- United States

- /

- Pharma

- /

- NYSE:BMY

How Upgraded Revenue Guidance and FDA Progress on Breyanzi at Bristol-Myers (BMY) Has Changed Its Investment Story

Reviewed by Simply Wall St

- In recent days, Bristol-Myers Squibb raised its full-year revenue guidance by US$700 million at the midpoint and announced that the FDA has accepted its supplemental biologics license application for Breyanzi as a potential treatment for marginal zone lymphoma, granting Priority Review with a decision expected by December 2025.

- These developments reflect strengthened demand across key oncology products and regulatory progress, further supported by streamlined patient monitoring for Breyanzi and ongoing expansion in the company's cell therapy portfolio.

- We'll take a look at how the upgraded revenue outlook and FDA momentum for Breyanzi shape Bristol-Myers Squibb’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Bristol-Myers Squibb Investment Narrative Recap

For investors considering Bristol-Myers Squibb, the central thesis remains focused on the company's ability to offset upcoming patent expiries with innovation from its pipeline and the successful execution of new product launches. Recent advances for Breyanzi, including Priority Review for marginal zone lymphoma and streamlined FDA monitoring, support the view that pipeline performance is the biggest short-term catalyst, though ongoing patent risk still looms largest; these news items are positive, but do not fully alleviate longer-term concerns around revenue concentration.

Among recent developments, the raised 2025 revenue guidance stands out as most relevant in light of Breyanzi's regulatory progress. The boost, driven by strength across growth portfolio products, reflects the company’s capacity to leverage new indications and accelerate commercial ramp-up, which is vital as legacy products approach exclusivity loss and reliance on a few blockbuster drugs persists.

On the other hand, investors should be aware that the risk of generic competition for core products could become material sooner than anticipated if...

Read the full narrative on Bristol-Myers Squibb (it's free!)

Bristol-Myers Squibb's outlook anticipates $41.2 billion in revenue and $9.2 billion in earnings by 2028. This entails a yearly revenue decline of 4.7% and a $4.2 billion increase in earnings from the current $5.0 billion.

Uncover how Bristol-Myers Squibb's forecasts yield a $53.48 fair value, a 16% upside to its current price.

Exploring Other Perspectives

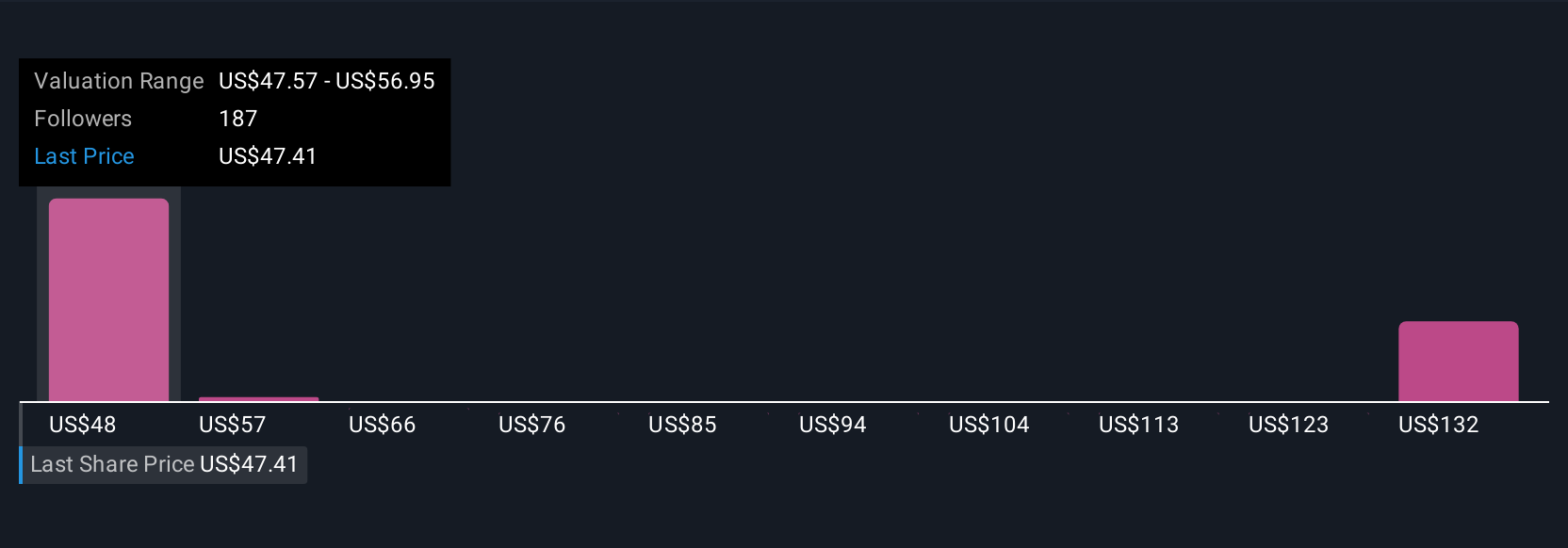

Simply Wall St Community members have estimated Bristol-Myers Squibb’s fair value between US$53 and US$141 across 11 individual forecasts. While new product catalysts are gaining traction, forward revenue remains exposed to long-standing patent risks, which could reshape near-term expectations.

Explore 11 other fair value estimates on Bristol-Myers Squibb - why the stock might be worth just $53.48!

Build Your Own Bristol-Myers Squibb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bristol-Myers Squibb research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bristol-Myers Squibb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bristol-Myers Squibb's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives