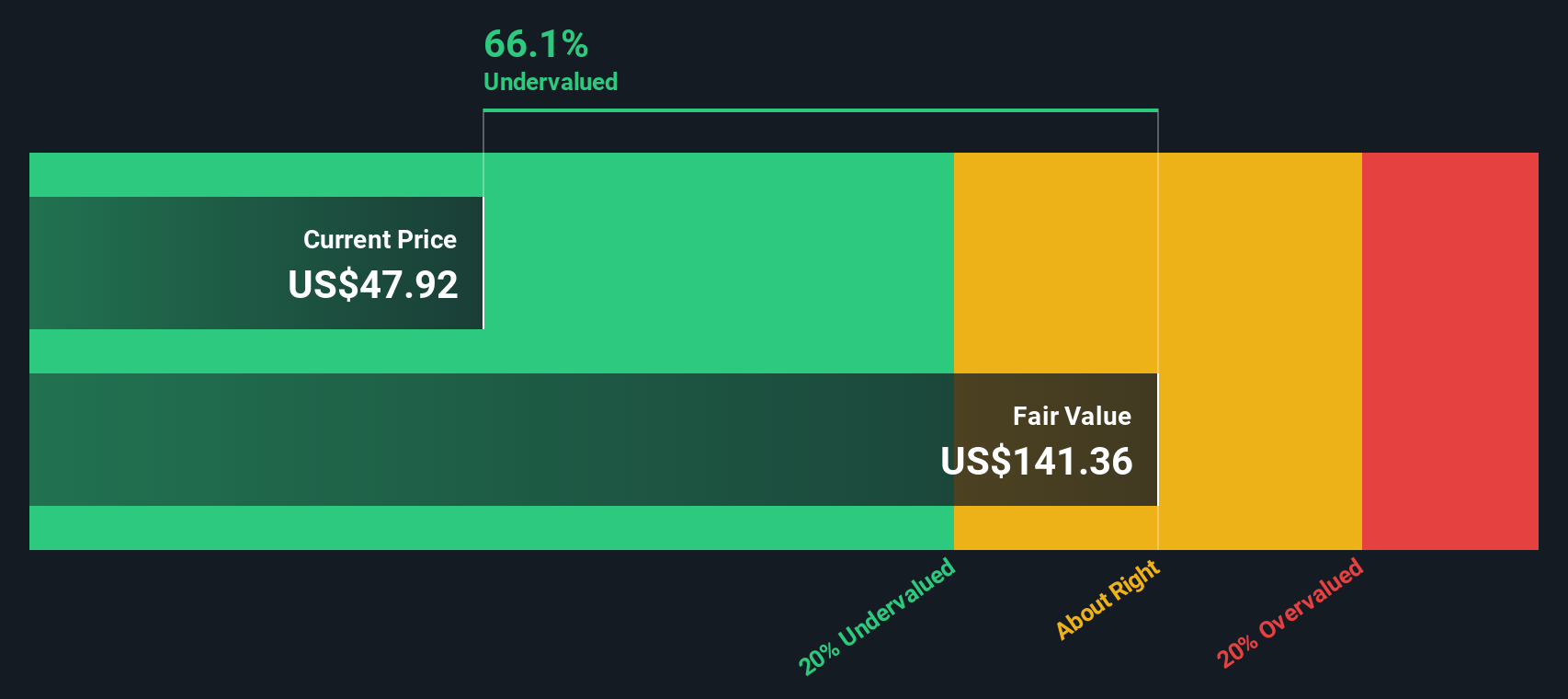

If you are looking at Bristol-Myers and wondering whether it is undervalued, here is the quick headline: by typical valuation checks, the company gets a 4 out of 6 on our value score. That means Bristol-Myers is undervalued in two-thirds of those classic tests. Still, stock picking is about more than just the math, so let’s break down which valuation methods point to opportunity, where the risks are, and, most importantly, how you can spot an even better way to decide what the stock is truly worth.

Why Bristol-Myers Squibb is lagging behind its peers

Approach 1: Bristol-Myers Squibb Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by forecasting a company’s future cash flows and then discounting those projections back to today’s value. This provides an estimate of what the business is really worth, based on its actual ability to generate money for shareholders over time.

Bristol-Myers Squibb’s latest twelve-month Free Cash Flow comes in at $14.6 billion. Analyst consensus projects free cash flow will decline a bit from here, with five-year forecasts averaging around $13.0 billion annually. Simply Wall St extrapolates further using existing growth patterns, estimating cash flow in 2029 at $11.8 billion and in 2035 at roughly $12.6 billion. The DCF approach combines these forecasts and discounts them back, aligning everything with today’s dollars.

This model estimates Bristol-Myers’ fair value at $132.55 per share. This is 65.7% higher than its current market price, suggesting the stock is considerably undervalued right now based on its future cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bristol-Myers Squibb is undervalued by 65.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bristol-Myers Squibb Price vs Earnings

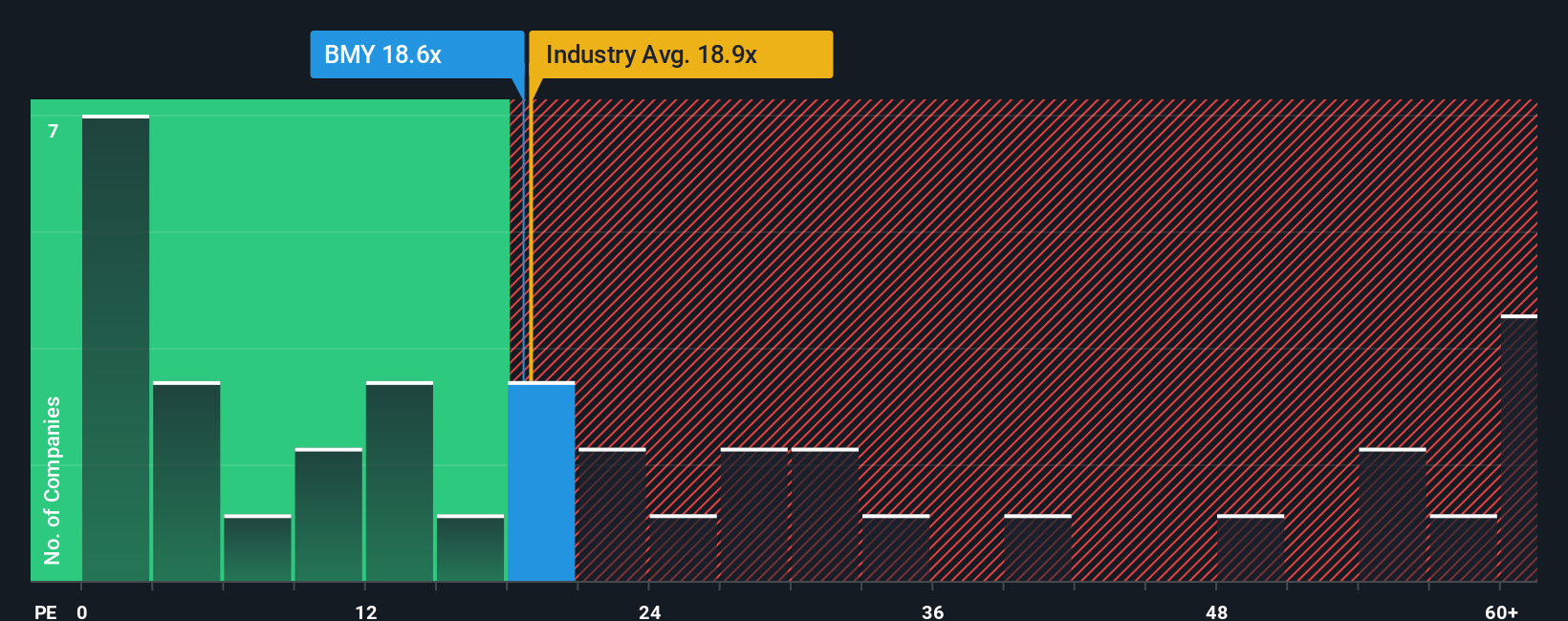

The Price-to-Earnings (PE) ratio is the go-to valuation metric for profitable companies because it directly relates a company’s share price to its annual earnings. A lower PE can imply a bargain, but what counts as “cheap” depends on growth expectations and risk. If a company’s earnings are projected to grow quickly, or if its business is seen as lower risk, investors typically reward it with a higher PE ratio. Conversely, slower growth or higher uncertainty can justify a lower PE.

Bristol-Myers Squibb is currently trading at a PE ratio of 18.3x. For context, the average PE across its pharmaceutical industry peers is about 20.0x, and key direct competitors average around 17.1x. At first glance, this puts Bristol-Myers in the middle of the pack, neither notably expensive nor unusually cheap compared with its sector.

However, Simply Wall St’s proprietary Fair Ratio, which incorporates factors like Bristol-Myers’ earnings growth outlook, risk profile, profit margins, industry, and scale, sets its benchmark at 23.1x. This is a more nuanced measure than simply lining up against industry or peers since it tailors the expected multiple specifically to the company’s circumstances.

With the stock trading at 18.3x versus a Fair Ratio of 23.1x, Bristol-Myers Squibb looks undervalued by this lens. The current market price does not fully reflect its earnings potential when adjusting for relevant fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bristol-Myers Squibb Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story behind the numbers; it is a way to combine your perspective on a company’s prospects with your own assumptions about its fair value, future revenue, earnings, and margins. Narratives connect what is happening in Bristol-Myers Squibb’s business (like product launches, regulatory changes, or cost-saving plans) to a specific financial forecast and calculate a dynamic fair value estimate based on those assumptions.

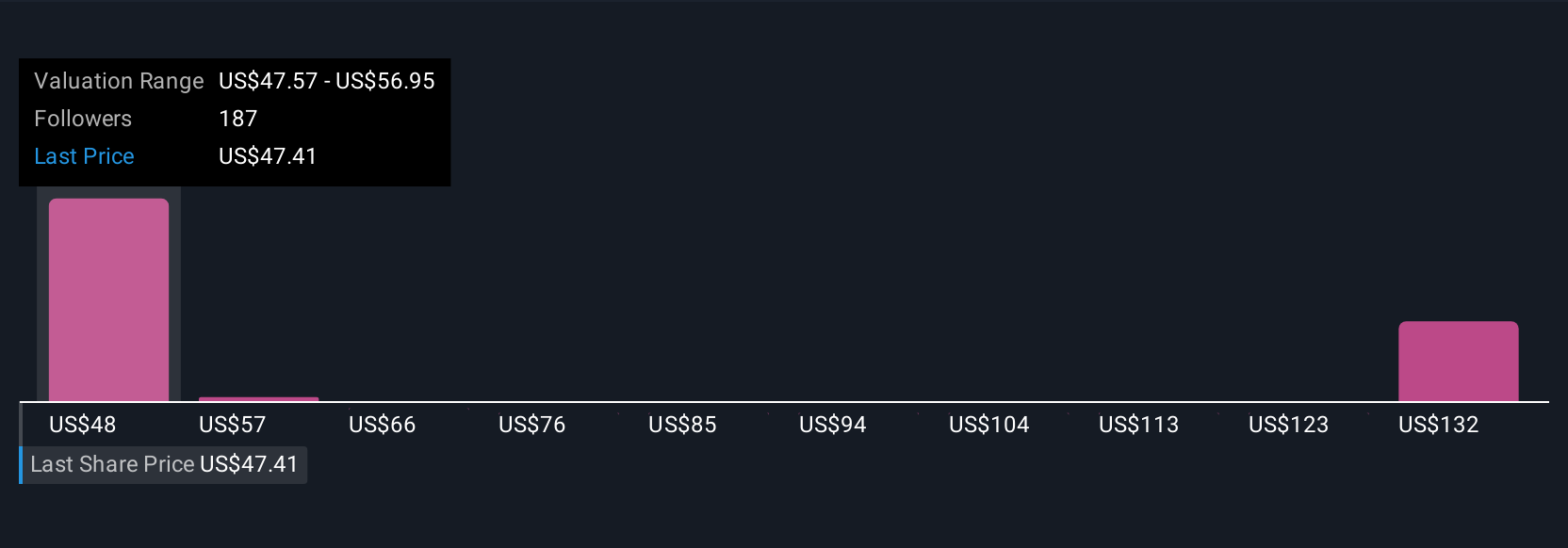

Instead of relying solely on formulas or analyst targets, Narratives let you take control by tailoring the numbers to your beliefs, giving you clarity about what needs to happen for a stock to be fairly valued. Simply Wall St’s Community page makes this approach accessible for everyone. Millions of investors use it to track how their views compare, update their scenarios when new information emerges, and see in real time whether the fair value calculated by their Narrative is above or below the current share price (for example, when the most bullish Bristol-Myers investors see a fair value of $68 and the most cautious set it as low as $34). This empowers you to decide when to buy or sell with more confidence and transparency.

Do you think there's more to the story for Bristol-Myers Squibb? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives