- United States

- /

- Life Sciences

- /

- NYSE:BIO

Assessing Bio-Rad Laboratories's Valuation Following Launch of New EZ-Check Salmonella Detection Kit

Reviewed by Kshitija Bhandaru

Bio-Rad Laboratories (BIO) just unveiled its EZ-Check Salmonella spp. Kit, a rapid test for detecting Salmonella in food and environmental samples. Validated by AOAC International and certified by AFNOR Certification, this new product aims to simplify and speed up food safety protocols for labs and manufacturers. For investors, the launch is more than a product announcement. It signals Bio-Rad’s ongoing commitment to innovation in the critical area of pathogen detection and could shape the company’s path in the food safety marketplace.

This product launch comes after a volatile year for Bio-Rad, with the stock remaining under pressure despite some positive momentum in the past three months. Shares have dropped nearly 14% over the past year and are still off more than 43% from five years ago, but there has been a gain of about 21% in the most recent quarter. Ongoing developments, such as a net cash position and new industry certifications, have helped keep sentiment mixed as investors weigh risk against potential upside.

After another year of seesawing returns, some investors may be considering whether Bio-Rad Laboratories offers a compelling entry point for value-focused strategies, or whether the market is simply factoring in expectations for future growth.

Most Popular Narrative: Narrative: 14.2% Undervalued

The most widely followed narrative currently views Bio-Rad Laboratories as undervalued, estimating the stock trades at a discount against future earnings potential. This narrative reflects optimism about growth vectors in the company's diagnostics and bioprocessing businesses, even as the broader market remains cautious.

Recent launch and expansion of the QX Continuum and QX700 Series ddPCR platforms, alongside the acquisition of Stilla Technologies, positions Bio-Rad to accelerate its share capture as demand grows for advanced molecular diagnostics and precision medicine tools. This is expected to drive ddPCR revenue growth and improve margins through higher consumable pull-through and broader assay adoption.

Curious about why this outlook suggests Bio-Rad deserves a much higher valuation? The calculations hinge on ambitious financial assumptions, stretching the company well beyond current performance norms. What are the core earnings and revenue levers that support such a bullish price target? Unpack the specifics behind the big calls and decide if you agree with this high-conviction narrative.

Result: Fair Value of $331.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent softness in instrument demand and shifting global healthcare policies could quickly dampen revenue growth and put pressure on Bio-Rad’s profit margins.

Find out about the key risks to this Bio-Rad Laboratories narrative.Another View: SWS DCF Model Points Even Lower

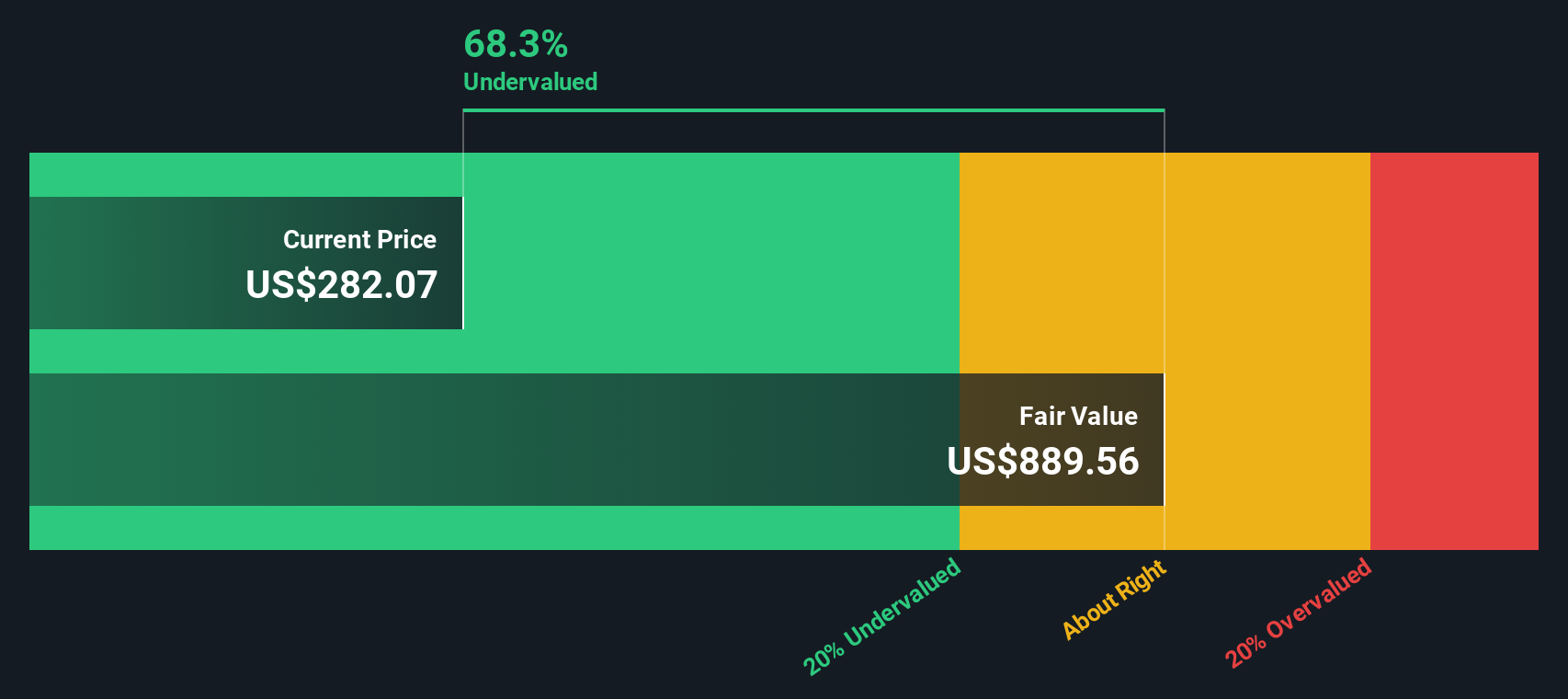

A different approach, using the SWS DCF model, offers a much more optimistic perspective and suggests Bio-Rad could be drastically undervalued by the market. However, an important question remains: does this long-term outlook truly capture the company’s risks and growth potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bio-Rad Laboratories Narrative

Keep in mind, if this view doesn’t fit your outlook or you want to analyze the numbers yourself, you can build your own narrative in just a few minutes with our tools. Do it your way.

A great starting point for your Bio-Rad Laboratories research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Use the Simply Wall Street Screener to target game-changing sectors others overlook and keep your edge in the market.

- Spot companies riding the artificial intelligence wave by tapping into AI penny stocks, which are positioned for significant growth and technological breakthroughs.

- Secure reliable returns with dividend stocks with yields > 3%, featuring businesses that offer robust yields above 3% and can add stability to your portfolio.

- Get ahead of the trend and assess the next generation of healthcare innovation using healthcare AI stocks to identify potential leaders in medical technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Rad Laboratories might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIO

Bio-Rad Laboratories

Manufactures and distributes life science research and clinical diagnostic products in the United States, Europe, Asia, Canada, and Latin America.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives