- United States

- /

- Pharma

- /

- NYSE:BMY

Bristol-Myers Squibb (BMY) Is Up 6.8% After FDA Priority Review and Upgraded 2025 Guidance

Reviewed by Simply Wall St

- In the past week, Bristol-Myers Squibb announced that the US FDA granted Priority Review to an sBLA for Breyanzi as a treatment for relapsed or refractory marginal zone lymphoma, with a decision expected by December 2025, and also raised its 2025 revenue guidance by US$700 million to US$46.5 billion–US$47.5 billion due to strong product performance and legacy sales.

- This combination of regulatory progress and improved financial outlook signals renewed momentum in both the company’s late-stage pipeline and its established portfolio, particularly driven by the performance of key products like Revlimid and Breyanzi.

- We'll explore how the FDA Priority Review for Breyanzi and the upgraded guidance strengthen Bristol-Myers Squibb's investment narrative and pipeline outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Bristol-Myers Squibb Investment Narrative Recap

To be a Bristol-Myers Squibb shareholder, you need to believe that the company’s innovative pipeline and stable core portfolio will offset patent cliffs and support earnings, even as competition and pricing pressures persist. The recent FDA Priority Review for Breyanzi and the uplift in revenue guidance sharpen the focus on regulatory momentum and late-stage product launches as immediate catalysts, but the long-term risk from major patent expirations, especially for Eliquis and Opdivo, is still significant and unchanged by these updates.

Among recent developments, the raised 2025 revenue guidance, driven by stronger-than-expected sales from both growth and legacy products, stands out as particularly relevant. It reinforces the importance of successfully launching and expanding indications for newer therapies like Breyanzi, which is now even more central to Bristol-Myers Squibb’s case for managing coming revenue headwinds.

Yet, with regulatory gains in focus, investors should also keep a close watch as the risk of generic competition to Eliquis and Opdivo approaches...

Read the full narrative on Bristol-Myers Squibb (it's free!)

Bristol-Myers Squibb's outlook anticipates $41.2 billion in revenue and $9.2 billion in earnings by 2028. This is based on a 4.7% annual revenue decline and an increase in earnings of $4.2 billion from the current $5.0 billion.

Uncover how Bristol-Myers Squibb's forecasts yield a $53.48 fair value, a 12% upside to its current price.

Exploring Other Perspectives

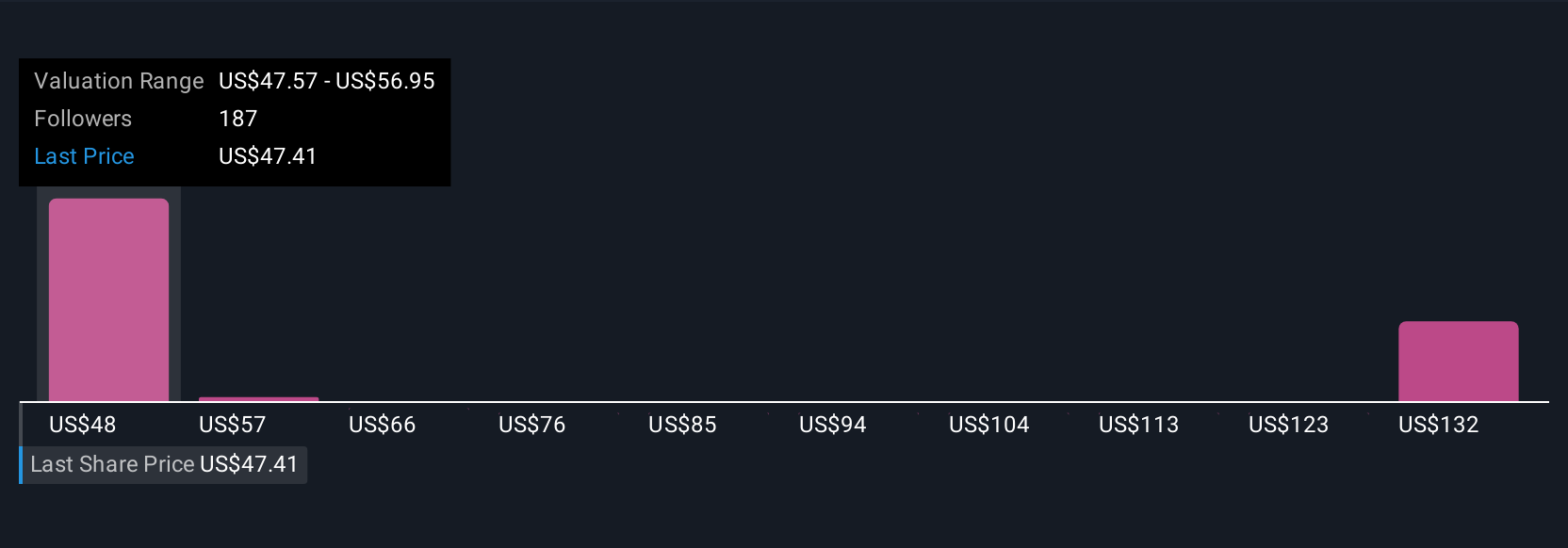

Community fair value estimates for Bristol-Myers Squibb range from US$53.48 to US$141.36, based on 11 perspectives from the Simply Wall St Community. Despite optimism for new launches, upcoming patent expirations continue to cast uncertainty over the company’s future growth, encouraging you to weigh multiple viewpoints.

Explore 11 other fair value estimates on Bristol-Myers Squibb - why the stock might be worth just $53.48!

Build Your Own Bristol-Myers Squibb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bristol-Myers Squibb research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bristol-Myers Squibb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bristol-Myers Squibb's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives