- United States

- /

- Pharma

- /

- NYSE:BHC

Is Bausch Health a Bargain After Recent 11% Slide and Earnings Forecast Update?

Reviewed by Bailey Pemberton

Thinking about what to do with Bausch Health Companies stock? If you’re feeling a bit torn, you’re not alone. The stock has definitely been on a wild ride, and a lot of investors are watching closely to see if now is the moment to jump in, add more, or wait things out. Over the last year, the share price has taken a hit, down 28.1%, and it’s slipped 24.3% year-to-date. Even looking back five years, Bausch Health is down a painful 66.6%. That kind of drawdown might turn some investors away, but what makes things interesting right now is what’s happening beneath the surface.

Despite some rough numbers in the short and long term, the past month has seen only a moderate drop of 11.4%. Some of this can be tied to shifts in the broader healthcare sector, along with changing risk appetites as markets digest news impacting pharmaceutical companies globally. While it is clear that sentiment has soured, especially in recent quarters, there are also hints of renewed growth potential if the company can steady the ship.

When it comes to valuation, Bausch Health is scoring a 3 out of 6 on major undervaluation checks. That means it is undervalued on three counts and possibly fairly priced or a bit expensive on the others. Before you make a move, it is essential to dig deeper into what exactly those valuation checks are and how they might shape your investment decision, but there is also an even smarter way to look at this, which will be discussed at the end of the article.

Why Bausch Health Companies is lagging behind its peers

Approach 1: Bausch Health Companies Discounted Cash Flow (DCF) Analysis

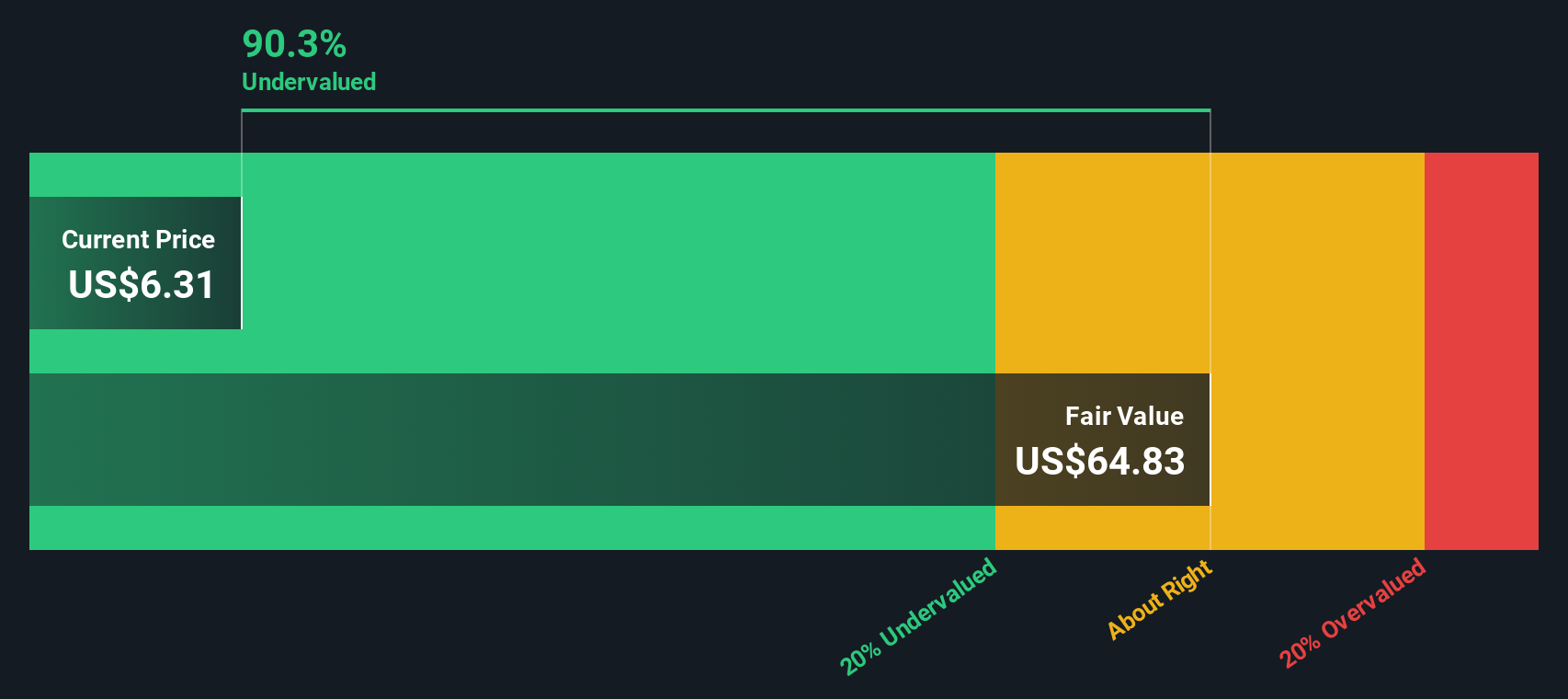

The Discounted Cash Flow (DCF) model focuses on projecting a company's future cash flows and then calculating what those are worth in today's dollars. It takes estimates of the money Bausch Health Companies is expected to generate and discounts them back to the present to arrive at a fair value for the stock.

Bausch Health Companies currently produces $1.15 billion in Free Cash Flow. Analyst forecasts see this figure growing substantially, with projected Free Cash Flow reaching $2.27 billion in 2029. While analysts supply estimates through 2029, cash flows for later years are extrapolated to complete the model.

According to the 2 Stage Free Cash Flow to Equity model, the DCF analysis calculates an intrinsic fair value of $64.83 per share. This valuation suggests the stock is trading at a 90.7% discount to its estimated intrinsic value based on long-term cash flow expectations.

In summary, the numbers indicate Bausch Health Companies is deeply undervalued relative to its future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bausch Health Companies is undervalued by 90.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

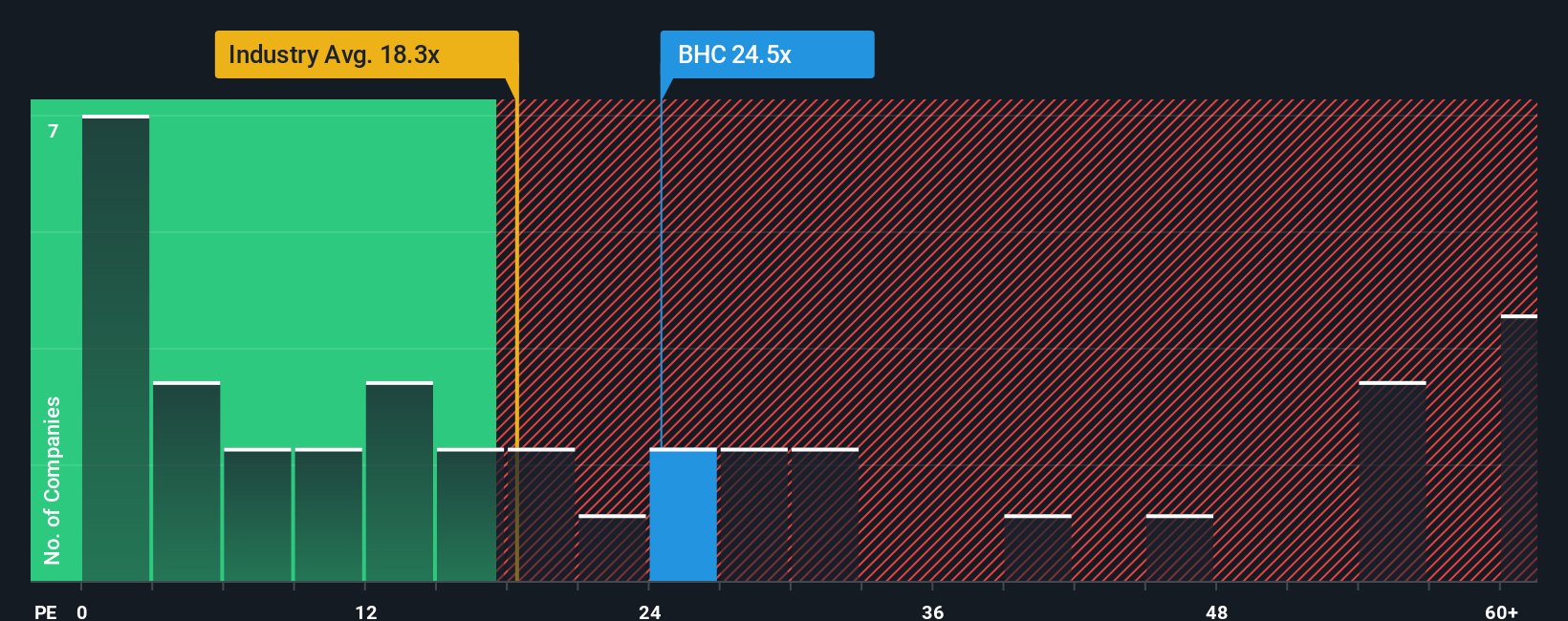

Approach 2: Bausch Health Companies Price vs Earnings

The Price-to-Earnings (PE) ratio is often the primary valuation metric for established, profitable companies. It provides a quick indication of how much investors are currently willing to pay for each dollar of earnings. Because Bausch Health Companies has maintained profitability, the PE ratio offers a meaningful perspective on its valuation relative to both the broader market and similar businesses.

It is important to remember that the appropriate PE ratio depends on several factors, including a company's growth outlook and the perceived risks associated with its earnings. Companies expected to grow quickly often trade at higher multiples, while those facing uncertainty or slower growth tend to have lower ones.

Currently, Bausch Health Companies trades at a PE ratio of 22.68x. This is higher than the average for its Pharmaceuticals industry peers, which is 18.01x, but below the peer group average of 34.32x. Simply Wall St calculates a proprietary "Fair Ratio" for Bausch Health Companies, which in this case is 20.03x. The Fair Ratio is a more nuanced benchmark than a simple industry or peer comparison because it incorporates company-specific attributes such as projected earnings growth, profitability, risk profile, market cap, and the broader industry context.

Comparing the current PE ratio to the Fair Ratio suggests the stock is trading close to fair value, as the difference is less than 0.10x. This indicates that, based on its fundamentals and prospects, Bausch Health Companies is being valued in line with what investors might reasonably expect at this time.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

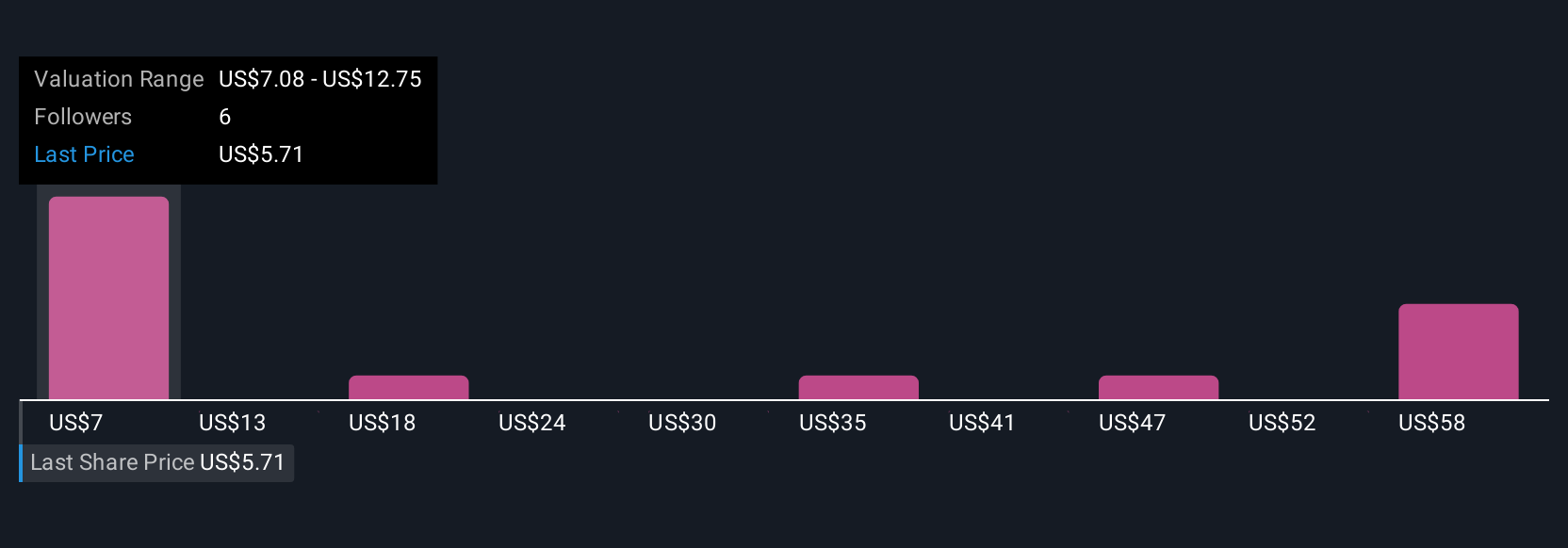

Upgrade Your Decision Making: Choose your Bausch Health Companies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story or perspective about a company. It puts all the numbers into context by clearly stating your view on what will drive future revenue, earnings, margins, and ultimately fair value.

Narratives connect the dots between a company's story, a financial forecast, and a fair value, making it much easier to see how your investment thesis stacks up. They are accessible and easy to use within Simply Wall St's Community page, a feature trusted by millions of investors around the world.

With Narratives, you can compare your estimate of fair value to the current price, helping you decide when to buy, hold, or sell. Since Narratives are automatically updated when new news or earnings are released, your investment rationale always stays current.

For example, if you review Bausch Health Companies, you might see one Narrative projecting a price target as high as $10.00 based on international expansion and new product launches, while another sets a much lower target of $5.00 due to concerns about debt and regulatory risks. This lets you quickly understand why different investors make different decisions, and choose the Narrative that best matches your own outlook.

Do you think there's more to the story for Bausch Health Companies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch Health Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHC

Bausch Health Companies

Operates as a diversified specialty pharmaceutical and medical device company, develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, generic pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health in the United States and internationally.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives