- United States

- /

- Pharma

- /

- NYSE:BMY

Assessing Bristol-Myers Squibb (BMY) Valuation as Shares Lag in 2024

Reviewed by Kshitija Bhandaru

See our latest analysis for Bristol-Myers Squibb.

Bristol-Myers Squibb’s share price has steadily lost ground through 2024, with a year-to-date price return of -23.17%. This points to fading momentum after a tough stretch for pharma stocks. Over the last twelve months, the company has delivered a total shareholder return of -13.94%, signaling that investor sentiment remains cautious despite underlying earnings resilience.

If you’re interested in finding more healthcare stocks with potential, this is a great time to see the full list via our See the full list for free..

With the share price lagging and the stock trading below most analyst targets, investors are now left asking whether this is a genuine value opportunity or if the market is already discounting future growth.

Most Popular Narrative: 17.7% Undervalued

Bristol-Myers Squibb’s fair value narrative places the company’s worth at $53, which is notably above the last close price of $43.63. This sizable gap hints at significant upside if the narrative plays out as outlined by analysts’ key assumptions.

Robust late-stage pipeline and ongoing life-cycle management for major brands, plus strategic partnerships (BioNTech, Philochem, Bain), expand the breadth of future regulatory approvals and label expansions, opening additional indications and helping to offset upcoming patent expiries, which underpins top-line and earnings growth.

Curious which financial levers analysts expect to drive this potential upside? A mix of margin improvement, bold revenue projections, and blockbuster drug launches set the stage for a valuation calculation unlike anything in BMY's recent history. Find out which assumptions are doing the heavy lifting behind that fair value estimate. There is more under the surface than meets the eye.

Result: Fair Value of $53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming patent expiries and tougher drug pricing reforms remain catalysts that could quickly unravel the bullish outlook for Bristol-Myers Squibb.

Find out about the key risks to this Bristol-Myers Squibb narrative.

Another View: Is Market Sentiment Overdone?

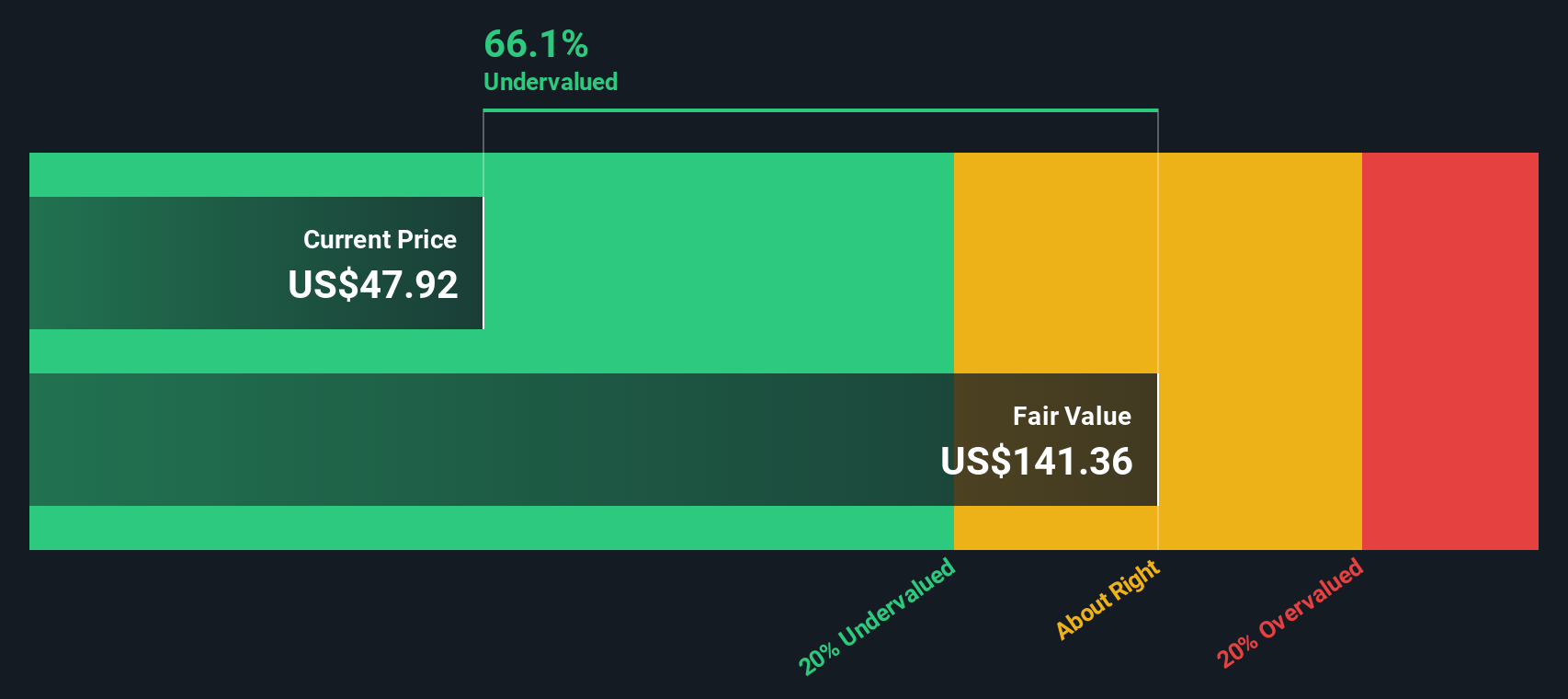

Looking at valuation through our SWS DCF model gives a strikingly different picture. It suggests Bristol-Myers Squibb could be deeply undervalued, trading far below our estimate of fair value. This gap raises the question: Is the market overlooking longer-term potential while focusing on near-term uncertainties?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bristol-Myers Squibb Narrative

If you want to dig deeper or have your own take on Bristol-Myers Squibb’s outlook, you can quickly create and share a personal narrative in just a few minutes. Do it your way

A great starting point for your Bristol-Myers Squibb research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Want to be the first to spot tomorrow’s standout stocks? Don’t wait until everyone else catches on. Unlock unique opportunities with these handpicked lists:

- Target steady income and build your portfolio’s financial backbone by tapping into these 18 dividend stocks with yields > 3% offering yields above 3%.

- Stay ahead of artificial intelligence market trends and position yourself for growth by evaluating these 24 AI penny stocks with disruption potential.

- Grow your wealth by seeking value where others overlook. Scan these 878 undervalued stocks based on cash flows chosen for strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives